Konica Minolta 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

KONICA MINOLTA HOLDINGS, INC. 2004

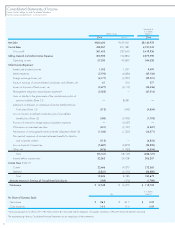

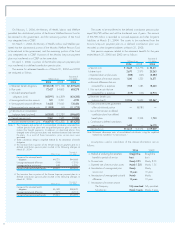

8. Research and Development Expenses

Total amounts charged to income for the fiscal years ended March 31,

2004 and 2003 are ¥49,103 million (US$464,595 thousand) and

¥30,308 million, respectively.

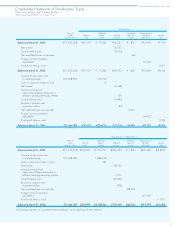

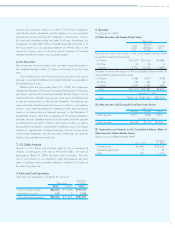

9. Shareholders’ Equity

On August 5, 2003, Konica Corp. (Konica) and Minolta Co., Ltd.

(Minolta) integrated their management by issuing 0.621 of a Konica

share to the shareholders of Minolta in an exchange for one Minolta

share. Before the share exchange, the articles of incorporation were

amended and as a result, the number of authorized shares increased

from 800,000,000 to 1,200,000,000. The number of issued and out-

standing shares increased from 357,655,368 to 531,664,337 by

174,008,969 after the integration. The amount of common stock did not

change whereas additional paid-in capital increased by ¥146,706

million as a result of the integration.

On May 20, 2004 the Board of Directors’ meeting approved a

cash dividend to be paid to shareholders of record as of March 31,

2004 totaling ¥2,655 million, at a rate of ¥5 per share.

Effective for the year ended March 31, 2003, the Company and its

domestic consolidated subsidiaries adopted the Statement of Financial

Accounting Standard No.1 “Accounting for Treasury Stock and Reversal

of Capital and Legal Reserves” issued by the Accounting Standards

Board of Japan. However, the effect on net income for the period of

adopting this new statement was immaterial.

10. Contingent Liabilities

The Companies were contingently liable as of March 31, 2004 for loan

guarantees of ¥2,030 million (US$19,207 thousand).

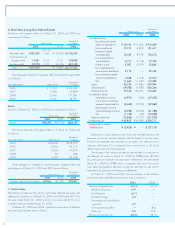

11. Lease Transactions

Information on the Companies’ finance lease transactions (except for

those which are deemed to transfer the ownership of the leased assets to

the lessee) and operating lease transactions are as follows:

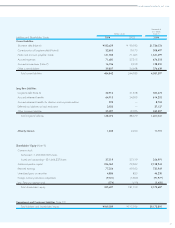

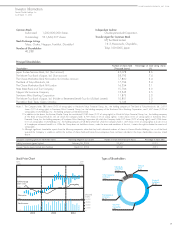

Lessee

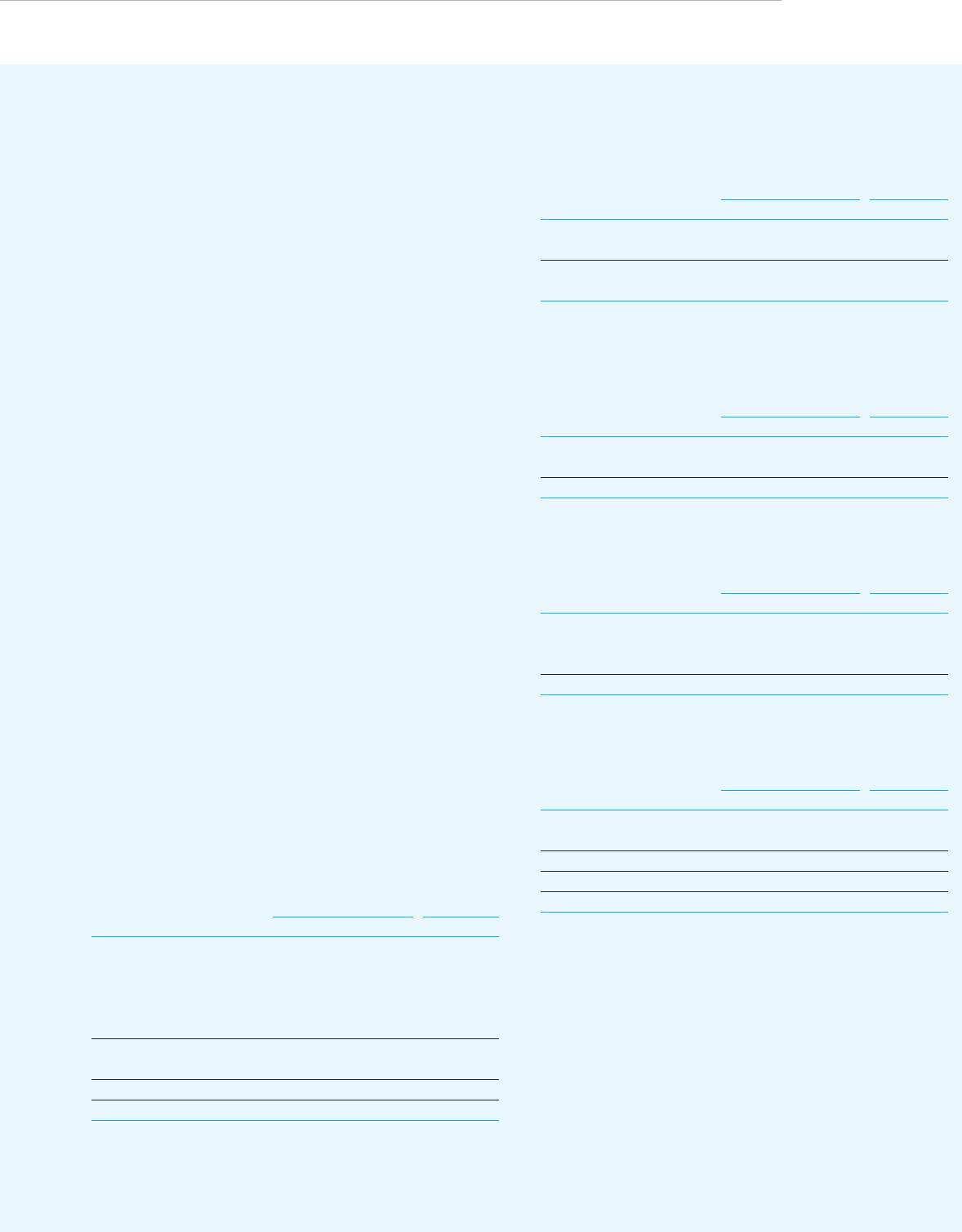

1) Finance Leases

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

Buildings and structures

¥7,346 ¥ 36 $ 69,505

Machinery and equipment

4,401 10,724 41,641

Tools and furniture

20,564 9,369 194,569

Rental business-use assets

9,045 —85,580

Intangible assets

1,085 471 10,266

42,443 20,601 401,580

Less: Accumulated depreciation

(22,392) (10,570) (211,865)

Net book value

20,051 10,031 189,715

Depreciation

¥5,640 ¥ 4,311 $ 53,364

Depreciation is based on the straight-line method over the lease terms

of the leased assets.

The scheduled maturities of future lease rental payments on such

lease contracts as of March 31, 2004 and 2003 are as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

Due within one year

¥ 8,089 ¥ 3,564 $ 76,535

Due over one year

11,961 6,466 113,171

Total 20,051 10,031 189,715

Lease rental expenses for the year

¥ 5,640 ¥ 4,311 $ 53,364

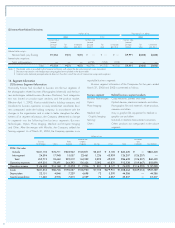

2) Operating Leases

The scheduled maturities of future lease rental payments on such lease

contracts as of March 31, 2004 and 2003 are as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

Due within one year ¥26,951 ¥ 4,940 $255,000

Due over one year 51,323 14,745 485,599

Total ¥78,275 ¥19,685 $740,609

Lessor

Finance Leases

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

Leased rental business-use assets:

Purchase cost

¥25,232 ¥576 $ 238,736

Accumulated depreciation

(14,938) (537) (141,338)

Net book value

¥10,294 ¥ 38 $ 97,398

The scheduled maturities of future lease rental income on such lease

contracts as of March 31, 2004 and 2003 are as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

Due within one year

¥ 6,221 ¥ 44 $ 58,861

Due over one year

5,616 —53,137

Total 11,838 44 112,007

Lease rental income for the year

17,178 618 162,532

Depreciation for the year

¥14,938 ¥537 $141,338

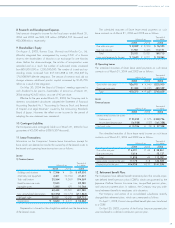

12. Retirement Benefit Plans

The Companies have defined benefit retirement plans that include corpo-

rate defined benefit pensions plans (CDBPs), which are governed by the

Japanese Welfare Pension Insurance Law, tax-qualified pension plans,

and lump-sum payment plans. In addition, the Company may pay addi-

tional retirement benefits to employees at its discretion.

The Company and certain of its consolidated subsidiaries recently

changed their retirement plans, which are summarized as follows.

On April 1, 2003, Konica’s tax-qualified benefit plan was transferred

to a CDBP.

On April 30, 2003, a portion of the Konica lump-sum payment plan

was transferred to a defined contribution pension plan.