Hyundai 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

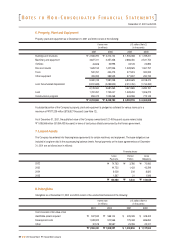

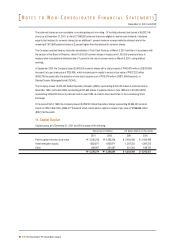

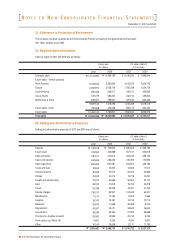

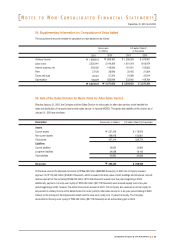

December 31, 2001 and 2000

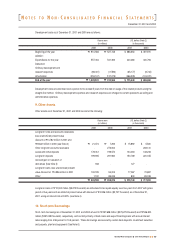

When each temporary difference reverses in the future, it will result in a decrease (increase) of taxable income and income tax

payable. Deferred income tax assets are recognized only when it is probable the tax benefits from temporary differences will be

realized in the future and calculated using the expected corporate tax rate in the period when the tax benefits will be realized.

As of December 31, 2001, the Company believes the deferred income tax assets of "241,570 million ($182,165 thousand)

can be realized in the future. Additionally, the Company believes average ordinary income in the coming years will exceed the

amount of deferred taxes to be realized every year based on its assessment. According to a revision in the Corporate Tax Law

dated on December 31, 2001, deferred income tax assets are recognized in applying to the revised tax rate of 29.7 percent.

The effective tax rate is 30.04 percent in 2001 and 14.39 percent in 2000.

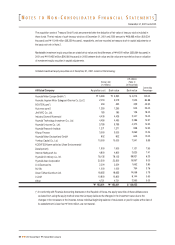

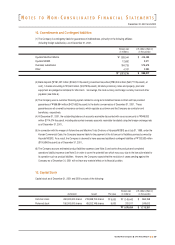

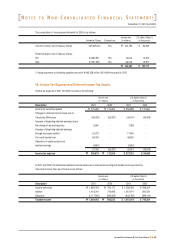

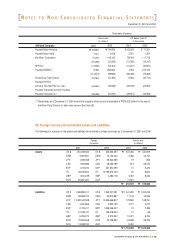

19. Related Party Transactions

Significant transactions with affiliated companies in 2001 and 2000 and outstanding balances as of December 31, 2001 and

2000 are summarized below:

(*) Sales in 2000 include the disposal value of the Motor Parts Division for after-sales service of "446,422 million, which

consists of the lump-sum royalty and the book value of the disposed net assets (see Note 25).

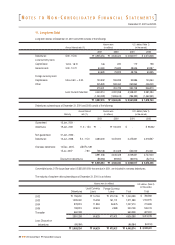

Description

Accumulated temporary

differences, net

Statutory tax rate

Tax credit carried over

Deferred income tax assets

2001

$613,352

29.7%

182,165

-

$182,165

2000

$432,225

30.8%

133,125

48,500

$181,625

2000

"573,174

30.8%

176,357

64,316

"

"240,853

2001

"813,366

29.7%

241,570

-

"

"241,570

U.S. dollars (Note 2) (in thousands)Korean won (in millions)

Affiliated Company

Hyundai Motor America

Hyundai Motor India

Kia Motor Corporation

KEFICO

Hyundai MOBIS (*)

Hyundai HYSCO

(formerly Hyundai Pipe Co., Ltd.)

2001

$ 4,104,851

86,484

610,281

(345,313)

(226,864)

173,047

(479,840)

(174,993)

2000

$ 2,238,073

65,072

603,562

(70,281)

(277,048)

461,275

(243,697)

(229,737)

2000

"2,967,908

86,292

800,383

(93,200)

(367,393)

611,697

(323,167)

(304,654)

2001

"5,443,443

114,687

809,293

(457,920)

(300,844)

229,478

(636,316)

(232,058)

U.S. dollars (Note 2) (in thousands)

Sales (Purchases)

Korean won (in millions)

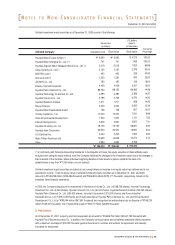

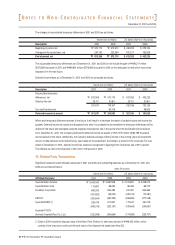

The changes in accumulated temporary differences in 2001 and 2000 are as follows:

The accumulated temporary differences as of December 31, 2001 and 2000 do not include the gain of "498,211 million

($375,696 thousand) in 2001 and "499,891 million ($376,963 thousand) in 2000 on the revaluation of land which may not be

disposed of in the near future.

Deferred income taxes as of December 31, 2001 and 2000 are computed as follows:

Description

Beginning of period, net

Changes in the current year, net

End of period, net

2001

$ 432,225

181,127

$ 613,352

2000

$ 279,700

152,525

$ 432,225

2000

"370,910

202,264

"

"573,174

2001

"573,174

240,192

"

"813,366

U.S. dollars (Note 2) (in thousands)Korean won (in millions)

N

OTES TO

N

ON

-C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

64

2001 Annual Report Hyundai Motor Company