Hyundai 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

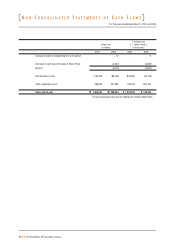

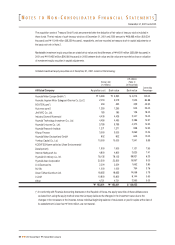

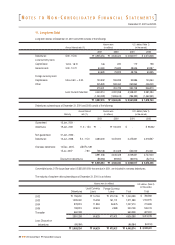

December 31, 2001 and 2000

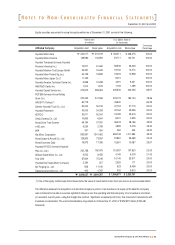

Hyundai Motor India

Hyundai Motor America (*)

Hyundai America Technical Center Inc.

Hyundai Machine Tool Europe GmbH

Hyundai Motor Japan Co.

Hyundai Motor Poland Sp.zo.o.

Hyundai Motor Europe Parts

HMJ R&D Center Inc.

Hyundai Translead (formerly Hyundai

Precision America Inc.)

Hyundai Capital Service Inc.

HAOSVT (Turkey)

KEFICO

Korea Drive Train System

Korea Rolling Stock Co.

Korea Space & Aircraft Co., Ltd.

e-HD.com

Kia Motor Corporation

Beijing Hyundai Namyang Real Estate

Development center Ltd.

Hyundai Space & Aircraft Co., Ltd.

Korea Economy Daily

Wuhan Grand Motor Co., Ltd.

Hyundai-Kia-Yueda Motor Company

Iljin Forging Co., Ltd.

Daesung Automotive Co., Ltd.

Hyundai HYSCO

(formerly Hyundai Pipe Co., Ltd.)

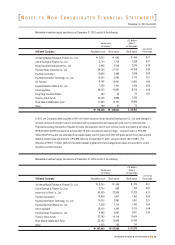

Book value Ownership

Percentage

$ 156,251

-

8,210

19,031

8,410

8,357

1,072

1,554

62,695

256,212

16,786

32,021

25,119

75,680

72,706

2,511

816,413

5,543

34,409

16,732

5,830

2,529

3,799

1,806

136,053

$ 1,769,729

100.00

100.00

100.00

100.00

100.00

100.00

100.00

100.00

100.00

85.57

50.00

50.00

49.93

39.18

33.33

33.30

30.15

30.00

25.96

22.75

21.43

20.00

20.00

20.00

23.43

Acquisition cost

$ 184,011

97,717

4,491

19,151

8,410

8,357

2,047

1,139

56,539

205,545

36,228

15,769

25,048

85,736

72,694

2,511

675,546

5,543

84,907

10,430

4,149

2,529

623

302

151,397

$ 1,760,819

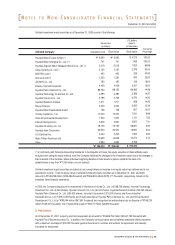

Book value

"207,205

-

10,887

25,237

11,152

11,082

1,422

2,061

83,140

339,763

22,260

42,463

33,310

100,359

96,416

3,330

1,082,645

7,351

45,630

22,188

7,731

3,354

5,038

2,395

180,419

"

"2,346,838

Acquisition costAffiliated Company

"244,017

129,582

5,956

25,397

11,152

11,082

2,715

1,510

74,977

272,573

48,042

20,911

33,216

113,694

96,400

3,330

895,842

7,351

112,595

13,832

5,502

3,354

826

400

200,768

"

"2,335,024

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

Equity securities accounted for using the equity method as of December 31, 2000 consist of the following:

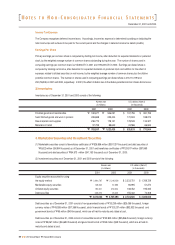

(*) Use of the equity method was discontinued since the value of investments is less than zero due to an accumulated deficit.

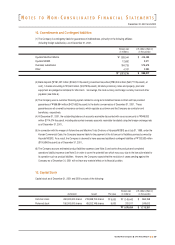

The difference between the acquisition cost and the Company’s portion of an investee’s net equity at the date the Company

was considered to be able to exercise significant influence over the operating and financial policy of an investee is amortized

(or reversed) over 20 years, using the straight-line method. Significant unrealized profit (loss) that occurred in transactions with

investees are eliminated. The unamortized balance of goodwill as of December 31, 2000 is "150,681 million ($113,627

thousand). In 2000, investments, excluding those in Kia Motor Corporation, Hyundai HYSCO (formerly Hyundai Pipe Co.,

Ltd.), Hyundai Capital Service Inc. and KEFICO, are valued based on the latest financial statements since investees did not

prepare financial statements as of December 31, 2000.

N

OTES TO

N

ON

-C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

52

2001 Annual Report Hyundai Motor Company