Intel 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Continued)

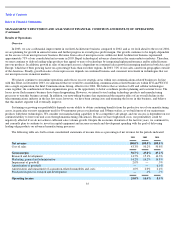

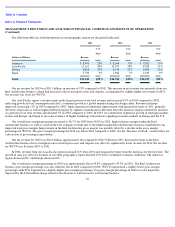

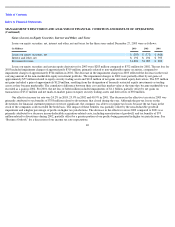

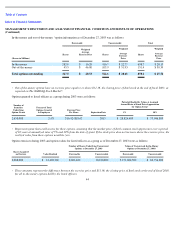

Operating Expenses

Operating expenses for the three years ended December 27, 2003 were as follows:

Research and development spending increased $326 million, or 8%, in 2003 compared to 2002, and increased $238 million, or 6%, in

2002 compared to 2001. The increase in 2003 compared to 2002 was primarily due to higher expenses for product development programs in

the Intel Architecture business and higher spending on the development of manufacturing process technologies, including the 65-nanometer

process technology, as well as higher profit-dependent compensation expenses. The increase in 2002 compared to 2001 was primarily due to

higher spending on the development of manufacturing process technologies, including the 90-nanometer process technology.

Marketing, general and administrative expenses were flat in 2003 compared to 2002. We lowered our discretionary spending and other

expenses as we reduced headcount and refocused on core strategic areas. This decrease in expenses was offset by higher marketing expenses

due to the launch of the Intel Centrino mobile technology brand in 2003; increased profit-dependent compensation expenses; and higher

spending for the Intel Inside

®

cooperative advertising program, primarily due to higher microprocessor revenue. Marketing, general and

administrative expenses decreased $130 million, or 3%, in 2002 compared to 2001, primarily due to the impact of lower spending within ICG

and for certain new business initiatives as we reduced headcount or exited certain businesses, as well as lower overall discretionary spending

related to cost containment programs. The spending decreases were partially offset by higher expenses for the Intel Inside cooperative

advertising program due to higher microprocessor revenue and the impact of our customers using a slightly higher percentage of their available

program funds.

During the fourth quarter of 2003, the company completed its annual impairment review for goodwill and found indicators of impairment

for the WCCG reporting unit. The WCCG business, comprised primarily of flash memory products and cellular baseband chipsets, has not

performed as management had expected. In the fourth quarter of 2003, it became apparent that WCCG was now expected to grow more slowly

than previously projected. A slower-than-expected rollout of products and slower-than-expected customer acceptance of our products in the

baseband chipset business, as well as a delay in the transition to next-generation phone networks, have pushed out the forecasts for sales of

products for high-end data cell phones. These factors resulted in lower growth expectations for the reporting unit and triggered a $611 million

charge for impairment of goodwill. Also during 2003, the company recorded a $6 million charge for impairment of the goodwill related to one

of the company’s seed businesses. Seed businesses support the company’

s strategic initiatives. In 2001, goodwill of $1.6 billion was amortized,

and there was a $98 million charge for goodwill impairment related to prior-year acquisitions. Beginning in 2002, goodwill is no longer

amortized.

Amortization and impairment of acquisition-related intangibles and costs was $301 million in 2003, decreasing from $548 million in

2002 and $628 million in 2001, as intangible assets related to prior acquisitions became fully amortized. The 2002 amount included $127

million of impairments ($26 million in 2001). No impairments were recorded in 2003. Amortization and impairment of both goodwill and

acquisition-related costs for all periods are included in the calculation of the operating loss for the “all other” category for segment reporting

purposes.

39

(In Millions)

2003

2002

2001

Research and development

$

4,360

$

4,034

$

3,796

Marketing, general and administrative

$

4,278

$

4,334

$

4,464

Impairment of goodwill

$

617

$

—

$

98

Amortization of goodwill

$

—

$

—

$

1,612

Amortization and impairment of acquisition

-

related intangibles and costs

$

301

$

548

$

628

Purchased in

-

process research and development

$

5

$

20

$

198