Intel 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Continued)

We typically invest in non-marketable equity securities of private companies and contribute a portion of the funds required for them to

grow. Our investment portfolio ranges from early-stage companies that are often still defining their strategic direction to more mature

companies whose products or technologies may directly support an Intel product or initiative. We invest for strategic reasons, with each

investment also evaluated for potential financial returns. The program seeks to invest in companies and businesses that can succeed and have an

impact on their market segment. However, these types of investments involve a great deal of risk, and there can be no assurance that any

specific company, whether at an early or mature stage, or somewhere in between, will grow or will become successful, and consequently, we

could lose all or part of our investment. When the strategic objectives of an investment have been achieved, or if the investment or business

diverges from our strategic objectives, we may decide to dispose of the investment. However, our investments in non-marketable equity

securities are not liquid, and there can be no assurance that we will be able to dispose of these investments on favorable terms or at all.

As of December 27, 2003, we had invested $124 million in non-voting stock of Elpida Memory, Inc., a Japanese provider of Dynamic

Random Access Memory (DRAM). This investment is intended to help align Elpida’s product roadmap, as appropriate, with our roadmap and

is part of our investment strategy to support the development and supply of DRAM products. No other investment in our non-marketable

portfolio was individually significant.

Our ability to recover our strategic investments in non-marketable equity securities and to earn a return on these investments is primarily

dependent on how successfully these companies are able to execute to their business plans and how well their products are accepted, as well as

their ability to obtain venture capital funding to continue operations, to grow and to take advantage of liquidity events. In the current equity

market environment, their ability to obtain additional funding as well as to take advantage of liquidity events, such as initial public offerings

(IPOs), mergers and private sales, remains constrained.

We review all of our investments quarterly for impairment; however, for non-marketable equity securities, the impairment analysis

requires significant judgment to identify events or circumstances that would likely have a significant adverse effect on the fair value of the

investment. The indicators that we use to identify those events or circumstances include (a) the investee’s revenue and earnings trends relative

to predefined milestones and overall business prospects, (b) the technological feasibility of the investee’s products and technologies, (c) the

general market conditions in the investee’s industry, and (d) the investee’s liquidity, debt ratios and the rate at which the investee is using its

cash.

Investments identified as having an indicator of impairment are subject to further analysis to determine if the investment is other than

temporarily impaired, in which case we write the investment down to its impaired value. When an investee is not considered viable from a

financial or technological point of view, we write down the entire investment since we consider the estimated fair market value to be nominal.

If an investee obtains additional funding at a valuation lower than our carrying amount or requires a new round of equity funding to stay in

operation and the new funding does not appear imminent, we presume that the investment is other than temporarily impaired, unless specific

facts and circumstances indicate otherwise.

We have experienced substantial impairments in our portfolio of non-

marketable equity securities as equity markets declined significantly

over the past few years. If the level of IPO market activity does not increase and the availability of venture capital funding for technology

investments does not improve, our non-marketable investments may be adversely affected. As companies within our portfolio attempt to raise

additional funds, the funds may not be available to them or they may receive lower valuations, with less favorable investment terms than in

previous financings, and the investments would likely become impaired. However, we are not able to determine at the present time which

specific investments are likely to be impaired in the future, or the extent or timing of individual impairments. Impairments of investments in

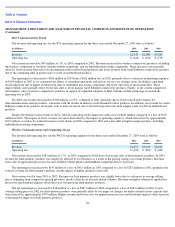

our portfolio, primarily impairments of non-marketable equity securities, were $319 million in 2003 ($524 million in 2002 and $1.1 billion in

2001).

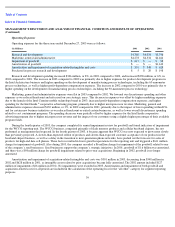

Inventory. The valuation of inventory requires us to estimate obsolete or excess inventory as well as inventory that is not of saleable

quality. The determination of obsolete or excess inventory requires us to estimate the future demand for our products within specific time

horizons, generally six months or less. The estimates of future demand that we use in the valuation of inventory are the basis for our published

revenue forecast, which is also consistent with our short-term manufacturing plan. If our demand forecast for specific products is greater than

actual demand and we fail to reduce manufacturing output accordingly, we could be required to record additional inventory reserves, which

would have a negative impact on our gross margin.

33