Hyundai 2001 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2001 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

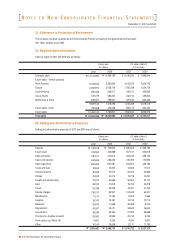

December 31, 2001 and 2000

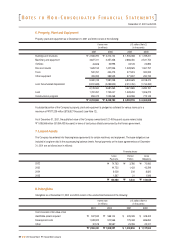

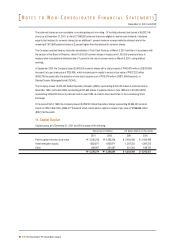

(1) Treasury stock

The Company has treasury stock consisting of 992,155 common shares and 3,168,600 preferred shares with a carrying value

of "71,786 million ($54,133 thousand) as of December 31, 2001, and 23,763,490 common shares and 4,178,600 preferred

shares with a carrying value of "437,050 million ($329,575 thousand) as of December 31, 2000, acquired directly or indirectly

through the Treasury Stock Funds and Trust Cash Funds.

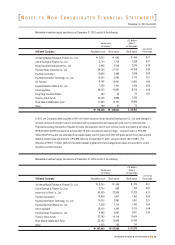

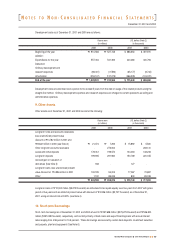

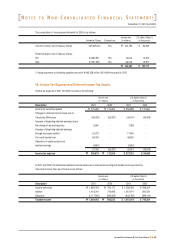

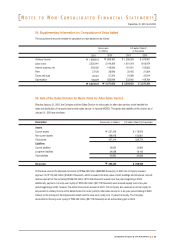

(2) Gain (Loss) on valuation of investment equity securities

Gain (Loss) on valuation of investment equity securities as of December 31 2001 and 2000 consist of the following:

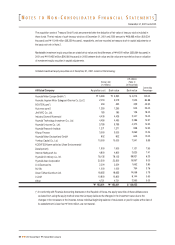

(3) Stock option cost

The Company granted 104 directors stock options (grant date: March 10, 2000, exercise date : March 10, 2003, expiry date :

March 9, 2008), at an exercise price of "14,900 as determined during the meeting of the Shareholders on March 10, 2000.

As of December 31, 2001, 85 directors are entitled to these stock options due to the retirement of directors after grant date. If

all of the stock options as of December 31, 2001, which require at least two-year continued service, are exercised, 1,470,000

new shares or shares held as treasury stock will be granted according to the decision of the Board of Directors.

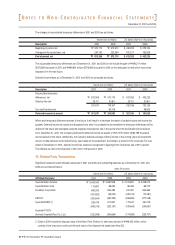

The Company calculates the total compensation expense using an option-pricing model. In the model, the risk-free rate of

9.04%, an expected exercise period of 5.5 years and an expected variation rate of stock price of 71.1 percent are used. Total

compensation expense amounting to "13,482 million (US$10,167 thousand) in 2001 and "15,958 million (US$12,034

thousand) in 2000 has been accounted for as a charge to current operations and a credit to capital adjustment over the

required period of service (two years) from the grant date using the straight-line method.

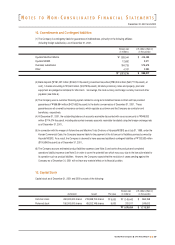

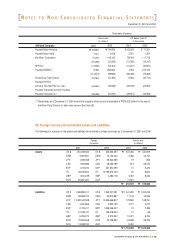

(4) Cumulative translation adjustments

Cumulative translation debits of "1,853 million (US$1,397 thousand) as of December 31, 2001 and "1,075 million (US$ 811

thousand) as of December 31, 2000, which result from the translation of financial statements of the branch located in the

United States, is included in capital adjustments on the basis set forth in Note 2.

(5) Loss on valuation of derivatives

Loss on valuation of the effective portion of derivative instruments for cash flow hedging purpose from forecasted exports,

amounting to "23,094 million ($17,416 thousand) as of December 31, 2001 and "55,676 million (US$41,985 thousand) as of

December 31, 2000, is included in capital adjustments on the basis set forth in Note 2.

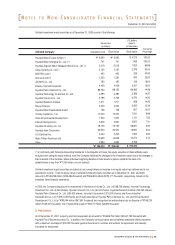

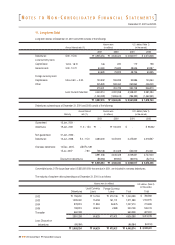

17. Dividends

The computation of the proposed dividends for 2001 is as follows:

Common shares, net of treasury shares

Preferred shares, net of treasury shares:

Old

New

"163,641

19,594

31,910

"

"215,145

$123,400

14,776

24,063

$162,239

15%

16%

17%

218,187,967

24,492,541

37,541,005

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)Dividend rateNumber of Shares

N

OTES TO

N

ON

-C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

Gain (Loss) on equity method valuation

Loss on valuation of marketable

investment equity securities

Gain (Loss), net

2001

$ (85,989)

(33,882)

$ 52,107

2000

$ (107,220)

(90,080)

$ (197,300)

2000

"(142,185)

(119,455)

"

"(261,640)

2001

"114,030

(44,931)

"

"69,099

U.S. dollars (Note 2) (in thousands)Korean won (in millions)

62

2001 Annual Report Hyundai Motor Company