Intel 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

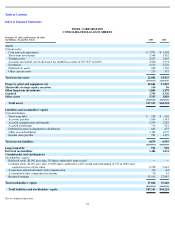

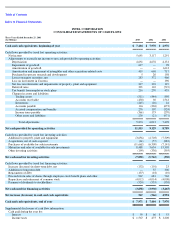

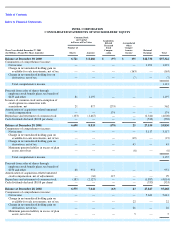

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

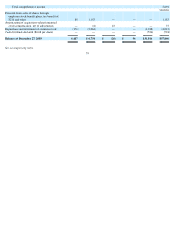

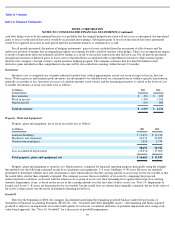

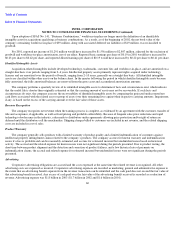

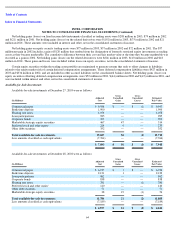

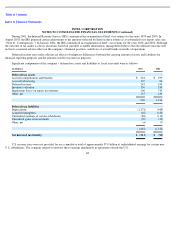

Employee Stock Benefit Plans

The company has employee stock benefit plans, which are described more fully in “Note 12: Employee Stock Benefit Plans.” The

company’s stock option plans are accounted for under the intrinsic value recognition and measurement principles of APB Opinion No. 25,

“Accounting for Stock Issued to Employees,” and related Interpretations. Because the exercise price of all options granted under these stock

option plans was equal to the market price of the underlying common stock (defined as the average of the high and low trading prices reported

by The NASDAQ Stock Market*) on the grant date, no stock-based employee compensation, other than acquisition-related compensation, is

recognized in net income. The following table illustrates the effect on net income and earnings per share if the company had applied the fair

value recognition provisions of SFAS No. 123, “Accounting for Stock-Based Compensation,” as amended, to options granted under the stock

option plans and rights to acquire stock granted under the company’s Stock Participation Plan, collectively called “options.” For purposes of

this pro-forma disclosure, the value of the options is estimated using a Black-Scholes option pricing model and amortized ratably to expense

over the options’ vesting periods. Because the estimated value is determined as of the date of grant, the actual value ultimately realized by the

employee may be significantly different.

It is the company’s policy under SFAS No. 123 to periodically make adjustments to pro-forma compensation expense to reflect

forfeitures. Based on recent forfeiture data, the company reversed previously recognized pro-forma compensation expense and related tax

effects totaling $190 million in 2003 ($87 million in 2002 and $93 million in 2001).

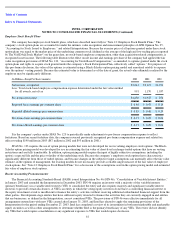

SFAS No. 123 requires the use of option pricing models that were not developed for use in valuing employee stock options. The Black-

Scholes option pricing model was developed for use in estimating the fair value of short-lived exchange-traded options that have no vesting

restrictions and are fully transferable. In addition, option pricing models require the input of highly subjective assumptions, including the

option’s expected life and the price volatility of the underlying stock. Because the company’s employee stock options have characteristics

significantly different from those of traded options, and because changes in the subjective input assumptions can materially affect the fair value

estimate, in the opinion of management, the existing models do not necessarily provide a reliable single measure of the fair value of employee

stock options. See “Note 12: Employee Stock Benefit Plans”

for a discussion of the assumptions used in the option pricing model and estimated

fair value of employee stock options.

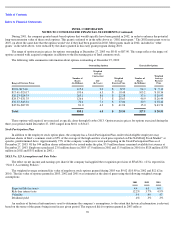

Recent Accounting Pronouncements

The Financial Accounting Standards Board (FASB) issued Interpretation No. 46 (FIN 46), “Consolidation of Variable Interest Entities,”

in January 2003 and amended the Interpretation in December 2003. FIN 46 requires an investor with a majority of the variable interests

(primary beneficiary) in a variable interest entity (VIE) to consolidate the entity and also requires majority and significant variable interest

investors to provide certain disclosures. A VIE is an entity in which the voting equity investors do not have a controlling financial interest or

the equity investment at risk is insufficient to finance the entity’

s activities without receiving additional subordinated financial support from the

other parties. Development-stage entities that have sufficient equity invested to finance the activities they are currently engaged in and entities

that are businesses, as defined in the Interpretation, are not considered VIEs. The provisions of FIN 46 were effective immediately for all

arrangements entered into with new VIEs created after January 31, 2003, and Intel has elected to apply the remaining provisions of the

Interpretation for the period ending December 27, 2003. Intel has completed a review of its investments in both non-

marketable and marketable

equity securities as well as other arrangements to determine whether Intel is the primary beneficiary of any VIEs. The review did not identify

any VIEs that would require consolidation or any significant exposure to VIEs that would require disclosure.

61

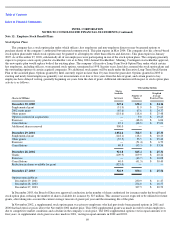

(In Millions—Except Per Share Amounts)

2003

2002

2001

Net income, as reported

$

5,641

$

3,117

$

1,291

Less: Total stock-based employee compensation expense determined under the fair value method

for all awards, net of tax

991

1,170

1,037

Pro

-

forma net income

$

4,650

$

1,947

$

254

Reported basic earnings per common share

$

0.86

$

0.47

$

0.19

Reported diluted earnings per common share

$

0.85

$

0.46

$

0.19

Pro

-

forma basic earnings per common share

$

0.71

$

0.29

$

0.04

Pro

-

forma diluted earnings per common share

$

0.71

$

0.29

$

0.04