Konica Minolta 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

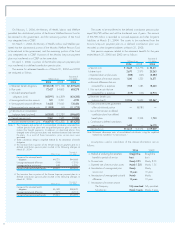

the tax basis of assets and liabilities and those as reported in the consoli-

dated financial statements.

(i) Research and Development Expenses

Expenses for research and development activities are charged to income

as incurred.

(j) Financial Instruments

Derivatives

All derivatives are stated at fair value, with changes in fair value included

in net profit or loss for the period in which they arise, except for deriva-

tives that are designated as “hedging instruments” (see Hedge

Accounting below).

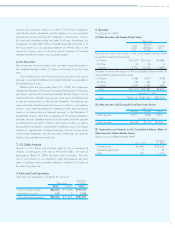

Securities

Securities held by the Companies are classified into two categories:

Investments by the Companies in equity securities issued by unconsol-

idated subsidiaries and affiliates are accounted for by the equity method;

however, investments in certain unconsolidated subsidiaries and affiliates

are stated at cost because the effect of application of the equity method

would be immaterial.

Other securities for which market quotations are available are stated

at fair value.

Net unrealized gains or losses on these securities are reported net-of-

tax as a separate component of shareholders’ equity.

Other securities for which market quotations are unavailable are

stated at cost, except in cases where the fair value of equity securities

issued by unconsolidated subsidiaries and affiliates, or other securities

has declined significantly and such impairment of the value is deemed

other than temporary. In these instances, securities are written down to

the fair value and the resulting losses are charged to income during the

period.

Hedge Accounting

Gains or losses arising from changes in fair value of the derivatives desig-

nated as “hedging instruments” are deferred as an asset or liability and

charged or credited to income in the same period, during which the

gains and losses on the hedged items or transactions are recognized.

The derivatives designated as hedging instruments by the Companies

are principally interest rate swaps, commodity swaps and forward

foreign currency exchange contracts. The related hedged items are trade

accounts receivable and payable, raw materials, long-term bank loans,

and debt securities issued by the Companies.

The Companies have a policy to utilize the above hedging instru-

ments in order to reduce the Companies’ exposure to the risk of interest

rate, commodity price and exchange rate fluctuations. Thus, the

Companies’ purchases of the hedging instruments are limited to, at

maximum, the amounts of the hedged items.

The Companies evaluate the effectiveness of their hedging activities

by reference to the accumulated gains or losses on the hedging instru-

ments and the related hedged items from the commencement of the

hedges.

(k) Leases

Finance leases other than those, which are deemed to transfer the owner-

ship of the leased assets to lessees, are accounted for mainly by a

method similar to that used for ordinary operating leases.

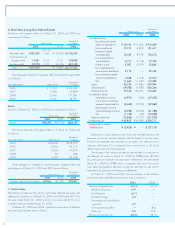

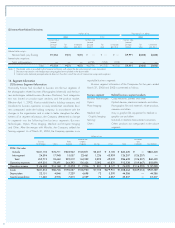

(l) Retirement Benefit Plans

Retirement Benefits for Employees

Pension and severance costs for employees are accrued based on the

actuarial valuation of projected benefit obligations and the plan assets at

the end of each fiscal year. The actuarial difference is amortized over the

average remaining service period (mainly 10 years), using the straight-

line method from the year subsequent to that in which the actuarial differ-

ence was incurred.

Pursuant to the Defined Benefit Enterprise Pension Plan Law, the

Company and several of its consolidated subsidiaries obtained approval

from the Ministry of Health, Labour and Welfare for the exemption from

the payment for future benefits of the substitutional portion of the Konica

Welfare Pension Fund to the government. The Company and several of

its consolidated subsidiaries applied accounting for return of the substitu-

tional portion at the date of approval, which is allowed as an alternative

accounting method in accordance with article 47-2 of Accounting

Committee Report No.13 “Practical Guidance for Accounting for

Pensions” issued by the Japanese Institute of Certified Public Accountants.

A gain on transfer to the government of the substitutional portion totaling

¥8,081 million was recorded in income for the year ended March 31,

2003 as described in Note 12, Retirement Benefit Plans.

On April 30, 2003, the Company, upon enactment of Defined

Contribution Pension Plan Law, transferred a portion of its lump-sum

payment plan to a defined contribution pension plan, pursuant to

Financial Accounting Standards Implementation Guidance No.1

“Accounting for Transfers between Retirement Benefit Plans” issued by the

Accounting Standards Board of Japan, and “Report of Practical Issues

No. 2 Practical Treatment of Accounting for Transfers between Retirement

Benefit Plans” issued by the Accounting Standards Board of Japan. A loss

on this totaling ¥2,993 million was recorded in income for the year

ended March 31, 2003 as described in Note 12, Retirement Benefit

Plans.

In addition, on April 1, 2004, a portion of the Minolta lump-sum

payment plan was transferred to a defined contribution pension plan. As

a result, the Company recorded loss of ¥180 million included in loss on

transition to defined contribution plans from defined benefit plans for the

year ended March 31, 2004 as described in Note 12, Retirement

Benefit Plans.

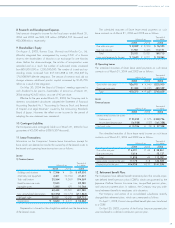

Retirement Benefits for Directors and Corporate Auditors

The Companies provide for the accrued costs of retirement benefits

payable to Directors and Corporate Auditors. The amounts accrued for

such retirement benefits is calculated as 100% of such benefits the

Companies would be required to pay on condition that all eligible

Directors and Corporate Auditors had retired at the year-end date.

The Companies amended their internal rules on retirement benefits of