Konica Minolta 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

On February 1, 2004, the Ministry of Health, Labour and Welfare

permitted the substitutional portion of the Konica Welfare Pension Fund to

be returned to the government, and the remaining portion of the Fund

was integrated into a CDBP.

On March 1, 2004, the Ministry of Health, Labour and Welfare per-

mitted that the substitutional portion of the Minolta Welfare Pension Fund

to be returned to the government, and the remaining portion of the Fund

was integrated into a CDBP. A portion of the Minolta lump-sum payment

plan was transferred to a CDBP on the same date.

On April 1, 2004, a portion of the Minolta lump-sum payment plan

was transferred to a defined contribution pension plan.

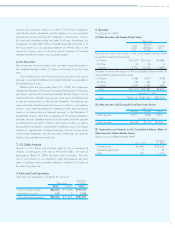

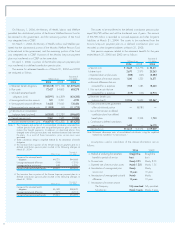

The reserve for retirement benefits as of March 31, 2004 and 2003

are analyzed as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

a.Retirement benefit obligations ¥(138,418) ¥(79,163) $(1,309,660)

b.Plan assets 72,427 34,853 685,278

c. Unfunded retirement benefit

obligations (a+b) (65,991) (44,309) (624,383)

d.Unrecognized transition amounts 521 2,391 4,930

e.Unrecognized actuarial differences 14,425 19,645 136,484

f. Unrecognized prior service costs (11,808) (65) (111,723)

g.Net amount on consolidated

balance sheets (c+d+e+f) (62,853) (22,337) (594,692)

h. Prepaid pension costs 2,061 1,965 19,500

i. Accrued retirement benefits (g–h) ¥ (64,915) ¥(24,303) $ (614,202)

Notes: 1. The Company and certain of its consolidated subsidiaries amended their

welfare pension fund plans and tax-qualified pension plans in order to

reduce their benefit payments. In addition, as described above, they

changed some of the pension plans and transferred certain funds between

the plans. As a result of these transactions, prior service costs were

generated.

2. Some subsidiaries adopt a simplified method for the calculation of benefit

obligation.

3. The transition from a portion of the Minolta lump-sum payment plan to a

defined contribution pension plan resulted in the following changes at

March 31, 2004:

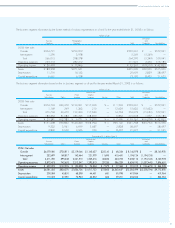

Thousands of

Millions of yen U.S. dollars

Decrease of the retirement benefit

obligations

¥4,721 $44,668

Unrecognized actuarial differences

(769) (7,276)

Unrecognized prior service costs

658 6,226

Decrease of accrued retirement benefits

¥4,610 $43,618

4. The transition from a portion of the Konica lump-sum payment plan to a

defined contribution pension plan resulted in the following changes at

March 31, 2003:

Thousands of

Millions of yen U.S. dollars

Decrease of the retirement benefit

obligations

¥6,182 $58,492

Unrecognized actuarial differences

(371) (3,510)

Decrease of accrued retirement benefits

¥5,810 $54,972

The assets to be transferred to the defined contribution pension plan

equal ¥4,790 million and will be transferred over 4 years. The amount

of ¥4,790 million is recorded as accrued expenses and other long-term

liabilities at March 31, 2004. The assets to be transferred from the

Konica lump-sum payment plan to a defined contribution plan was

recorded as other long-term liabilities at March 31, 2003.

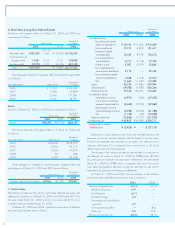

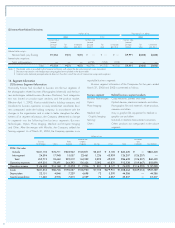

Net pension expenses related to the retirement benefits for the year

ended March 31, 2004 and 2003 are as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

a.Service costs ¥ 5,645 ¥ 4,776 $ 53,411

b.Interest costs 2,670 2,975 25,263

c. Expected return on plan assets (358) (545) (3,387)

d.Amortization of transition amounts 1,540 1,325 14,571

e.Actuarial differences that are

accounted for as expenses 1,968 1,285 18,620

f. Prior service costs that are

accounted for as expenses (519) (156) (4,911)

g.Retirement benefit costs

(a+b+c+d+e+f) 10,946 9,662 103,567

h. Gain on transfer to the government

of the substitutional portion —(8,081) —

i. Loss on the transition to defined

contribution plans from defined

benefit plans 180 2,993 1,703

j. Contribution to defined contribution

pension plans 1,488 —14,079

Total (g+h+i+j) ¥12,615 ¥ 4,574 $119,359

Note: Retirement allowance costs of consolidated subsidiaries using the simplified

method are included in “a. Service costs.”

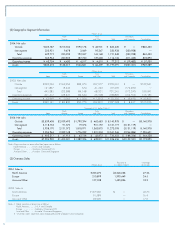

Assumptions used in calculation of the above information are as

follows:

2004 2003

a. Method of attributing the retirement Straight-line Straight-line

benefits to periods of service basis basis

b. Discount rate Mainly 2.5% Mainly 3.0%

c. Expected rate of return on plan assets Mainly 1.25% Mainly 1.5%

d. Amortization of unrecognized prior Mainly Mainly

service cost 10 years 10 years

e. Amortization of unrecognized actuarial Mainly Mainly

differences 10 years 10 years

f. Amortization of transition amount

The Company: Fully amortized Fully amortized

Subsidiaries: Mainly 5 years Mainly 5 years