Intel 2003 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

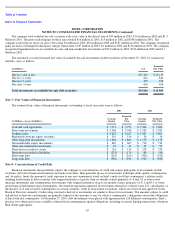

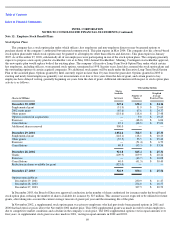

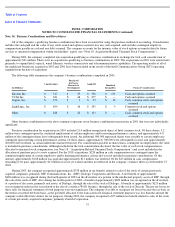

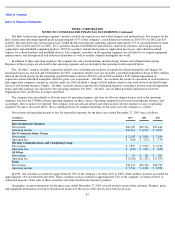

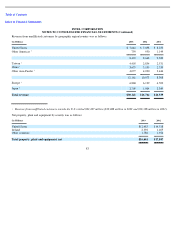

The amounts recognized on the balance sheet for the plans described above were as follows:

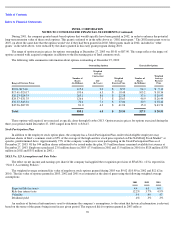

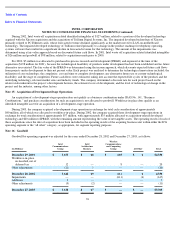

The accumulated benefit obligations for the plans were as follows:

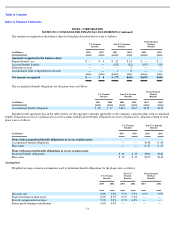

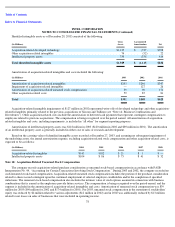

Included in the aggregate data in the tables below are the aggregate amounts applicable to the company’

s pension plans with accumulated

benefit obligations in excess of plan assets as well as plans with projected benefit obligations in excess of plan assets. Amounts related to such

plans were as follows:

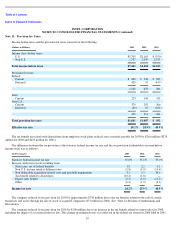

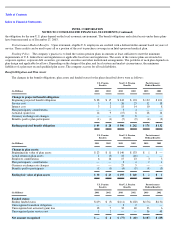

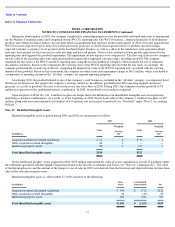

Assumptions

Weighted-average actuarial assumptions used to determine benefit obligations for the plans were as follows:

73

U.S. Pension

Benefits

Non-U.S. Pension

Benefits

Postretirement

Medical

Benefits

(In Millions)

2003

2002

2003

2002

2003

2002

Amounts recognized in the balance sheet:

Prepaid benefit cost

$

—

$

4

$

25

$

14

$

—

$

—

Accrued benefit liability

—

—

(

103

)

(82

)

(107

)

(85

)

Deferred tax asset

—

—

—

2

—

—

Accumulated other comprehensive income

—

—

1

6

—

—

Net amount recognized

$

—

$

4

$

(77

)

$

(60

)

$

(107

)

$

(85

)

U.S. Pension

Benefits

Non-U.S. Pension

Benefits

Postretirement

Medical

Benefits

(In Millions)

2003

2002

2003

2002

2003

2002

Accumulated benefit obligation

$

28

$

17

$

224

$

167

$

178

$

132

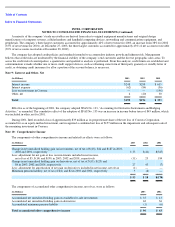

U.S. Pension

Benefits

Non-U.S. Pension

Benefits

(In Millions)

2003

2002

2003

2002

Plans with accumulated benefit obligations in excess of plan assets:

Accumulated benefit obligations

—

—

$

148

$

68

Plan assets

—

—

$

87

$

25

Plans with projected benefit obligations in excess of plan assets:

Projected benefit obligations

$

49

$

28

$

306

$

242

Plan assets

$

30

$

23

$

195

$

140

U.S. Pension

Benefits

Non-U.S.

Pension

Benefits

Postretirement

Medical

Benefits

2003

2002

2003

2002

2003

2002

Discount rate

6.0

%

7.0

%

5.5

%

7.9

%

6.0

%

7.0

%

Expected return on plan assets

8.0

%

8.5

%

6.7

%

9.2

%

—

—

Rate of compensation increase

5.0

%

5.0

%

3.5

%

6.8

%

—

—

Future profit

-

sharing contributions

6.0

%

6.0

%

—

—

—

—