Konica Minolta 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

KONICA MINOLTA HOLDINGS, INC. 2004

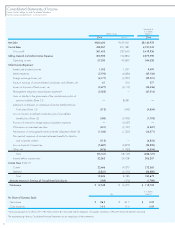

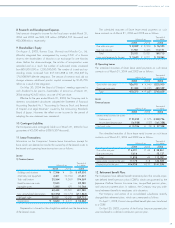

Billions of yen

Impact of

Foreign Currency Integration

Exchange Rates Expenses

Business Technologies +8.5 –4.1

Optics –0.8 –0.2

Photo Imaging +1.8 –0.5

Medical & Graphic Imaging –0.6 –0.2

Sensing –0.1 –0.1

Other Businesses 0.0 –3.7

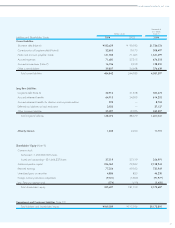

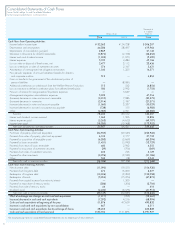

Cash Flows

In the fiscal year ended March 31, 2004, net cash provided by

operating activities totaled ¥86.1 billion, while net cash used in

investing activities, primarily for capital expenditure, was ¥31.9

billion. As a result, free-cash flows for the fiscal year ended

March 31, 2004 totaled ¥54.2 billion.

A portion of these funds were used to repay certain borrow-

ings and corporate bonds. Interest-bearing debt as of March 31,

2004 totaled at ¥268 billion, while the debt-to-equity ratio fell

from 0.84 to 0.80. Net cash used in financing activities in the

fiscal year ended March 31, 2004 was ¥55.3 billion.

After considering the cash flows from operating, investing,

and financing activities and the ¥1.6 billon decrease for the

effect of exchange rate changes, cash and cash equivalents at

March 31, 2004 declined ¥2.7 billion as compared to March

31, 2003. Due to the integration with Minolta Co., Ltd. and

new subsidiaries included in the Company’s scope of consolida-

tion, cash and cash equivalents increased by ¥33.5 billion and

¥1.0 billion, respectively. As a result, the balance of cash and

cash equivalents at March 31, 2004 was ¥83.7 billion.

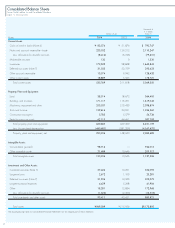

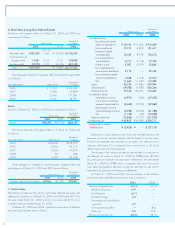

Assets, Liabilities, and Equity

As of March 31, 2004, total assets were ¥969.6 billion and

included current assets of ¥535.8 billion and fixed assets of

¥433.8 billion.

The principal components of current assets were notes and

accounts receivable—trade of ¥223.0 billion, inventories of

¥173.9 billion, and cash and cash equivalents of ¥83.6 billion

before adding ¥0.1 billion of marketable securities.

The significant components in fixed assets at March 31,

2004 included property, plant and equipment, consolidation

goodwill, investment securities and noncurrent deferred tax assets

of ¥220.2 billion, ¥98.7 billion, ¥37.4 billion, and ¥31.9 bil-

lion, respectively. The consolidation goodwill account is being

amortized on a straight-line basis over 5 to 20 years.

Amortization expense of the consolidation goodwill amount in

the fiscal year ended March 31, 2004 was ¥2.4 billion.

As of March 31, 2004, total liabilities were ¥632.9 billion

and included current liabilities of ¥484.8 billion and long-term

liabilities of ¥148.1 billion. The balance of liabilities, as of

March 31, 2004, was impacted by repayments of interest-

bearing debt through free-cash flows generated for the period.

Current liabilities comprised mainly short-term debt, notes

and accounts payable—trade, and accrued expenses with bal-

ances of ¥182.4 billion, ¥141.8 billion, and ¥71.5 billion,

respectively. The principal components of long-term liabilities

included long-term debt of ¥52.9 billion and accrued retirement

benefits of ¥65.8 billion. Minority interests as of March 31,

2004 were ¥1.2 billion.

The primary components of shareholders’ equity at March

31, 2004 include common stock, additional paid-in capital,

and retained earnings, with balances of ¥37.5 billion, ¥226.1

billion and ¥77.3 billion, respectively. Additional shareholders’

equity components include unrealized gains on securities of

¥4.9 billion and foreign currency translation adjustments, which

reflect cumulative translation losses of ¥9.7 billion. The total

shareholders’ equity balance at the March 31, 2004 was

¥335.4 billion.

Driven by efforts to streamline assets, the equity ratio was

34.6%, while equity per share totaled ¥631.54.

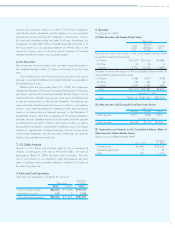

Capital Expenditures and Research and Development

Expenditures

During the fiscal year ended March 31, 2004, the Company

incurred capital expenditures totaling ¥43.1 billion with the aim

of developing new products, increasing production capacity,

implementing rationalization measures, and promoting labor effi-

ciency and power conservation. These expenditures by business

segment include ¥15.2 billion for Business Technologies, ¥6.3

billion for Optics, ¥9.9 billion for Photo Imaging, ¥4.5 billion for

Medical and Graphic Imaging, ¥0.1 billion for Sensing and

¥7.1 billion for all other business segments combined.

Research and development expenditure totaled ¥63.2 billion

during the fiscal year ended March 31, 2004 and included

¥29.6 billion for the Business Technologies segment, ¥7.0 bil-

lion for Optics, ¥9.7 billion for Photo Imaging, ¥7.7 billion for

Medical and Graphic Imaging, and ¥1.0 billion for Sensing.

Expenditures not allocated to a specific business segment, but

used for the development of basic research totaled ¥8.2 billion.

Outlook

The outlook for future economic conditions remains mixed. On

the one hand, an overall global economic recovery is antici-

pated, fueled by a noticeable surge in U.S. business conditions.

This positive scenario is in part offset by concerns over the situa-

tion in the Middle East, and particularly Iraq, and the continued

appreciation of the yen against the U.S. dollar. Against this back-

drop, we will accelerate the implementation of business integra-

tion measures and work to quickly realize the underlying benefits.