Intel 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

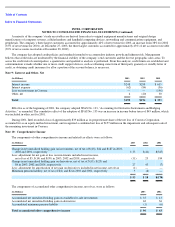

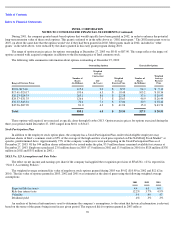

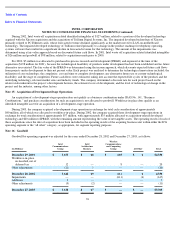

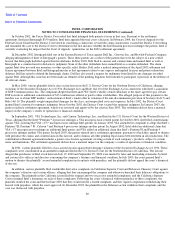

Weighted-average actuarial assumptions used to determine costs for the plans were as follows:

Asset return assumptions are derived following actuarial and statistical methodologies, from an analysis of long-term historical data

relevant to the country where each plan is in effect and the investments applicable to the plan. Plans are subject to regulation under local law,

which may directly or indirectly affect the types of investments that a plan may hold.

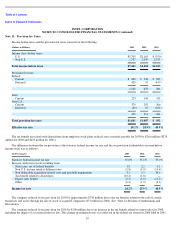

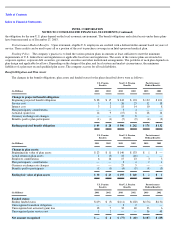

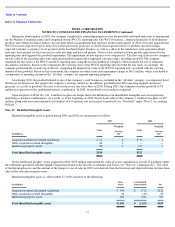

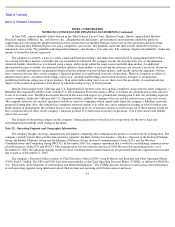

Net Periodic Benefit Cost

The net periodic benefit cost for the plans included the following components:

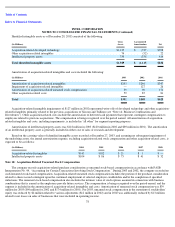

U.S. Plan Assets

The company’s U.S. Pension Plan asset allocation at the end of fiscal 2003 and 2002 was 100% allocated to equity securities. The target

allocation for 2004 is expected to remain the same. The expected long-term rate of return for these equity securities is 8%. The company’s

long-term investment goal is to provide a basic level of benefits through the U.S. Pension Plan guarantee, with an opportunity for participants

to accumulate funds in excess of amounts guaranteed by the U.S. Pension Plan through asset accumulation in the Profit Sharing Plan. The U.S.

plan assets are invested in equity securities, primarily in large, diversified domestic and multinational U.S. equities, which seek to match the

performance of the Standard and Poor’s 500 Index*. The company believes that investing in large, multinational companies achieves adequate

diversity, in that such companies represent a wide range of industries, and many of those companies derive a significant portion of their

revenue from non-U.S. sources or otherwise reflect market conditions throughout the world. When deemed appropriate, a portion of the fund

may be invested in futures contracts for the purpose of acting as a temporary substitute for investment in equity securities. The fund does not

engage in speculative futures transactions.

In order to determine the expected long-term rate of return for the U.S. plan assets, the company used actuarial and statistical methods to

estimate the likely results over a 20-year time horizon. The analysis was based on historical equity market returns during the period from 1926

to 2002. Management selected a rate of return within the likely range reflecting a conservative view of future expected returns.

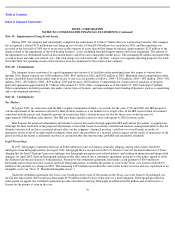

Funding Expectation for 2004

No further contributions are required during 2004 under applicable law for the U.S. Pension Plan. The company intends to make

voluntary contributions so that assets exceed the Accumulated Benefit Obligation at the end of the year. Employer contributions to the

Postretirement Medical Benefits Plan are expected to be approximately $4 million during 2004.

74

U.S. Pension

Benefits

Non-U.S.

Pension

Benefits

Postretirement

Medical

Benefits

2003

2002

2003

2002

2003

2002

Discount rate

7.0

%

7.0

%

5.5

%

7.9

%

6.0

%

7.0

%

Expected return on plan assets

8.0

%

8.5

%

6.7

%

9.2

%

—

—

Rate of compensation increase

5.0

%

5.0

%

3.5

%

6.8

%

—

—

Future profit

-

sharing contributions

6.0

%

6.0

%

—

—

—

—

U.S. Pension Benefits

Non-U.S. Pension

Benefits

Postretirement Medical

Benefits

(In Millions)

2003

2002

2001

2003

2002

2001

2003

2002

2001

Service cost

$

7

$

6

$

3

$

27

$

22

$

34

$

12

$

10

$

9

Interest cost

2

2

1

18

14

13

10

8

7

Expected return on plan assets

(2

)

(1

)

(1

)

(1

)

(12

)

(15

)

—

—

—

Amortization of prior service cost

1

—

—

—

—

1

4

4

4

Recognized net actuarial (gain) loss

1

—

—

1

—

1

—

—

—

Net periodic benefit cost

$

9

$

7

$

3

$

45

$

24

$

34

$

26

$

22

$

20