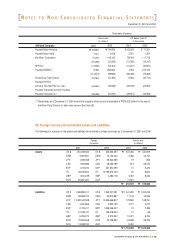

Hyundai 2001 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2001 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

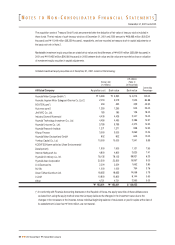

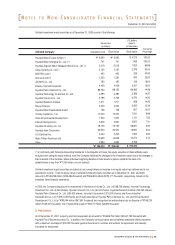

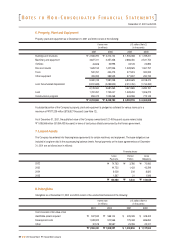

December 31, 2001 and 2000

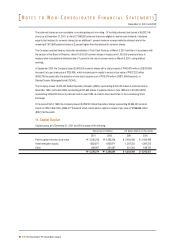

At January 1, 1981, January 1, 1993 and July 1, 1998, the Company revalued property, plant and equipment at their respective

appraised values (which were appraised by the Korea Appraisal Board and approved by the relevant tax office). The resultant

cumulative appraisal gains, amounting to "2,547,417 million (US$1,920,984 thousand), were included in capital surplus, after

offsetting accumulated deficit of "16,022 million (US$12,082 thousand), a deferred foreign currency translation loss of

"594,275 million (US$448,137 thousand), reduction for an asset revaluation tax payment of "67,547 million (US$50,937

thousand) and adjustment of "16,702 million (US$ 12,595 thousand) due to the disposal of revalued assets within 1 year after

revaluation.

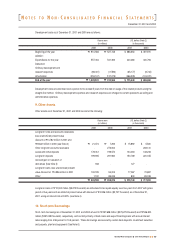

In 2001, the Company sold 2,290,800 shares of its common stock held as treasury stock to DaimlerChrysler Aktiengesellschaft

for "47,878 million (US$ 36,104 thousand) resulting in a gain of "7,783 million (US$ 5,869 thousand), net of tax effect of

"2,470 million (US$1,863 thousand), and 10,659,010 common shares held as treasury stock to INI Steel Company (formerly

Inchon Iron & Steel Co., Ltd.) for "185,725 million (US$ 140,054 thousand) resulting in a gain of "7,597 million (US$ 5,729

thousand), net of tax effect of "2,411 million (US$1,818 thousand). Total gains of "15,380 million (US$ 11,598 thousand)

were recorded in capital surplus.

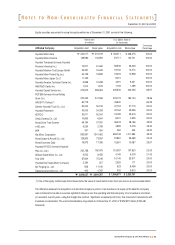

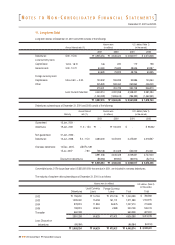

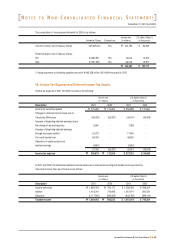

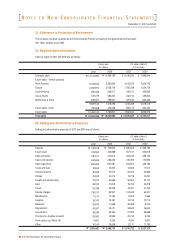

15.Retained Earnings

Retained earnings as of December 31, 2001 and 2000 consist of the following:

The Korean Commercial Code requires the Company to appropriate, as a legal reserve, a minimum of 10 percent of annual

cash dividends declared, until such reserve equals 50 percent of its capital stock issued. Pursuant to the Tax Incentive

Limitation Law, the Company is required to appropriate, as a reserve for business rationalization, the exemption of income

taxes resulting from investment tax credits and certain deductions from taxable income specified by the Law. The Regulation

on Issues and Disclosures of the Securities for listed companies requires the Company to appropriate, as a reserve for

improvement of financial structure, an amount equal to at least 50 percent of the net gain on disposition of property, plant and

equipment and 10 percent of net income for each year until the Company's net worth equals 30 percent of total assets. These

reserves are not available for the payment of cash dividends, but may be transferred to capital stock or may be used to reduce

any accumulated deficit.

The reserves for overseas market development and technological development are voluntary reserves, which are available for

the payment of dividends.

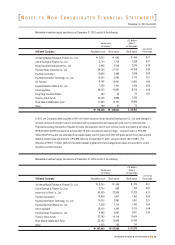

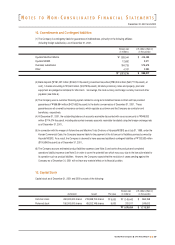

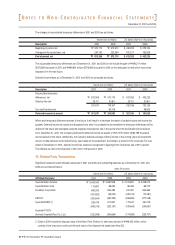

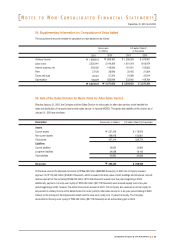

16. Capital Adjustments

Capital adjustments as of December 31, 2001 and 2000 consist of the following:

Appropriated:

Legal reserve

Reserve for business rationalization

Reserve for improvement of financial structure

Reserve for overseas market development

Reserve for technological development

Unappropriated

2001

$ 76,819

411,583

74,615

36,799

1,104,819

1,704,635

145

$ 1,704,780

2000

$ 60,229

290,928

74,615

36,799

563,759

1,026,330

130,961

$ 1,157,291

2000

"79,870

385,800

98,947

48,800

747,600

1,361,017

173,667

"

"1,534,684

2001

"101,870

545,800

98,947

48,800

1,465,100

2,260,517

192

"

"2,260,709

U.S. dollars (Note 2) (in thousands)Korean won (in millions)

Treasury stock

Loss on valuation of investment equity

securities

Stock option cost

Cumulative translation adjustments for

overseas branches

Loss on valuation of derivatives (see Note 2)

2001

$ (54,133)

52,107

9,206

(1,397)

(17,416)

$ (11,633)

2000

$ (329,575)

(197,300)

4,921

(811)

(41,985)

$ (564,750)

2000

"(437,050)

(261,640)

6,526

(1,075)

(55,676)

"

"(748,915)

2001

"(71,786)

69,099

12,208

(1,853)

(23,094)

"

"(15,426)

U.S. dollars (Note 2) (in thousands)Korean won (in millions)

N

OTES TO

N

ON

-C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

61

2001 Annual ReportHyundai Motor Company