Hyundai 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

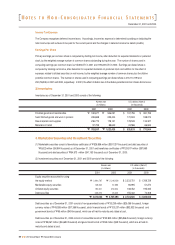

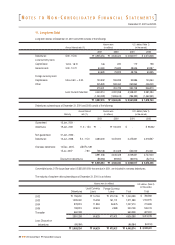

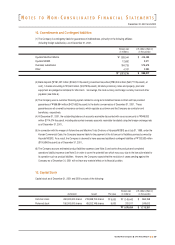

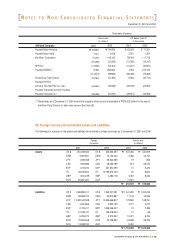

December 31, 2001 and 2000

Beginning of the year

Addition:

Expenditures for the year

Deduction:

Ordinary development and

research expenses

Amortization

End of the year

2001

$ 686,650

420,280

(65,177)

(266,305)

$ 775,448

2000

$ 397,970

400,794

(8,744)

(103,370)

$ 686,650

2000

"527,748

531,493

(11,596)

(137,079)

"

"910,566

2001

"910,566

557,334

(86,431)

(353,147)

"

"1,028,322

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

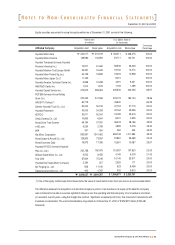

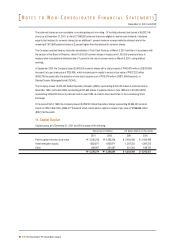

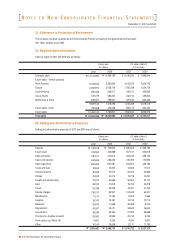

Long-term notes and accounts receivable,

less unamortized present value

discount of "4,782 million in 2001 and

"8,622 million in 2000 (see Note 2)

Other long-term accounts receivable

Lease and rental deposits

Long-term deposits

Accrued gain on valuation of

derivatives (See Note 2)

Long-term loans, less unamortized present

value discount of "4,956 million in 2001

Other

2001

$ 15,892

-

134,463

150,769

127

77,067

830

$ 379,148

2000

$ 5,500

208,131

148,233

220,165

-

70,887

65,036

$ 717,952

2000

"7,293

276,002

196,572

291,960

-

94,003

86,246

"

"952,076

2001

"21,074

-

178,312

199,935

168

102,199

1,100

"

"502,788

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

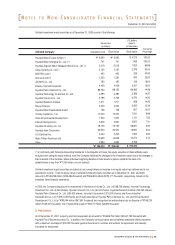

Development costs as of December 31, 2001 and 2000 are as follows:

Development costs are amortized over a period not to exceed 5 years from the date of usage of the related products using the

straight-line method. Ordinary development expenses and research expenses are charged to current operations as selling and

administrative expenses.

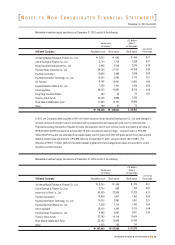

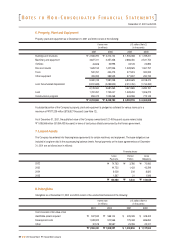

9. Other Assets

Other assets as of December 31, 2001 and 2000 consist of the following:

Long-term loans of "12,300 million ($9,275 thousand) are scheduled to be repaid equally over five years from 2007 with grace

period of five years and are stated at present value with discount of "4,956 million ($3,737 thousand) as of December 31,

2001, using an interest rate of 9.29% (see Note 4).

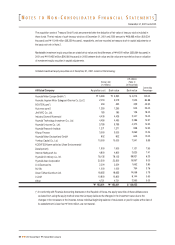

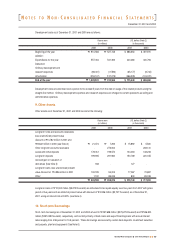

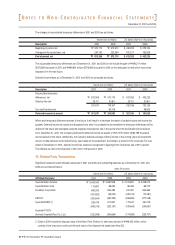

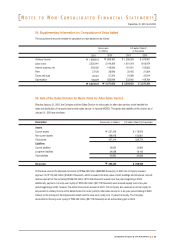

10. Short-term Borrowings

Short- term borrowings as of December 31, 2001 and 2000 amount to "497,658 million ($375,279 thousand) and "526,500

million ($397,029 thousand), respectively, and consist primarily of bank loans and export financing loans with annual interest

rates ranging from 4.56 percent to 10.5 percent. These borrowings are secured by certain bank deposits, investment securities

and property, plant and equipment (See Note 6).

N

OTES TO

N

ON

-C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

57

2001 Annual ReportHyundai Motor Company