Intel 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

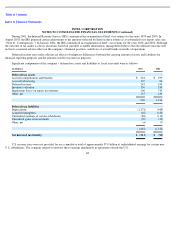

Table of Contents

Index to Financial Statements

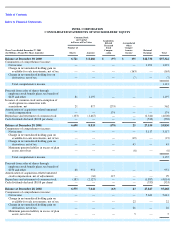

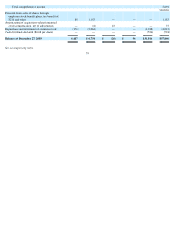

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

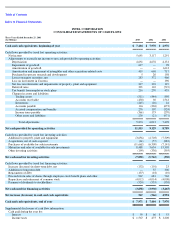

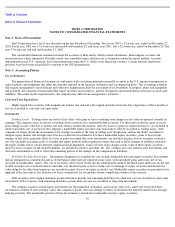

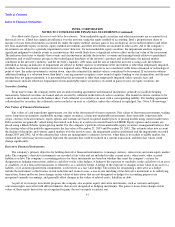

cash flow hedge were to be discontinued because it is probable that the original hedged transaction will not occur as anticipated, the unrealized

gains or losses on the related derivative would be reclassified into earnings. Subsequent gains or losses on the related derivative instrument

would be recognized in income in each period until the instrument matures, is terminated or is sold.

For all periods presented, the portion of hedging instruments’ gains or losses excluded from the assessment of effectiveness and the

ineffective portions of hedges had an insignificant impact on earnings for both cash flow and fair value hedges. There was no significant impact

to results of operations from discontinued cash flow hedges as a result of forecasted transactions that did not occur. For all periods presented,

insignificant amounts of deferred gains or losses were reclassified from accumulated other comprehensive income to depreciation expense

related to the company’s foreign currency capital purchase hedging program. The company estimates that less than $10 million of net

derivative gains included in other comprehensive income will be reclassified into earnings within the next 12 months.

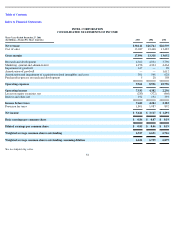

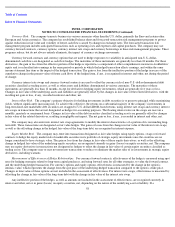

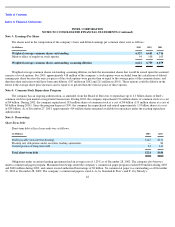

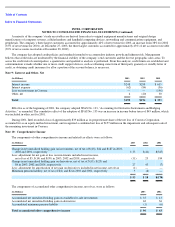

Inventories

Inventory cost is computed on a currently adjusted standard basis (which approximates actual cost on an average or first-in, first-out

basis). Work in process and finished goods inventory are determined to be saleable based on a demand forecast within a specific time horizon,

generally six months or less. Inventory in excess of saleable amounts is not valued, and the remaining inventory is valued at the lower of cost

or market. Inventories at fiscal year-ends were as follows:

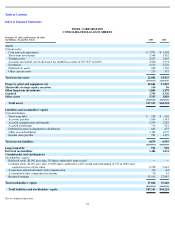

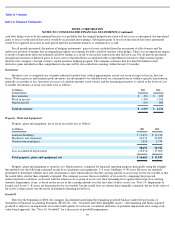

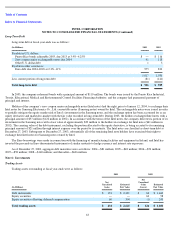

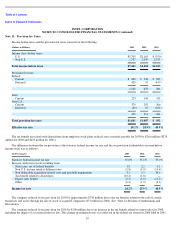

Property, Plant and Equipment

Property, plant and equipment, net at fiscal year-ends was as follows:

Property, plant and equipment is stated at cost. Depreciation is computed for financial reporting purposes principally using the straight-

line method over the following estimated useful lives: machinery and equipment, 2–4 years; buildings, 4–40 years. Reviews are regularly

performed to determine whether facts and circumstances exist which indicate that the carrying amount of assets may not be recoverable or that

the useful life is shorter than originally estimated. The company assesses the recoverability of its assets by comparing the projected

undiscounted net cash flows associated with the related asset or group of assets over their remaining lives against their respective carrying

amounts. Impairment, if any, is based on the excess of the carrying amount over the fair value of those assets (see “Note 19: Impairment of

Long-Lived Assets”). If assets are determined to be recoverable, but the useful lives are shorter than originally estimated, the net book value of

the assets is depreciated over the newly determined remaining useful lives.

Goodwill

Effective the beginning of 2002, the company discontinued amortizing the remaining goodwill balances under the provisions of

Statement of Financial Accounting Standards (SFAS) No. 142, “Goodwill and Other Intangible Assets.” All remaining and future acquired

goodwill is subject to an impairment test in the fourth quarter of each year, or earlier if indicators of potential impairment exist, using a fair-

value-based approach. See “Note 16: Goodwill” for a discussion of goodwill impairments.

59

(In Millions)

2003

2002

Raw materials

$

333

$

223

Work in process

1,490

1,365

Finished goods

696

688

Total inventories

$

2,519

$

2,276

(In Millions)

2003

2002

Land and buildings

$

12,651

$

11,374

Machinery and equipment

24,233

22,800

Construction in progress

1,808

2,738

38,692

36,912

Less accumulated depreciation

(22,031

)

(19,065

)

Total property, plant and equipment, net

$

16,661

$

17,847