Hyundai 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

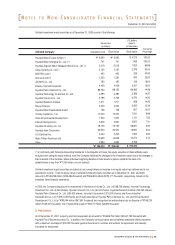

December 31, 2001 and 2000

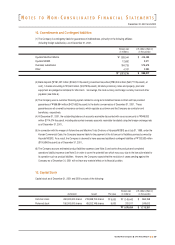

The preferred shares are non-cumulative, non-participating and non-voting. Of the total preferred stock issued of 65,202,146

shares as at December 31, 2001, a total of 27,588,281 preferred shares are eligible to receive cash dividends, if declared,

equal to that declared for common shares plus an additional 1 percent minimum increase while the dividend rate for the

remaining 37,613,865 preferred shares is 2 percent higher than that declared for common shares.

The Company acquired treasury stock after cancellation of Trust Cash Funds as of March 2, 2001 and then, in accordance with

the decision of the Board of Directors, retired 10,000,000 common shares in treasury and 1,000,000 preferred shares in

treasury which had additional dividends rate of 1 percent to the rate of common stock on March 5, 2001, using retained

earnings.

In September 2000, the Company issued 20,618,000 common shares with a total proceeds of "430,916 million (US$324,950

thousand) (at a per share price of "20,900), which included paid-in capital in excess of par value of "327,222 million

($246,755 thousand) after the deduction of new stock issuance cost of "15,378 million (US$11,596 thousand), to

DaimlerChrysler Aktiengesellschaft (DCAG)..

The Company issued 10,000,000 Global Depositary Receipts (GDRs) representing 5,000,000 shares of preferred stock in

November 1992, 4,675,324 GDRs representing 2,337,662 shares of preferred stock in June 1995 and 7,812,500 GDRs

representing 3,906,250 shares of preferred stock in June 1996, all of which have been listed on the Luxembourg Stock

Exchange.

In the second half of 1999, the Company issued 45,788,000 Global Depositary Shares representing 22,894,000 common

shares for "601,356 million ($453,477 thousand) which include paid-in capital in excess of par value of "486,886 million

($367,156 thousand).

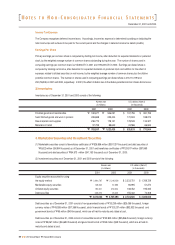

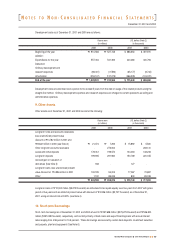

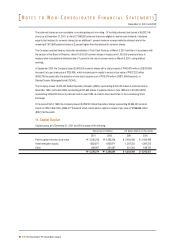

14. Capital Surplus

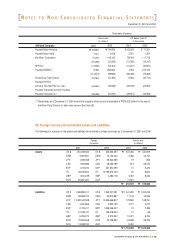

Capital surplus as of December 31, 2001 and 2000 consists of the following:

Paid-in capital in excess of par value

Asset revaluation surplus

Other

2001

$ 2,455,498

1,397,233

201,318

$ 4,054,049

2000

$ 2,455,498

1,397,233

189,720

$ 4,042,451

2000

"3,256,236

1,852,871

251,587

"

"5,360,694

2001

"3,256,236

1,852,871

266,967

"

"5,376,074

U.S. dollars (Note 2) (in thousands)Korean won (in millions)

N

OTES TO

N

ON

-C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

60

2001 Annual Report Hyundai Motor Company