Intel 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

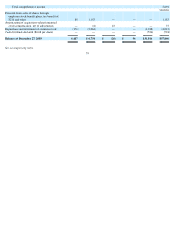

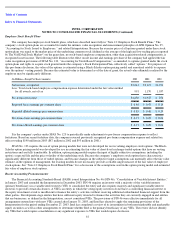

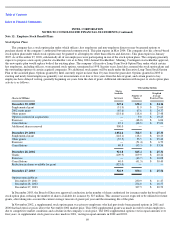

Upon adoption of SFAS No. 141, “Business Combinations,” workforce-in-place no longer meets the definition of an identifiable

intangible asset for acquisitions qualifying as business combinations. As a result, as of the beginning of 2002, the net book value of the

company’s remaining workforce-in-place of $39 million, along with associated deferred tax liabilities of $19 million, was reclassified to

goodwill.

For 2001, reported net income of $1,291 million would have increased by $1,556 million to $2,847 million, adjusted for the exclusion of

goodwill and workforce-in-place amortization, net of tax effect. Reported basic earnings per share of $0.19 in 2001 would have increased by

$0.23 per share to $0.42 per share, and reported diluted earnings per share of $0.19 would have increased by $0.22 per share to $0.41 per share.

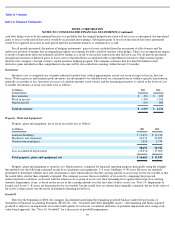

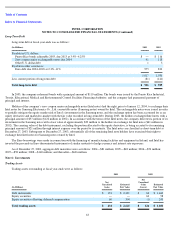

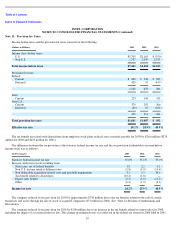

Identified Intangible Assets

Acquisition-related intangibles include developed technology, trademarks, customer lists and workforce-in-place, and are amortized on a

straight-line basis over periods ranging from 2–6 years. Intellectual property assets primarily represent rights acquired under technology

licenses and are amortized over the periods of benefit, ranging from 2–10 years, generally on a straight-line basis. All identified intangible

assets are classified within other assets on the balance sheet. In the quarter following the period in which identified intangible assets become

fully amortized, the fully amortized balances are removed from the gross asset and accumulated amortization amounts.

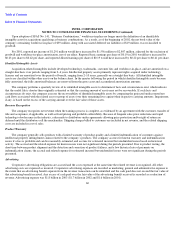

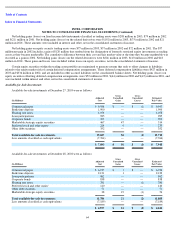

The company performs a quarterly review of its identified intangible assets to determine if facts and circumstances exist which indicate

that the useful life is shorter than originally estimated or that the carrying amount of assets may not be recoverable. If such facts and

circumstances do exist, the company assesses the recoverability of identified intangible assets by comparing the projected undiscounted net

cash flows associated with the related asset or group of assets over their remaining lives against their respective carrying amounts. Impairment,

if any, is based on the excess of the carrying amount over the fair value of those assets.

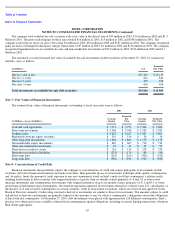

Revenue Recognition

The company recognizes net revenue when the earnings process is complete, as evidenced by an agreement with the customer, transfer of

title and acceptance, if applicable, as well as fixed pricing and probable collectibility. Because of frequent sales price reductions and rapid

technology obsolescence in the industry, sales made to distributors under agreements allowing price protection and/or right of return are

deferred until the distributors sell the merchandise. Shipping charges billed to customers are included in net revenue, and the related shipping

costs are included in cost of sales.

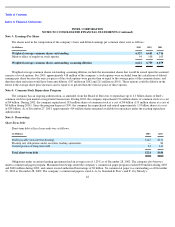

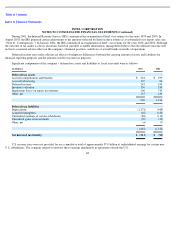

Product Warranty

The company generally sells products with a limited warranty of product quality and a limited indemnification of customers against

intellectual property infringement claims related to the company’s products. The company accrues for known warranty and indemnification

issues if a loss is probable and can be reasonably estimated, and accrues for estimated incurred but unidentified issues based on historical

activity. The accrual and the related expense for known issues were not significant during the periods presented. Due to product testing, the

short time between product shipment and the detection and correction of product failures, and a low historical rate of payments on

indemnification claims, the accrual and related expense for estimated incurred but unidentified issues were not significant during the periods

presented.

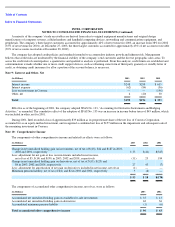

Advertising

Cooperative advertising obligations are accrued and the costs expensed at the same time the related revenue is recognized. All other

advertising costs are expensed as incurred. Cooperative advertising expenses are recorded as marketing, general and administrative expense to

the extent that an advertising benefit separate from the revenue transaction can be identified and the cash paid does not exceed the fair value of

that advertising benefit received. Any excess of cash paid over the fair value of the advertising benefit received is recorded as a reduction of

revenue. Advertising expense was $1.8 billion in 2003 ($1.7 billion in 2002 and $1.6 billion in 2001).

60