Intel 2003 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

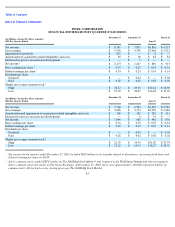

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

In October 2002, the Texas District Court ruled that Intel infringed both patents at issue in that case. Pursuant to the settlement

agreement, Intel paid Intergraph $150 million. Intel then appealed the trial court’s decision. In February 2004, the Court of Appeals for the

Federal Circuit found that the District Court erred in construing a claim term, revised the claim construction, vacated the District Court ruling

and remanded the case to the District Court to determine in the first instance whether the Intel Itanium processor infringes the patents. Intel is

currently evaluating the impact that the Court of Appeals’ opinion has on the 2002 settlement agreement.

In December 2002, Intergraph filed suit in the Eastern District of Texas against Dell Inc., Gateway Inc. and Hewlett-Packard Company,

alleging infringement of three of Intergraph’s patents. These three patents are a subset of the patents that were the subject of a now settled

lawsuit that Intergraph had filed against Intel in Alabama. In May 2003, Dell filed its answer and counterclaim and named Intel as well as

Intergraph in a counterclaim for declaratory judgment. None of the other defendants have named Intel as a counter-defendant. The claim

against Intel does not seek any monetary or other specific relief. Rather, Dell seeks a judicial interpretation of the April 2002 settlement and

license agreement between Intel and Intergraph insofar as that agreement relates to any express and implied licenses and patent exhaustion

defenses Dell has raised to defend the Intergraph claims. Dell has also issued a request for indemnity from Intel for any damages awarded

against Dell, although this issue has not been made an element of the pending litigation. Intel intends to participate vigorously in the defense of

all relevant claims.

In May 2000, various plaintiffs filed a class-action lawsuit in the U.S. District Court for the Northern District of California, alleging

violations of the Securities Exchange Act of 1934 (Exchange Act) and Rule 14d-10 of the Exchange Act in connection with Intel’s acquisition

of DSP Communications, Inc. The complaint alleged that Intel and CWC (Intel’s wholly owned subsidiary at the time) agreed to pay certain

DSP executives additional consideration of $15.6 million not offered or paid to other stockholders. The alleged purpose of this payment to the

insiders was to obtain DSP insiders’ endorsement of Intel’s tender offer in violation of the anti-

discrimination provision of Section 14(d)(7) and

Rule 14d-10. The plaintiffs sought unspecified damages for the class, and unspecified costs and expenses. In July 2002, the District Court

granted Intel’s motion for summary judgment, but in October 2002, the District Court vacated the summary judgment. In January 2003, the

parties reached a settlement agreement, which was reviewed and approved by the court in June 2003. The settlement did not have a material

impact on the company’s results of operations or financial condition.

In September 2001, VIA Technologies, Inc. and Centaur Technology, Inc. sued Intel in the U.S. District Court for the Western District of

Texas, alleging that the Intel

®

Pentium

®

4 processor infringes a VIA microprocessor-related patent. In October 2001, Intel filed counterclaims

against VIA, asserting that VIA’s C3* microprocessors infringe Intel patents. In January 2002, VIA amended its complaint to allege that Intel’

s

Pentium

®

II, Pentium

®

III , Celeron

®

and Pentium 4 processors infringe another patent. In August 2002, Intel added an additional claim that

VIA’s C3 microprocessors infringe an additional Intel patent, and VIA added an additional claim that Intel’s Pentium III and Pentium 4

processors infringe another VIA patent. In April 2003, the parties entered into a settlement agreement, pursuant to which they agreed to dismiss

with prejudice the claims and counterclaims in this lawsuit, and to dismiss all other pending legal claims between them in all jurisdictions. The

confidential settlement agreement includes a patent cross-license agreement covering certain of each company’s products, subject to certain

terms and limitations. The settlement agreement did not have a material impact on the company’s results of operations or financial condition.

In 2001, various plaintiffs filed five class-action lawsuits against Intel alleging violations of the Securities Exchange Act of 1934. These

complaints were consolidated in an amended complaint filed in the U.S. District Court for the Northern District of California. The lawsuit

alleged that purchasers of Intel stock between July 19, 2000 and September 29, 2000 were misled by false and misleading statements by Intel

and certain of its officers and directors concerning the company’s business and financial condition. In July 2003, the court granted Intel’s

motion to dismiss the plaintiffs’ second amended complaint in its entirety with prejudice, and the plaintiffs did not appeal the court’s dismissal

of the suit.

In addition, various plaintiffs filed stockholder derivative complaints in California Superior Court and Delaware Chancery Court against

the company’s directors and certain officers, alleging that they mismanaged the company and otherwise breached their fiduciary obligations to

the company. The plaintiffs in the California action filed the original and two successive amended complaints, and the California Superior

Court sustained Intel’s demurrers on each of these complaints. Following the court’s dismissal without prejudice of these complaints, the

plaintiffs notified the court and Intel in June 2003 that they would not file a fourth complaint, and they signed a stipulation withdrawing their

lawsuit with prejudice, which the court approved. In December 2003, the plaintiffs in the Delaware action withdrew their complaint, and the

case was dismissed with prejudice.

80