Hyundai 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

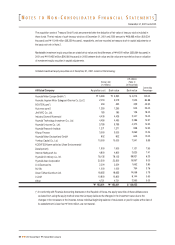

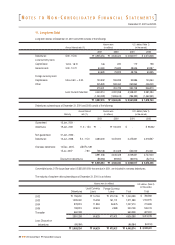

December 31, 2001 and 2000

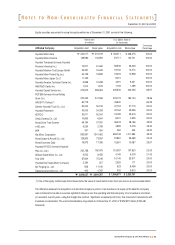

Jin Heung Mutual Savings & Finance Co., Ltd.

Comet Savings & Finance Co., Ltd.

Korea Industrial Development Co., Ltd.

Hyundai Heavy Industries Co., Ltd.

Hyundai Corporation

Hyundai Information Technology Co., Ltd.

LG Telecom

Hyundai Merchant Marine Co., Ltd.

Cho Hung Bank

DongYang Investment Bank

Treasury Stock Funds

Stock Market Stabilization Fund

Other

Ownership

Percentage

9.01

9.00

8.18

2.99

2.99

2.21

0.69

0.55

0.48

0.23

Book value

$ 664

1,288

2,976

43,308

2,638

2,710

11,682

1,056

8,215

34

7,455

14,896

73

$ 96,995

Book value

"880

1,709

3,946

57,431

3,498

3,594

15,491

1,400

10,894

45

9,886

19,754

97

"

"128,625

Acquisition costAffiliated Company

"2,000

2,700

3,946

59,004

13,626

10,000

9,795

7,329

25,000

283

22,020

17,663

190

"

"173,556

U.S. dollars

(Note 2)

(in thousands)

Korean won

(in millions)

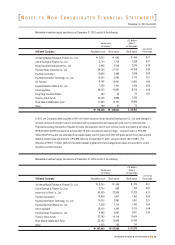

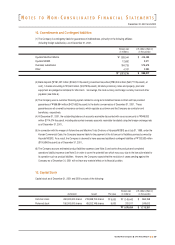

Jin Heung Mutual Savings & Finance Co., Ltd.

Comet Savings & Finance Co., Ltd.

Inchon Iron & Steel Co., Ltd.

Hyundai Corporation

Hyundai Information Technology Co., Ltd.

Hyundai Merchant Marine Co., Ltd.

Cho Hung Bank

Hyundai Heavy Industries Co., Ltd.

Treasury Stock Funds

Stock Market Stabilization Fund

Other

Ownership

Percentage

9.01

9.00

4.70

2.99

2.21

0.55

0.48

0.36

Book value

$ 374

753

17,222

1,363

1,951

1,293

3,313

3,831

10,645

10,435

90

$ 51,270

Book value

"496

999

22,838

1,807

2,587

1,714

4,394

5,080

14,116

13,838

120

"

"67,989

Acquisition costAffiliated Company

"2,000

2,700

60,425

13,626

10,000

7,329

25,000

4,966

37,793

22,182

1,423

"

"187,444

U.S. dollars

(Note 2)

(in thousands)

Korean won

(in millions)

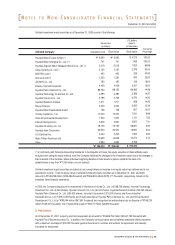

Marketable investment equity securities as of December 31, 2001 consist of the following:

In 2001, the Company’s debt securities of "51,401 million issued by Korea Industrial Development Co., Ltd. were changed to

common stocks and long-term loans in accordance with its reorganization plan approved by the court. In conformity with

Financial Accounting Standards in Republic of Korea, the acquisition cost of such common stocks was stated at fair value of

"3,946 million ($2,976 thousand) as at December 29, 2001, the effective date of change. Long-term loans of "12,300

million ($9,275 thousand) are scheduled to be repaid equally over five years from 2007 with grace period of five years and are

stated at present value with discount of "4,956 million as of December 31, 2001, using an interest rate of 9.29%. The

difference of "40,111 million ($30,247 thousand) between original and newly-changed book values are recorded in current

operations as other expense.

Marketable investment equity securities as of December 31, 2000 consist of the following:

N

OTES TO

N

ON

-C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

53

2001 Annual ReportHyundai Motor Company