Home Depot 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

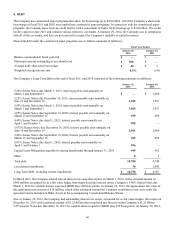

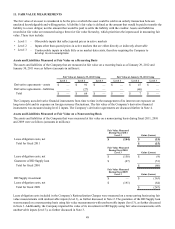

Long-lived assets, goodwill and other intangible assets were also analyzed for impairment on a nonrecurring basis using fair

value measurements with unobservable inputs (level 3). Impairment charges related to long-lived assets, goodwill and other

intangible assets in fiscal 2011 and 2010 were not material, as further discussed in Note 1 under the captions "Impairment of

Long-Lived Assets" and "Goodwill and Other Intangible Assets," respectively.

The aggregate fair value of the Company’s Senior Notes, based on quoted market prices, was $12.1 billion and $9.8 billion at

January 29, 2012 and January 30, 2011, respectively, compared to a carrying value of $10.3 billion and $9.3 billion at

January 29, 2012 and January 30, 2011, respectively.

12. COMMITMENTS AND CONTINGENCIES

At January 29, 2012, the Company was contingently liable for approximately $413 million under outstanding letters of credit

and open accounts issued for certain business transactions, including insurance programs, trade contracts and construction

contracts. The Company’s letters of credit are primarily performance-based and are not based on changes in variable

components, a liability or an equity security of the other party.

The Company is involved in litigation arising from the normal course of business. In management’s opinion, this litigation is

not expected to have a material adverse effect on the Company’s consolidated financial condition or results of operations.

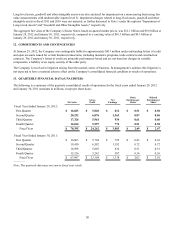

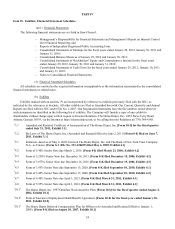

13. QUARTERLY FINANCIAL DATA (UNAUDITED)

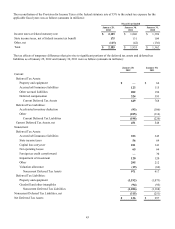

The following is a summary of the quarterly consolidated results of operations for the fiscal years ended January 29, 2012

and January 30, 2011 (amounts in millions, except per share data):

Fiscal Year Ended January 29, 2012:

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Fiscal Year

Fiscal Year Ended January 30, 2011:

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Fiscal Year

Net Sales

$ 16,823

20,232

17,326

16,014

$ 70,395

$ 16,863

19,410

16,598

15,126

$ 67,997

Gross

Profit

$ 5,828

6,876

5,961

5,597

$ 24,262

$ 5,794

6,582

5,685

5,243

$ 23,304

Net

Earnings

$ 812

1,363

934

774

$ 3,883

$ 725

1,192

834

587

$ 3,338

Basic

Earnings per

Share

$ 0.51

0.87

0.61

0.51

$ 2.49

$ 0.43

0.72

0.51

0.36

$ 2.03

Diluted

Earnings per

Share

$ 0.50

0.86

0.60

0.50

$ 2.47

$ 0.43

0.72

0.51

0.36

$ 2.01

—————

Note: The quarterly data may not sum to fiscal year totals.