Konica Minolta 2004 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2004 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

Q. Please outline improvements to your financial position.

A. We have taken concrete steps to improve the Company’s financial position and have

reduced interest-bearing debt to ¥268 billion as of March 31, 2004. On the other hand, in

order to secure acceptable growth, we recognize the need for capital and R&D investment,

particularly in the Business Technologies and Optics businesses. Our goals are to further

reduce interest-bearing debt to ¥175 billion through the use of internal cash flows and to

secure a robust shareholders’ equity ratio. With this as our platform, we will embark on an

aggressive investment program with the aim of achieving dynamic growth.

Q. What is your strategy for the growing Chinese market?

A. China represents not only a manufacturing base, but also a vast and lucrative market in its

own right. Currently, China is the Konica Minolta Group’s largest production base. In terms of

marketing, we are still in the early stages of development. China is clearly recognized, howev-

er, as a strategic region for Konica Minolta and its importance extends beyond the individual

business company level, impacting the fortunes of the Group overall. We allocated specialist

staff to assist in developing marketing strategies in China for each business company, whose

missions include formulating and implementing business strategies specific to China, promoting

management integration, and actively building a dynamic brand for the Chinese market.

While a number of issues require clarification, we will continue to focus on China and its mar-

ket trends with the aim of establishing a leading position.

Positioning China as a

strategic region

>

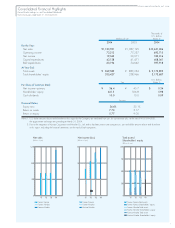

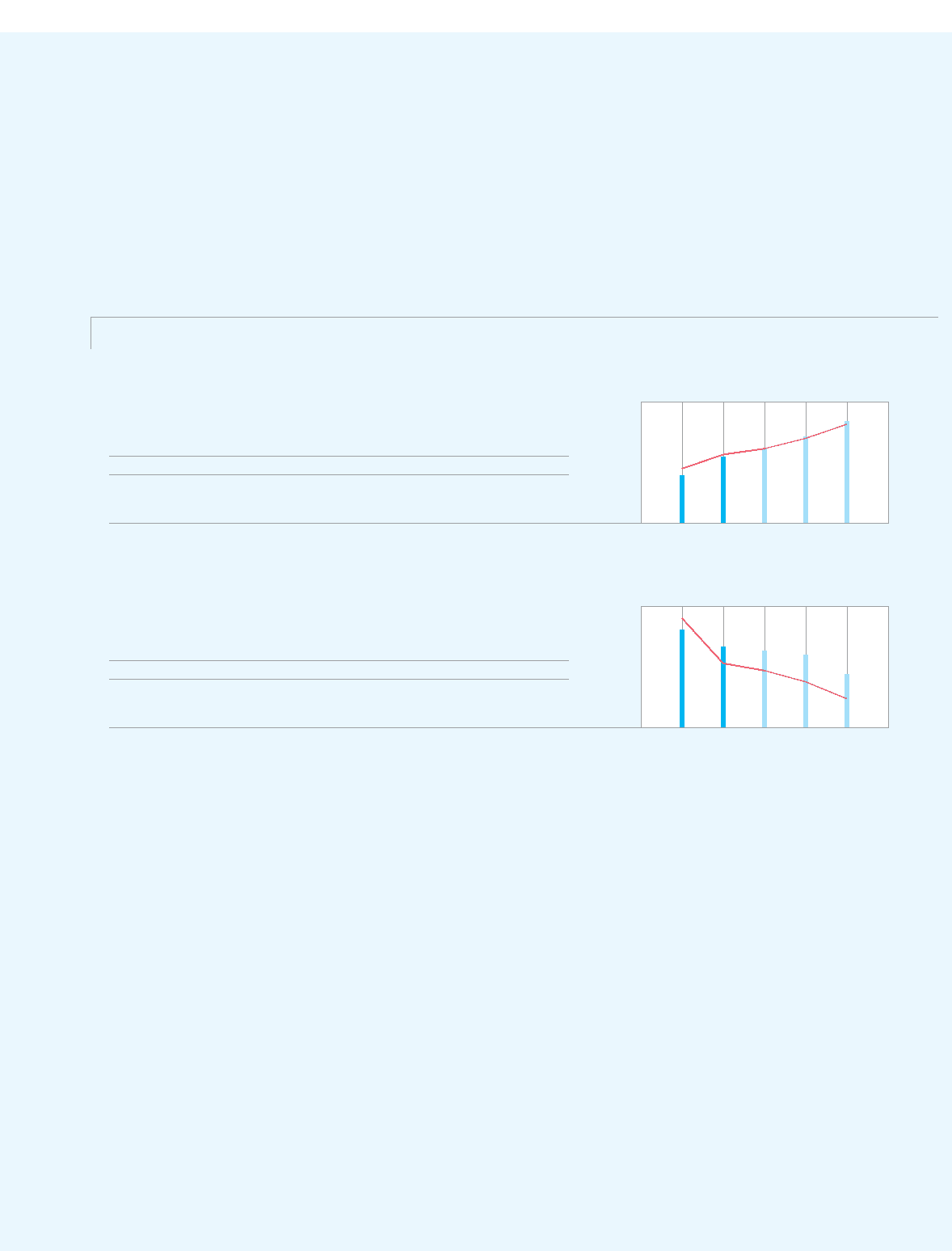

Shareholders’ equity (Billions of yen)

Mar ’03 Mar ’04 Mar ’05 Mar ’06

Results Targets

Mar ’07

239.0 335.4 370.0 430.0 505.0

27.1 34.6 37.4 42.0 49.0Equity ratio (%)

Strengthen Financial Position

Shareholders’ equity & Equity ratio

Interest-bearing debt & Debt/equity ratio

(Billions of yen) (%)

Interest-bearing debt (Billions of yen)

Mar ’03 Mar ’04 Mar ’05 Mar ’06

Results Targets

Mar ’07

322.8 268.0 255.0 240.0 175.0

1.35 0.80 0.71 0.56 0.35Debt/equity ratio (Times)

’03

600

400

200

0

60

40

20

0

’04 ’05 ’06 ’07

(Billions of yen) (Times)

’03

400

300

200

100

0

1.5

1.0

0.5

0.0

’04 ’05 ’06 ’07

Debt/equity ratio Equity ratio

Shareholders’ equityInterest-bearing debt