Hyundai 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

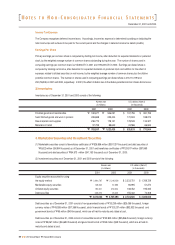

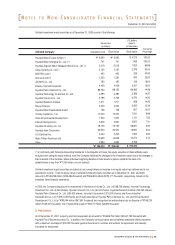

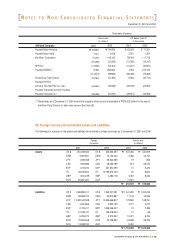

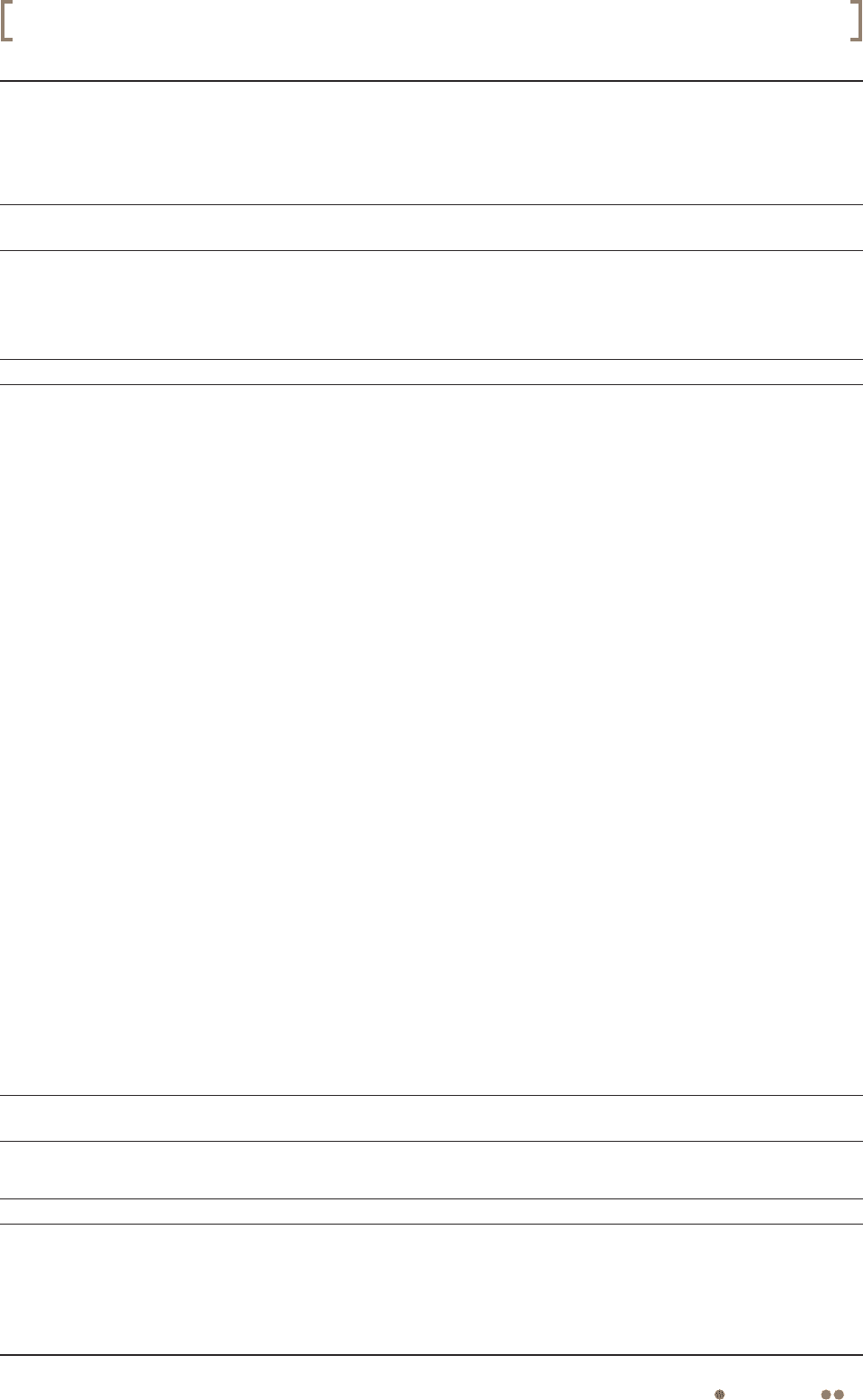

December 31, 2001 and 2000

Hyundai Merchant Marine

Hyundai MOBIS

Overseas subsidiaries

Other

$406,488

9,571

576,678

3,580

$996,317

"539,044

12,692

764,733

4,747

"

"1,321,216

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

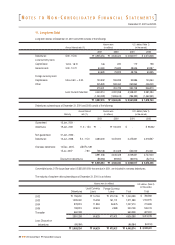

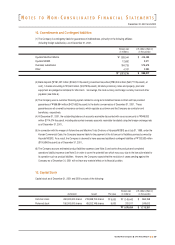

12. Commitments and Contingent liabilities

(1) The Company is contingently liable for guarantees of indebtedness, primarily for the following affiliates

(including foreign subsidiaries), as of December 31, 2001.

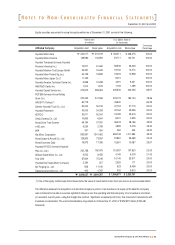

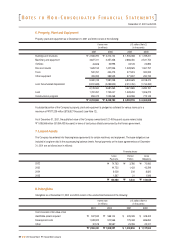

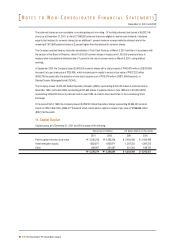

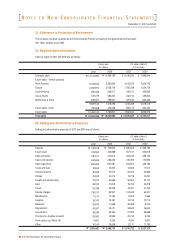

(2) Bank deposits ["181,027 million ($136,511 thousand)], investment securities ["83,240 million ($62,771 thousand), at

cost], 1 checks amounting to "2,624 million ($1,979 thousand), 30 blank promissory notes and property, plant and

equipment are pledged as collateral for short-term borrowings, the local currency and foreign currency loans and other

payables (see Note 6).

(3) The Company uses a customer financing system related to a long-term installment sales contract and has provided

guarantees of "566,884 million ($427,482 thousand) to the banks concerned as of December 31, 2001. These

guarantees are all covered by insurance contracts, which regulate a customer and the Company as contractor and

beneficiary, respectively.

(4) At December 31, 2001, the outstanding balance of accounts receivable discounted with recourse amounts to "946,933

million ($714,074 thousand), including discounted overseas accounts receivable translated using the foreign exchange rate

as of December 31, 2001..

(5) In connection with the merger of Automotive and Machine Tools Divisions of Hyundai MOBIS as at July 31, 1999, under the

Korean Commercial Code, the Company became liable for the payment of the full amount of liabilities previously owned by

Hyundai MOBIS. As a result, the Company is deemed to have assumed additional contingent liabilities of "133,533 million

($100,696 thousand) as of December 31, 2001..

(6) The Company accrues estimated product liabilities expenses (see Note 2) and carries the products and completed

operations liability insurance (see Note 5) in order to cover the potential loss which may occur due to the law suits related to

its operation such as product liabilities. However, the Company expects that the resolution of cases pending against the

Company as of December 31, 2001 will not have any material effect on its financial position.

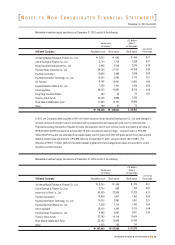

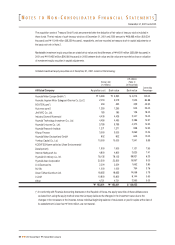

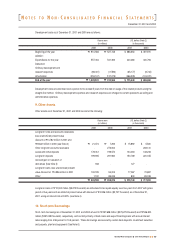

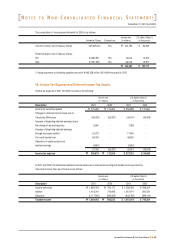

13. Capital Stock

Capital stock as of December 31, 2001 and 2000 consists of the following:

Common stock

Preferred stock

$863,768

249,613

$1,113,381

U.S. dollars (Note 2)

(in thousands)

"1,145,443

331,011

"

"1,476,454

Korean won

(in millions)

"5,000

5,000

Par value

219,088,702 shares

65,202,146 shares

Issued

450,000,000 shares

150,000,000 shares

Authorized

N

OTES TO

N

ON

-C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

59

2001 Annual ReportHyundai Motor Company