Home Depot 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

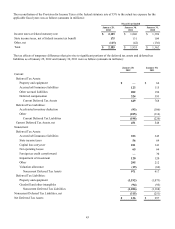

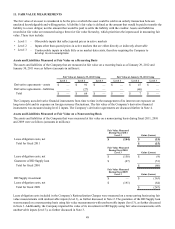

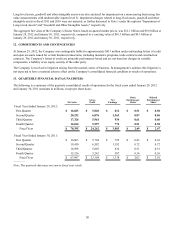

11. FAIR VALUE MEASUREMENTS

The fair value of an asset is considered to be the price at which the asset could be sold in an orderly transaction between

unrelated knowledgeable and willing parties. A liability’s fair value is defined as the amount that would be paid to transfer the

liability to a new obligor, not the amount that would be paid to settle the liability with the creditor. Assets and liabilities

recorded at fair value are measured using a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair

value. These tiers include:

•

•

•

Level 1

Level 2

Level 3

–

–

–

Observable inputs that reflect quoted prices in active markets

Inputs other than quoted prices in active markets that are either directly or indirectly observable

Unobservable inputs in which little or no market data exists, therefore requiring the Company to

develop its own assumptions

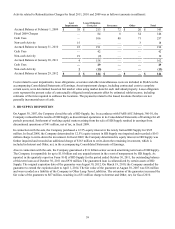

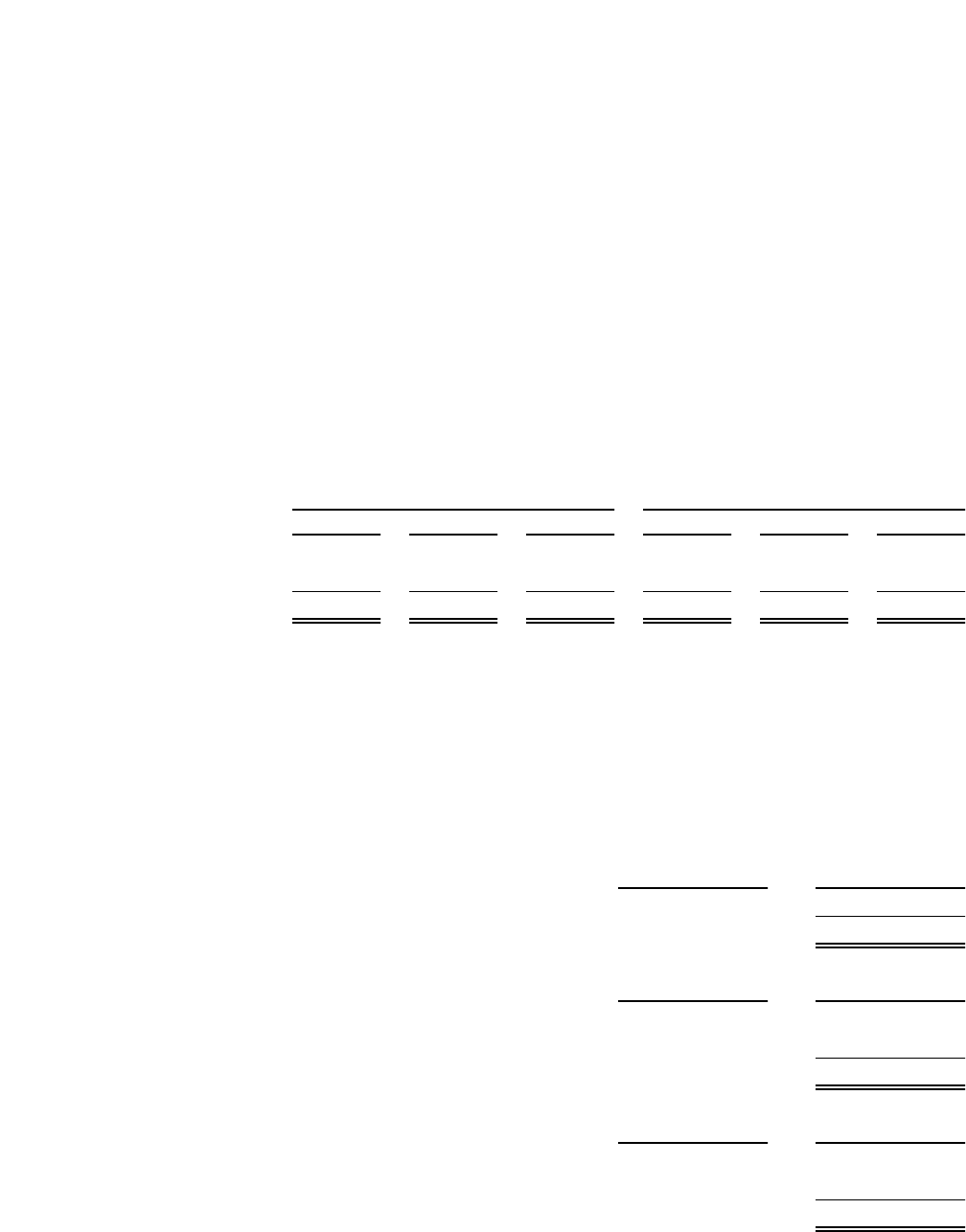

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The assets and liabilities of the Company that are measured at fair value on a recurring basis as of January 29, 2012 and

January 30, 2011 were as follows (amounts in millions):

Derivative agreements - assets

Derivative agreements - liabilities

Total

Fair Value at January 29, 2012 Using

Level 1

$—

—

$—

Level 2

$91

(27)

$64

Level 3

$—

—

$—

Fair Value at January 30, 2011 Using

Level 1

$—

—

$—

Level 2

$47

(40)

$7

Level 3

$—

—

$—

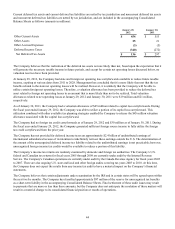

The Company uses derivative financial instruments from time to time in the management of its interest rate exposure on

long-term debt and its exposure on foreign currency fluctuations. The fair value of the Company’s derivative financial

instruments was measured using level 2 inputs. The Company’s derivative agreements are discussed further in Note 4.

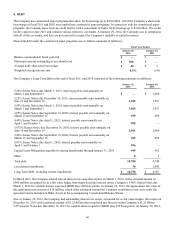

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

The assets and liabilities of the Company that were measured at fair value on a nonrecurring basis during fiscal 2011, 2010

and 2009 were as follows (amounts in millions):

Lease obligation costs, net

Total for fiscal 2011

Lease obligation costs, net

Guarantee of HD Supply loan

Total for fiscal 2010

HD Supply investment

Lease obligation costs, net

Total for fiscal 2009

Fair Value Measured

During Fiscal 2011

Level 3

$(144)

Fair Value Measured

During Fiscal 2010

Level 3

$(158)

$(67)

Fair Value Measured

During Fiscal 2009

Level 3

$—

$(191)

Gains (Losses)

$(15)

$(15)

Gains (Losses)

$(9)

(51)

$(60)

Gains (Losses)

$(163)

(84)

$(247)

Lease obligation costs included in the Company’s Rationalization Charges were measured on a nonrecurring basis using fair

value measurements with unobservable inputs (level 3), as further discussed in Note 2. The guarantee of the HD Supply loan

was measured on a nonrecurring basis using fair value measurements with unobservable inputs (level 3), as further discussed

in Note 3. Additionally, the Company impaired the value of its investment in HD Supply using fair value measurements with

unobservable inputs (level 3), as further discussed in Note 3.