Intel 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

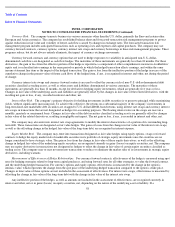

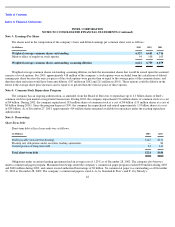

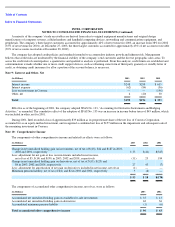

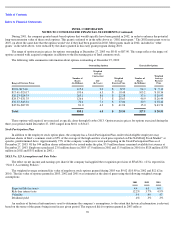

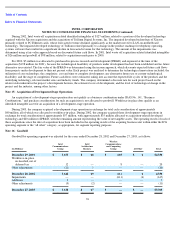

Note 11: Provision for Taxes

Income before taxes and the provision for taxes consisted of the following:

The tax benefit associated with dispositions from employee stock plans reduced taxes currently payable for 2003 by $216 million ($270

million for 2002 and $435 million for 2001).

The difference between the tax provision at the statutory federal income tax rate and the tax provision attributable to income before

income taxes was as follows:

The company reduced its tax provision for 2003 by approximately $758 million due to the tax benefits related to the sale of certain

businesses and assets through the sale of stock of acquired companies ($75 million in 2002). See “Note 14: Business Combinations and

Divestitures.”

The company reduced its tax provision for 2001 by $100 million due to an increase in the tax benefit related to export sales for 2000,

including the impact of a revision in the tax law. This change in estimated taxes was reflected in the federal tax return for 2000 filed in 2001.

67

(Dollars in Millions)

2003

2002

2001

Income (loss) before taxes:

U.S.

$

5,705

$

2,165

$

(350

)

Non

-

U.S.

1,737

2,039

2,533

Total income before taxes

$

7,442

$

4,204

$

2,183

Provision for taxes:

Federal:

Current

$

808

$

542

$

903

Deferred

420

91

(417

)

1,228

633

486

State:

Current

223

143

142

Non

-

U.S.:

Current

379

292

366

Deferred

(29

)

19

(102

)

350

311

264

Total provision for taxes

$

1,801

$

1,087

$

892

Effective tax rate

24.2

%

25.9

%

40.9

%

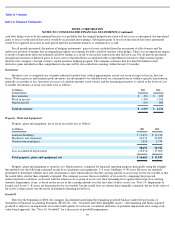

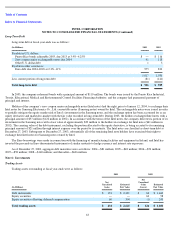

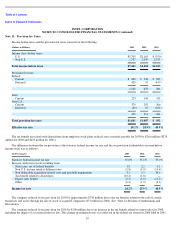

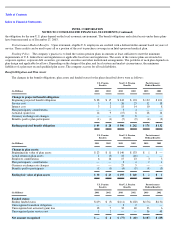

(In Percentages)

2003

2002

2001

Statutory federal income tax rate

35.0

%

35.0

%

35.0

%

Increase (reduction) in rate resulting from:

State taxes, net of federal benefits

1.9

2.2

4.2

Non

-

U.S. income taxed at different rates

(2.8

)

(5.9

)

(15.4

)

Non

-

deductible acquisition

-

related costs and goodwill impairments

3.1

1.3

30.6

Tax benefit related to divestitures

(10.2

)

(1.8

)

—

Export sales benefit

(2.5

)

(3.0

)

(11.2

)

Other

(0.3

)

(1.9

)

(2.3

)

Income tax rate

24.2

%

25.9

%

40.9

%