Intel 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

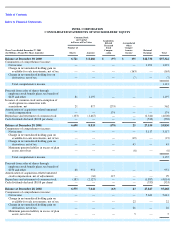

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

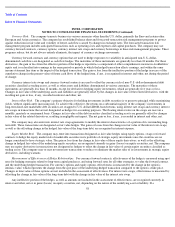

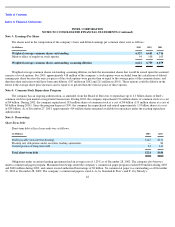

Net holding gains (losses) on fixed income debt instruments classified as trading assets were $208 million in 2003, $79 million in 2002

and $(21) million in 2001. Net holding gains (losses) on the related derivatives were $(192) million in 2003, $(75) million in 2002 and $21

million in 2001. These amounts were included in interest and other, net in the consolidated statements of income.

Net holding gains on equity security trading assets were $77 million in 2003, $57 million in 2002 and $72 million in 2001. The $57

million net gain in 2002 includes a gain of $120 million that resulted from the designation of formerly restricted equity investments as trading

assets as they became marketable. The cumulative difference between their cost and fair market value at the time they became marketable was

recorded as a gain in 2002. Net holding gains (losses) on the related derivatives were $(84) million in 2003, $110 million in 2002 and $18

million in 2001. These gains and losses were included within losses on equity securities, net in the consolidated statements of income.

Certain equity securities within the trading asset portfolio are maintained to generate returns that seek to offset changes in liabilities

related to the equity market risk of certain deferred compensation arrangements. These deferred compensation liabilities were $427 million in

2003 and $336 million in 2002, and are included in other accrued liabilities on the consolidated balance sheets. Net holding gains (losses) on

equity securities offsetting deferred compensation arrangements were $52 million in 2003, $(64) million in 2002 and $(45) million in 2001, and

were included within interest and other, net in the consolidated statements of income.

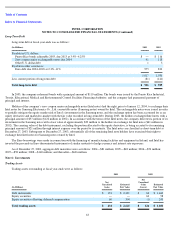

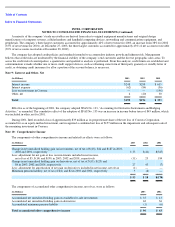

Available

-for-Sale Investments

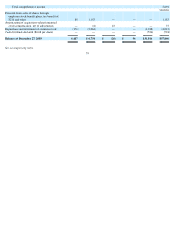

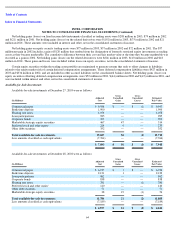

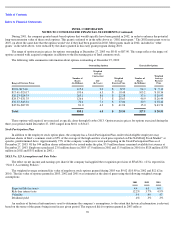

Available-for-sale investments at December 27, 2003 were as follows:

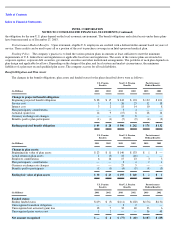

Available-for-sale investments at December 28, 2002 were as follows:

64

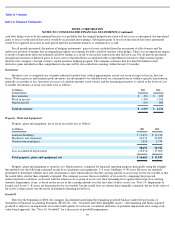

(In Millions)

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

Commercial paper

$

9,948

$

—

$

(

1

)

$

9,947

Bank time deposits

1,900

—

—

1,900

Floating rate notes

1,078

—

—

1,078

Loan participations

985

—

—

985

Corporate bonds

703

—

—

703

Marketable strategic equity securities

467

47

—

514

Preferred stock and other equity

224

9

—

233

Other debt securities

352

—

—

352

Total available

-

for

-

sale investments

15,657

56

(1

)

15,712

Less amounts classified as cash equivalents

(7,764

)

—

—

(

7,764

)

$

7,893

$

56

$

(1

)

$

7,948

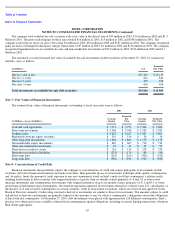

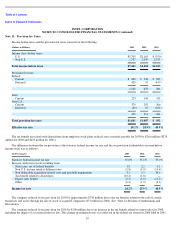

(In Millions)

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

Commercial paper

$

6,935

$

1

$

—

$

6,936

Bank time deposits

2,121

1

—

2,122

Loan participations

862

—

—

862

Corporate bonds

838

—

—

838

Floating rate notes

781

—

(

1

)

780

Preferred stock and other equity

140

—

—

140

Other debt securities

71

—

—

71

Marketable strategic equity securities

38

19

(1

)

56

Total available

-

for

-

sale investments

11,786

21

(2

)

11,805

Less amounts classified as cash equivalents

(7,189

)

—

—

(

7,189

)

$

4,597

$

21

$

(2

)

$

4,616