Intel 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Continued)

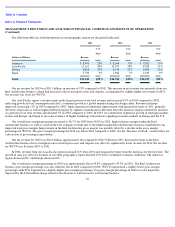

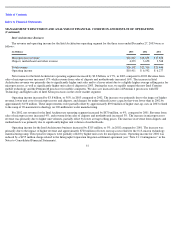

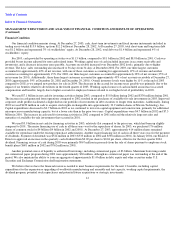

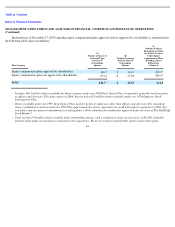

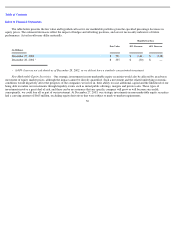

Contractual Obligations

The following table summarizes our significant contractual obligations at December 27, 2003, and the effect such obligations are

expected to have on our liquidity and cash flows in future periods. This table excludes amounts already recorded on our balance sheet as

current liabilities at December 27, 2003.

Payments Due by Period

(In Millions)

Total

Less than

1 year

1–3

years

3–5

years

More than

5 years

Operating lease obligations

$

503

$

101

$

135

$

64

$

203

Capital purchase obligations

1

1,474

1,368

106

—

—

Other purchase obligations and commitments

2

317

173

144

—

—

Long

-

term debt obligations

1,017

81

102

198

636

Total

3

$

3,311

$

1,723

$

487

$

262

$

839

1

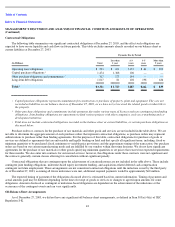

Capital purchase obligations represent commitments for construction or purchase of property, plant and equipment. They are not

recorded as liabilities on our balance sheet as of December 27, 2003, as we have not yet received the related goods or taken title to

the property.

2

Other purchase obligations and commitments include payments due under various types of licenses and non-contingent joint funding

obligations. Joint funding obligations are agreements to fund various projects with other companies, such as co-marketing and co-

development initiatives.

Purchase orders or contracts for the purchase of raw materials and other goods and services are not included in the table above. We are

not able to determine the aggregate amount of such purchase orders that represent contractual obligations, as purchase orders may represent

authorizations to purchase rather than binding agreements. For the purposes of this table, contractual obligations for purchase of goods or

services are defined as agreements that are enforceable and legally binding on Intel and that specify all significant terms, including: fixed or

minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the transaction. Our purchase

orders are based on our current manufacturing needs and are fulfilled by our vendors within short time horizons. We do not have significant

agreements for the purchase of raw materials or other goods specifying minimum quantities or set prices that exceed our expected requirements

for three months. We also enter into contracts for outsourced services; however, the obligations under these contracts were not significant and

the contracts generally contain clauses allowing for cancellation without significant penalty.

Contractual obligations that are contingent upon the achievement of certain milestones are not included in the table above. These include

contingent joint funding obligations, milestone-based equity investment funding, and acquisition-related deferred cash compensation

contingent on future employment. These arrangements are not considered contractual obligations until the milestone is met by the third party.

As of December 27, 2003, assuming all future milestones were met, additional required payments would be approximately $60 million.

The expected timing of payment of the obligations discussed above is estimated based on current information. Timing of payments and

actual amounts paid may be different depending on the time of receipt of goods or services or changes to agreed-upon amounts for some

obligations. Amounts disclosed as contingent or milestone-based obligations are dependent on the achievement of the milestones or the

occurrence of the contingent events and can vary significantly.

Off-Balance-Sheet Arrangements

As of December 27, 2003, we did not have any significant off-balance-sheet arrangements, as defined in Item 303(a)(4)(ii) of SEC

Regulation S-K.

42

3

Total does not include contractual obligations recorded on the balance sheet as current liabilities, or certain purchase obligations as

discussed below.