Intel 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

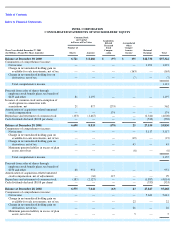

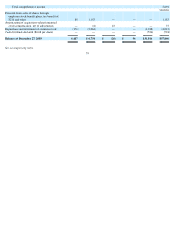

Table of Contents

Index to Financial Statements

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Continued)

Demand for our products, which impacts our revenue and gross margin percentage, is affected by business and economic conditions, as well as

computing and communications industry trends and the development and timing of introduction of compelling software applications and

operating systems that take advantage of the features of our products. Demand for our products is also affected by changes in customer order

patterns, such as changes in the levels of inventory maintained by our customers and the timing of customer purchases. Revenue and gross

margin could also be affected by competitive factors, such as competing chip architectures and manufacturing technologies, competing

software-compatible microprocessors, pricing pressures and other competitive factors, as well as market acceptance of our new products in

specific market segments, the availability of sufficient inventory to meet demand and the availability of externally purchased components. Our

future revenue is also dependent on continuing technological advancement, including developing and implementing new processes and

strategic products, as well as the timing of new product introductions, sustaining and growing new businesses, and integrating and operating

any acquired businesses. Our results could also be affected by adverse effects associated with product defects and errata (deviations from

published specifications) and by litigation involving intellectual property, stockholder, consumer and other issues.

We believe that we have the product offerings, facilities, personnel, and competitive and financial resources for continued business

success, but future revenue, costs, gross margins and profits are all influenced by a number of factors, including those discussed above, all of

which are inherently difficult to forecast.

Status of Business Outlook and Related Risk Factor Statements

We expect that our corporate representatives will from time to time meet privately with investors, investment analysts, the media and

others, and may reiterate the forward-looking statements contained in the “Business Outlook” section and elsewhere in this Form 10-K,

including any such statements that are incorporated by reference in this Form 10-K. At the same time, we will keep this Form 10-K and our

then current Business Outlook publicly available on our Investor Relations web site (www.intc.com). The public can continue to rely on the

Business Outlook published on the web site as representing our current expectations on matters covered, unless we publish a notice stating

otherwise. The statements in Business Outlook and other forward-looking statements in this Form 10-K are subject to revision during the

course of the year in our quarterly earnings releases and SEC filings, our mid-quarter business updates and at other times.

We intend to publish a Mid-Quarter Business Update on March 4, 2004. From the close of business on February 27, 2004 until

publication of the Update, we will observe a “Quiet Period” during which the Business Outlook and other forward-looking statements first

published in our earnings press release on January 14, 2004, as reiterated or updated, as applicable, in this Form 10-K, should be considered

historical, speaking as of prior to the Quiet Period only and not subject to update. During the Quiet Period, our representatives will not

comment on the Business Outlook or our financial results or expectations.

A Quiet Period operating in similar fashion with regard to the Business Outlook and our Form 10-K will begin at the close of business on

March 12, 2004 and will extend until the day that our next quarterly Earnings Release is published, presently scheduled for April 13, 2004.

48