Intel 2003 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

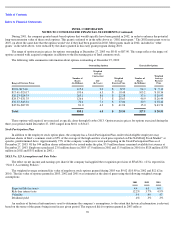

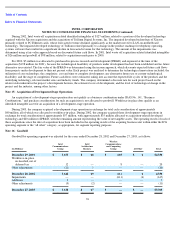

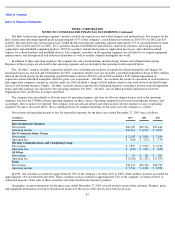

During the fourth quarter of 2003, the company completed its annual impairment review for goodwill and found indicators of impairment

for the Wireless Communications and Computing Group (WCCG) reporting unit. The WCCG business, comprised primarily of flash memory

products and cellular baseband chipsets, has not performed as management had expected. In the fourth quarter of 2003, it became apparent that

WCCG was now expected to grow more slowly than previously projected. A slower-than-expected rollout of products and slower-than-

expected customer acceptance of our products in the baseband chipset business, as well as a delay in the transition to next-generation phone

networks, have pushed out the forecasts for sales into high-end data cell phones. These factors resulted in lower growth expectations for the

reporting unit and triggered the goodwill impairment. The impairment review requires a two-

step process. The first step of the review compares

the fair value of the reporting units with substantial goodwill against their aggregate carrying values, including goodwill. The company

estimated the fair value of the WCCG and ICG reporting units using the income method of valuation, which includes the use of estimated

discounted cash flows. Based on the comparison, the carrying value of the WCCG reporting unit exceeded the fair value. Accordingly, the

company performed the second step of the test, comparing the implied fair value of the WCCG reporting unit’s goodwill with the carrying

amount of that goodwill. Based on this assessment, the company recorded a non-cash impairment charge of $611 million, which is included as

a component of operating income in the “all other” category for segment reporting purposes.

Also during 2003, the goodwill related to one of the company’s seed businesses, included in the “all other” category, was impaired. Seed

businesses are businesses that support the company’s strategic initiatives. In addition, goodwill in the ICG operating segment decreased,

primarily as a result of goodwill allocated to divestitures on a fair value basis in 2003. During 2003, the company recorded goodwill of $3

million in connection with a qualifying business combination. In 2002, no goodwill was recorded or impaired.

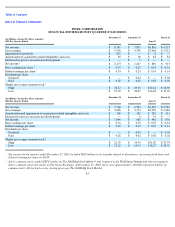

Upon adoption of SFAS No. 141, workforce-in-place no longer meets the definition of an identifiable intangible asset in acquisitions

qualifying as business combinations. As a result, as of the beginning of 2002, the net book value of the company’s workforce-in-place of $39

million, along with associated deferred tax liabilities of $19 million, was reclassified to goodwill (see “Goodwill” under “Note 2: Accounting

Policies”).

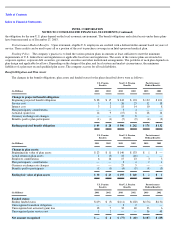

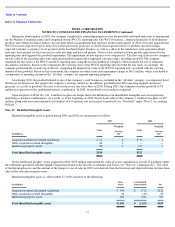

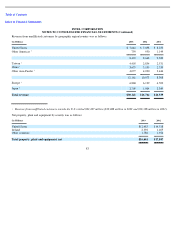

Note 17: Identified Intangible Assets

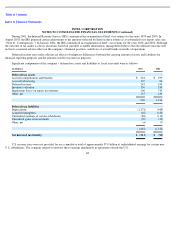

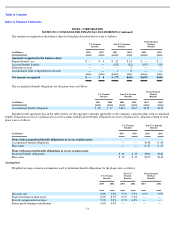

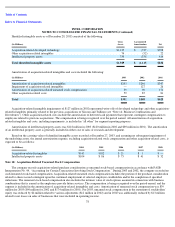

Identified intangible assets acquired during 2003 and 2002 are summarized as follows:

Of the intellectual property assets acquired in 2002, $295 million represented the value of assets capitalized as a result of payments under

the settlement agreement with Intergraph Corporation related to the lawsuits in Alabama and Texas (see “Note 21: Contingencies”). The value

of the Intergraph assets and the amount of the charge to cost of sales in 2002 were derived from the historical and expected future revenue from

sales of the relevant microprocessors.

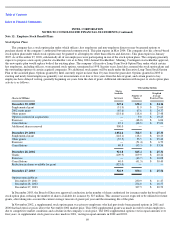

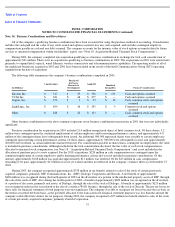

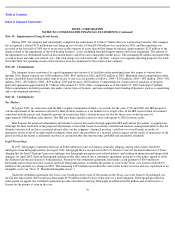

Identified intangible assets as of December 27, 2003 consisted of the following:

77

2003

2002

(In Millions)

Value

Weighted

Average

Life

Value

Weighted

Average

Life

Acquisition

-

related developed technology

$

14

4

$

35

2

Other acquisition

-

related intangibles

40

2

—

—

Intellectual property assets

96

5

317

7

Total identified intangible assets

$

150

$

352

(In Millions)

Gross

Assets

Accumulated

Amortization

Net

Acquisition

-

related developed technology

$

994

$

(772

)

$

222

Other acquisition

-

related intangibles

94

(49

)

45

Intellectual property assets

604

(212

)

392

Total identified intangible assets

$

1,692

$

(1,033

)

$

659