Konica Minolta 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

KONICA MINOLTA HOLDINGS, INC. 2004

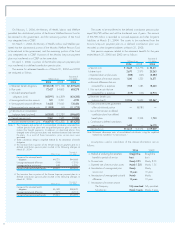

Investor Information

Konica Minolta Holdings, Inc.

As of March 31, 2004

Common Stock

Authorized: 1,200,000,000 shares

Outstanding: 531,664,337 shares

Stock Exchange Listings

Tokyo, Osaka, Nagoya, Frankfurt, Düsseldorf

Number of Shareholders

40,288

Independent Auditor

ChuoAoyama Audit Corporation

Transfer Agent for Common Stock

UFJ Trust Bank Limited

1- 4-3, Marunouchi, Chiyoda-ku,

Tokyo 100-0005, Japan

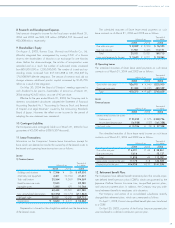

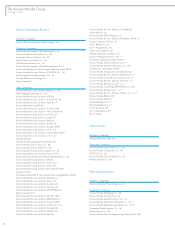

Principal Shareholders

Number of shares held Percentage of total voting shares

Shareholders (Thousand shares) (%)

Japan Trustee Services Bank, Ltd. (Trust account) 45,078 8.6

The Master Trust Bank of Japan, Ltd. (Trust account) 38,793 7.4

The Chase Manhattan Bank NA London SL Omnibus Account 17,800 3.4

The Bank of Tokyo-Mitsubishi, Ltd. 17,794 3.4

The Chase Manhattan Bank NA London 16,354 3.1

State Street Bank and Trust Company 15,706 3.0

Nippon Life Insurance Company 13,343 2.5

Sumitomo Mitsui Banking Corporation 11,875 2.3

The Master Trust Bank of Japan, Ltd. (Holder in Retirement Benefit Trust for UFJ Bank Limited) 10,801 2.0

The Melon Bank Treaty Clients Omnibus 9,143 1.7

Notes: 1. The Company holds 280 shares (0.0% of voting rights) in Mitsubishi Tokyo Financial Group, Inc., the holding company of The Bank of Tokyo-Mitsubishi, Ltd.; 3,501

shares (0.1% of voting rights) in Sumitomo Mitsui Financial Group, Inc. the holding company of the Sumitomo Mitsui Banking Corporation; and 1,637 shares (0.0% of

voting rights) in UFJ Holdings, Inc., the holding company of UFJ Bank Limited.

2. In addition to the above, the Konica Minolta Group has contributed 9,180 shares (0.1% of voting rights) in Mitsubishi Tokyo Financial Group, Inc., the holding company

of The Bank of Tokyo-Mitsubishi, Ltd. (of which the Company holds 2,759 shares (0.0% of voting rights)); 1,040 shares (0.0% of voting rights) in Sumitomo Mitsui

Financial Group, Inc. the holding company of Sumitomo Mitsui Banking Corporation (of which the Company holds 317 shares (0.0% of voting rights)); and 5,094 shares

(0.1% of voting rights) in UFJ Holdings, Inc., the holding company of UFJ Bank Limited (of which the Company holds 1,407 shares (0.0% of voting rights)) to assets in trust

of its employee retirement benefit trust. While the Group does not hold these shares, under the terms and conditions of the trust, it retains the right to dictate the exercise of

voting rights.

3. Although significant shareholder reports from the following companies claim that they hold substantial numbers of shares in Konica Minolta Holdings, Inc. as of the fiscal

year-end the Company is unable to confirm the number of shares held and hence these companies have not been included in the major shareholders overview stated

above.

Companies submitting significant shareholder reports Reporting obligation accrual date Number of shares held (Thousand shares) Percentage of shares held

Fidelity Investments Japan Limited February 26, 2004 59,417 11.2 %

Morgan Stanley Japan Limited (Joint holding) March 31, 2004 36,031 6.8 %

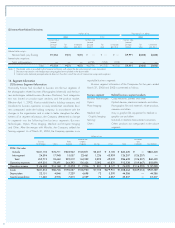

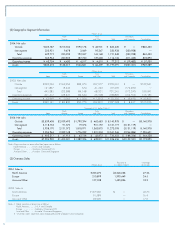

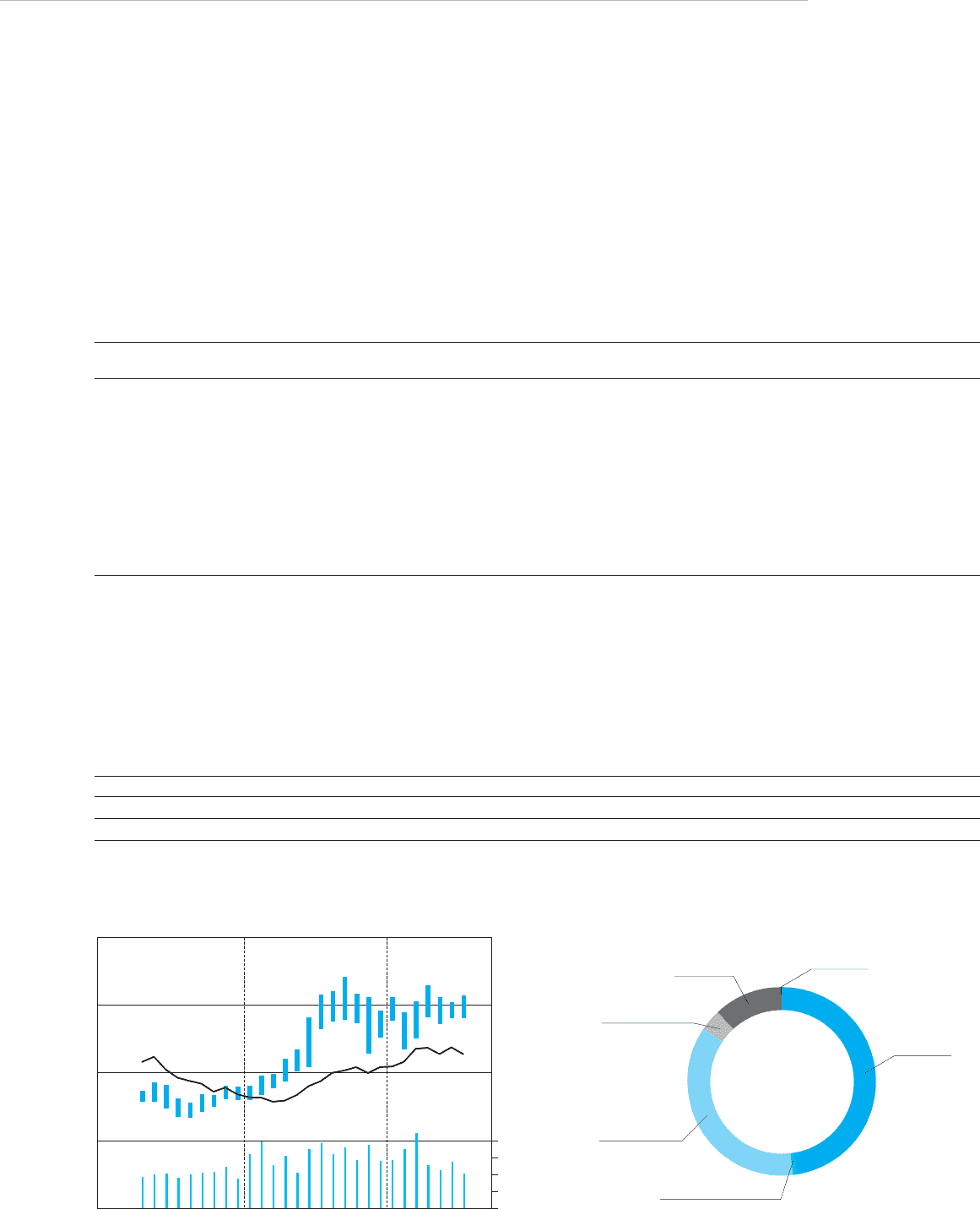

Stock Price Chart Types of Shareholders

0

500

1,000

1,500

2,000

(yen) (yen)

0

15,000

30,000

45,000

60,000

(thousand

shares)

Share price

Stock turnover

TOPIX average

(right scale)

2002

0

500

1,000

1,500

2,000

2003 2004

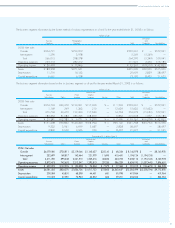

Financial

Institutions

47.4%

Treasury

Stock

0.1%

Individuals

and Others

11.8%

Other Japanese

Institutions

3.7%

Non-Japanese

Institutions

36.3%

Securities

Companies

0.7%