Hyundai 2001 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2001 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

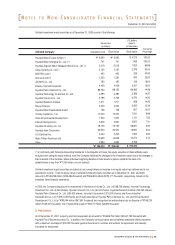

December 31, 2001 and 2000

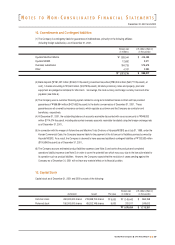

Income Tax Expense

The Company recognizes deferred income taxes. Accordingly, income tax expense is determined by adding or deducting the

total income tax and surtaxes to be paid for the current period and the changes in deferred income tax debits (credits).

Earnings Per Share

Primary earnings per common share is computed by dividing net income, after deduction for expected dividends on preferred

stock, by the weighted average number of common shares outstanding during the year. The number of shares used in

computing earnings per common share is 215,692,671 in 2001 and 199,249,370 in 2000. Earnings per diluted share is

computed by dividing net income, after deduction for expected dividends on preferred stock and addition for the effect of

expenses related to diluted securities on net income, by the weighted average number of common shares plus the dilutive

potential common shares. The number of shares used in computing earnings per diluted share is 216,110,199 and

202,736,308, in 2001 and 2000, respectively. In 2001, the effect of dilution due to the dilutive potential common shares did not occur.

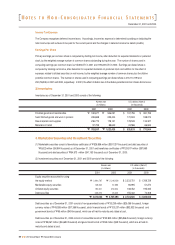

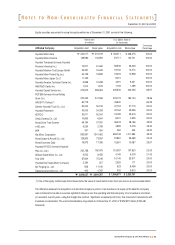

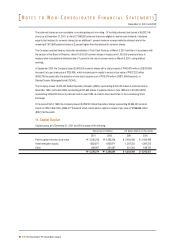

3.Inventories

Inventories as of December 31, 2001 and 2000 consist of the following:

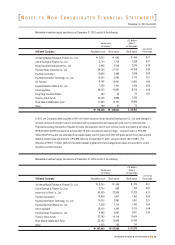

4. Marketable Securities and Investment Securities

(1) Marketable securities consist of beneficiary certificates of "526,856 million ($397,297 thousand) and debt securities of

"6,622 million ($4,994 thousand) as of December 31, 2001 and beneficiary certificates of "129,917 million ($97,969

thousand) and debt securities of "54,573 million ($41,153 thousand) as of December 31, 2000.

(2) Investment securities as of December 31, 2001 and 2000 consist of the following:

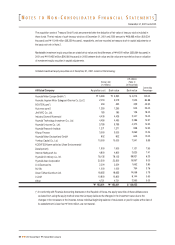

Debt securities as of December 31, 2001 consist of non-guaranteed bonds of "33,239 million ($25,065 thousand), foreign

currency notes of "49,538 million ($37,356 thousand), stock financial bonds of "123,237 million ($92,932 thousand) and

government bonds of "65 million ($49 thousand), which are all held-to-maturity and stated at cost.

Debt securities as of December 31, 2000 consist of convertible bonds of "33,903 million ($25,566 thousand), foreign currency

notes of "59,267 million ($44,693 thousand) and government bonds of "65 million ($49 thousand), which are all held-to-

maturity and stated at cost.

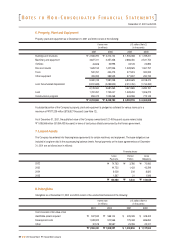

Finished goods and merchandise

Semi finished goods and work in process

Raw materials and supplies

Materials in transit

2001

$137,755

170,943

178,549

43,586

$530,833

2000

$381,759

188,074

134,327

66,844

$771,004

2000

"506,251

249,404

178,131

88,642

"

"1,022,428

2001

"182,677

226,688

236,773

57,799

"

"703,937

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

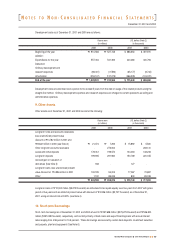

Equity securities accounted for using

the equity method

Marketable equity securities

Unlisted equity securities

Debt securities

2001

$2,333,751

96,995

138,452

155,402

$ 2,724,600

2000

$1,769,729

51,270

195,335

70,308

$ 2,086,642

2000

"#$%&'$(%(

')$*(*

#+*$,%&

*%$#%+

"

"2,767,096

2001

"%$,*&$)()

-#($'#+

-(%$',-

#,'$,)*

"

"3,613,092

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

N

OTES TO

N

ON

-C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

50

2001 Annual Report Hyundai Motor Company