Konica Minolta 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

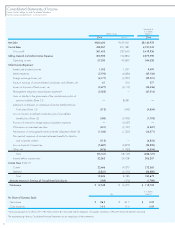

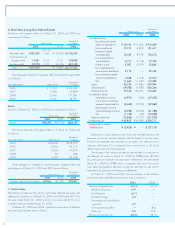

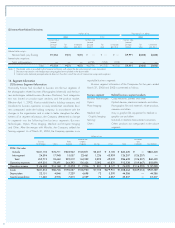

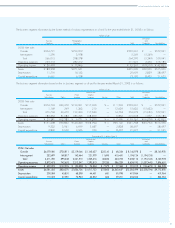

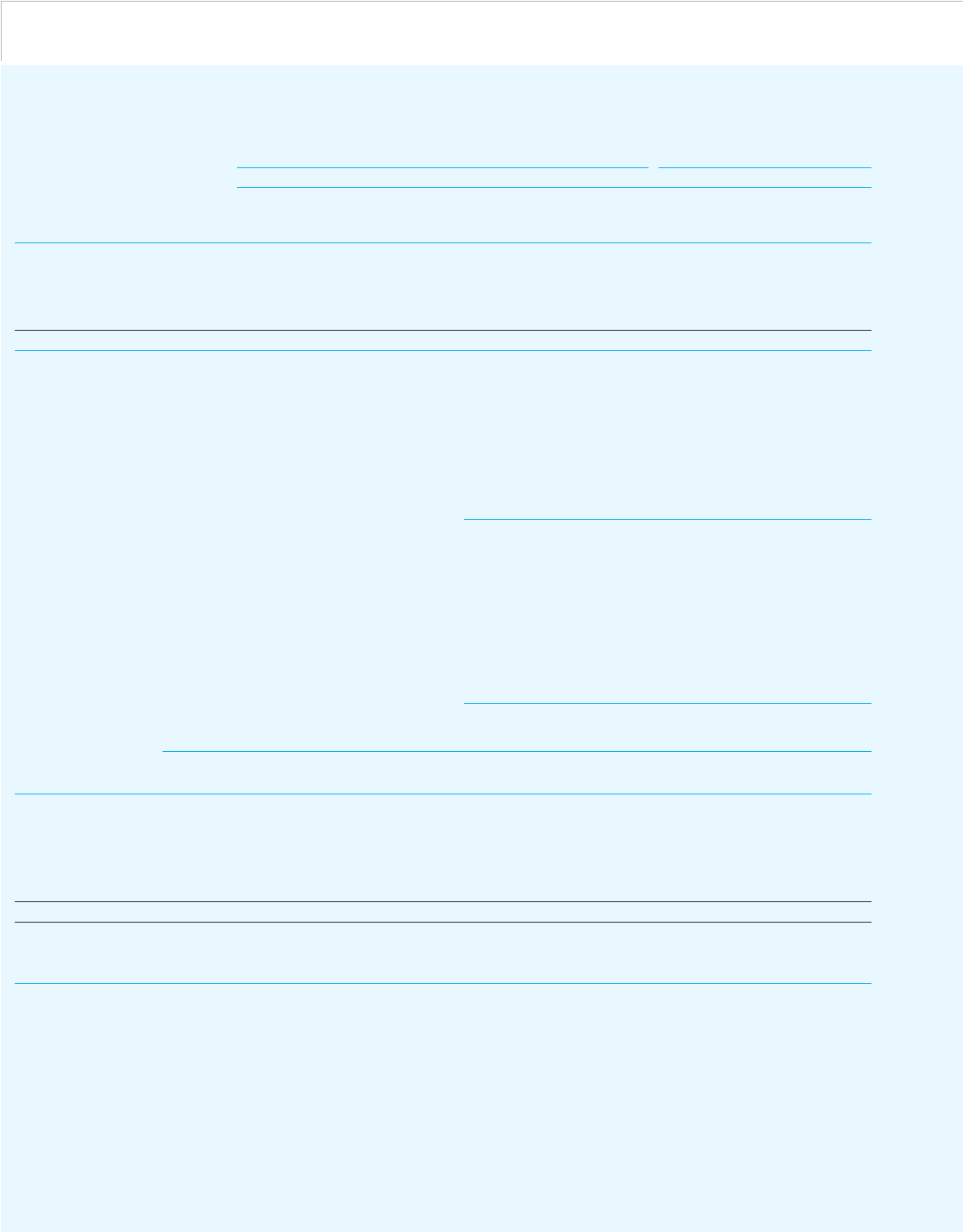

Millions of yen

Medical and Elimination

Business Photo Graphic and

Technologies Optics Imaging Imaging Sensing Other Total Corporate Consolidation

2004: Net sales

Outside ¥431,118 ¥76,711 ¥223,962 ¥120,871 ¥2,657 ¥ 5,100 ¥ 860,420 ¥ — ¥860,420

Intersegment 24,594 17,948 15,057 23,461 1,236 43,909 126,207 (126,207) —

Total 455,712 94,660 239,019 144,332 3,893 49,009 986,628 (126,207) 860,420

Operating expenses 409,303 78,491 244,392 136,426 3,092 40,831 912,538 (109,647) 802,890

Operating income ¥ 46,408 ¥16,168 ¥ (5,372) ¥ 7,906 ¥ 801 ¥ 8,177 ¥ 74,090 ¥ (16,559) ¥ 57,530

Assets ¥431,374 ¥86,726 ¥196,027 ¥106,930 ¥7,703 ¥479,901 ¥1,308,664 ¥(339,074) ¥969,589

Depreciation 22,151 4,846 7,229 4,698 72 5,390 44,386 — 44,386

Capital expenditure 11,660 4,976 7,815 4,529 70 6,257 35,307 — 35,307

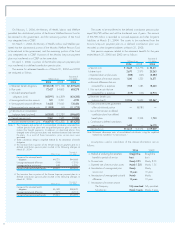

14. Segment Information

(1) Business Segment Information

Historically, Konica had classified its business into the two segments of

the photographic related business (Photographic Materials) and the busi-

ness technologies related business (Business Machines). Such categoriza-

tion was based on product type similarity and the product market.

Effective April 1, 2003, Konica established a holding company and

transferred its business operations to newly established subsidiaries (busi-

ness companies) under the holding company. In accordance with the

changes in the organization and in order to better strengthen the effec-

tiveness of its segment information, the Company determined to change

its segments into the following five business segments: Business

Technologies, Optics, Photo Imaging, Medical and Graphic Imaging

and Other. After the merger with Minolta, the Company added the

Sensing segment. As of March 31, 2004, the Company operates in six

reportable business segments.

Business segment information of the Companies for the years ended

March 31, 2004 and 2003 is presented as follows:

Business segment Related business segment products

Business Technologies: Copy machines, printers and others

Optics: Optical devices, electronic materials and others

Photo Imaging: Photographic film and materials, ink-jet products,

cameras and others

Medical and X-ray or graphic film, equipment for medical or

Graphic Imaging: graphic use and others

Sensing: Industrial or medical measurement instruments

Other: Others products not categorized in the above

segments

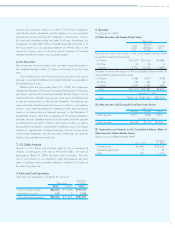

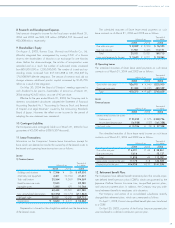

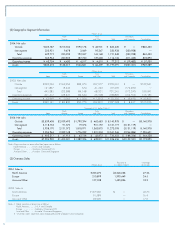

(2) Interest-Rate-Related Derivatives

Millions of yen Thousands of U.S. dollars

2004 2003 2004

Contract value Contract value Contract value

(notional (notional (notional

principal Fair Unrealized principal Fair Unrealized principal Fair Unrealized

amount) value gain (loss) amount) value gain (loss) amount) value gain (loss)

Interest-rate swaps:

Receive fixed, pay floating ¥1,056 ¥(51) ¥(51) ¥ — ¥ — ¥ — $9,991 $(483) $(483)

Interest-rate swaptions:

Sold, call-swaptions ———4,796 (174) (174) ———

Total ¥1,056 ¥(51) ¥(51) ¥4,796 ¥(174) ¥(174) $9,991 $(483) $(483)

Notes:1. The market value is provided by the financial institutions with whom the derivative contracts were transacted.

2. Derivative transactions with hedge accounting applied are excluded in the above table.

3. Contract value (notional principal amount) does not show the size of the risks of interest-rate swaps and swaptions.