Intel 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

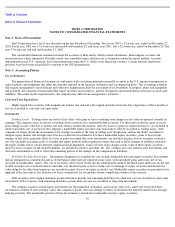

Non-Marketable Equity Securities and Other Investments. Non-marketable equity securities and other investments are accounted for at

historical cost or, if Intel has significant influence over the investee, using the equity method of accounting. Intel’s proportionate share of

income or losses from investments accounted for under the equity method, and any gain or loss on disposal, are recorded in interest and other,

net. Non-marketable equity securities, equity-method investments and other investments are included in other assets. All of the company’s

investments are subject to a periodic impairment review; however, for non-marketable equity securities, the impairment analysis requires

significant judgment to identify events or circumstances that would likely have a significant adverse effect on the fair value of the investment.

The indicators Intel uses to identify those events and circumstances include the investee’s revenue and earnings trends relative to predefined

milestones and overall business prospects; the technological feasibility of the investee’s products and technologies; the general market

conditions in the investee’s industry; and the investee’s liquidity, debt ratios and the rate at which the investee is using cash. Investments

identified as having an indicator of impairment are subject to further analysis to determine if the investment is other than temporarily impaired,

in which case the investment is written down to its impaired value. When an investee is not considered viable from a financial or technological

point of view, the entire investment is written down, since the estimated fair market value is considered to be nominal. If an investee obtains

additional funding at a valuation lower than Intel’s carrying amount or requires a new round of equity funding to stay in operation, and the new

funding does not appear imminent, it is presumed that the investment is other than temporarily impaired, unless specific facts and

circumstances indicate otherwise. Impairment of non-marketable equity securities is recorded in gains (losses) on equity securities, net.

Securities Lending

From time to time, the company enters into securities lending agreements with financial institutions, generally to facilitate hedging

transactions. Selected securities are loaned and are secured by collateral in the form of cash or securities. The loaned securities continue to be

carried as investment assets on the balance sheet. Cash collateral is recorded as an asset with a corresponding liability. For lending agreements

collateralized by securities, the collateral is not recorded as an asset or a liability, unless the collateral is repledged. See “Note 5: Borrowings.”

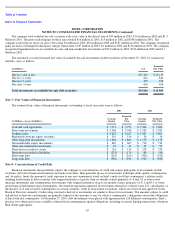

Fair Values of Financial Instruments

Fair values of cash equivalents approximate cost due to the short period of time to maturity. Fair values of short-

term investments, trading

assets, long-term investments, marketable strategic equity securities, certain non-marketable investments, short-term debt, long-term debt,

swaps, currency forward contracts, equity options and warrants are based on quoted market prices or pricing models using current market rates.

Debt securities are generally valued using discounted cash flows in a yield-curve model based on LIBOR. Equity options and warrants are

priced using a Black-Scholes option pricing model. For the company’s portfolio of non-marketable equity securities, management believes that

the carrying value of the portfolio approximates the fair value at December 27, 2003 and December 28, 2002. This estimate takes into account

the decline of the equity and venture capital markets over the last few years, the impairment analyses performed and the impairments recorded

during 2003 and 2002. All of the estimated fair values are management’s estimates; however, when there is no readily available market, the

estimated fair values may not necessarily represent the amounts that could be realized in a current transaction, and these fair values could

change significantly.

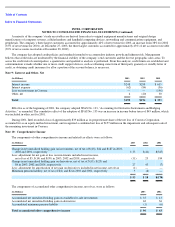

Derivative Financial Instruments

The company’

s primary objective for holding derivative financial instruments is to manage currency, interest rate and some equity market

risks. The company’s derivative instruments are recorded at fair value and are included in other current assets, other assets, other accrued

liabilities or debt. The company’s accounting policies for these instruments are based on whether they meet the company’s criteria for

designation as hedging transactions, either as cash flow or fair value hedges. A hedge of the exposure to variability in the cash flows of an asset

or a liability, or of a forecasted transaction, is referred to as a cash flow hedge. A hedge of the exposure to changes in fair value of an asset or a

liability, or of an unrecognized firm commitment, is referred to as a fair value hedge. The criteria for designating a derivative as a hedge

include the instrument’s effectiveness in risk reduction and, in most cases, a one-to-one matching of the derivative instrument to its underlying

transaction. Gains and losses from changes in fair values of derivatives that are not designated as hedges for accounting purposes are

recognized currently in earnings, and generally offset changes in the values of related assets, liabilities or debt.

As part of its strategic investment program, the company also acquires equity derivative instruments, such as warrants and equity

conversion rights associated with debt instruments, that are not designated as hedging instruments. The gains or losses from changes in fair

values of these equity derivatives are recognized in gains (losses) on equity securities, net.

57