Home Depot 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

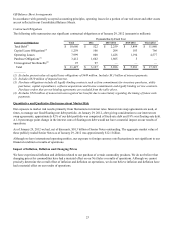

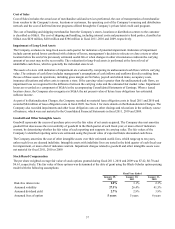

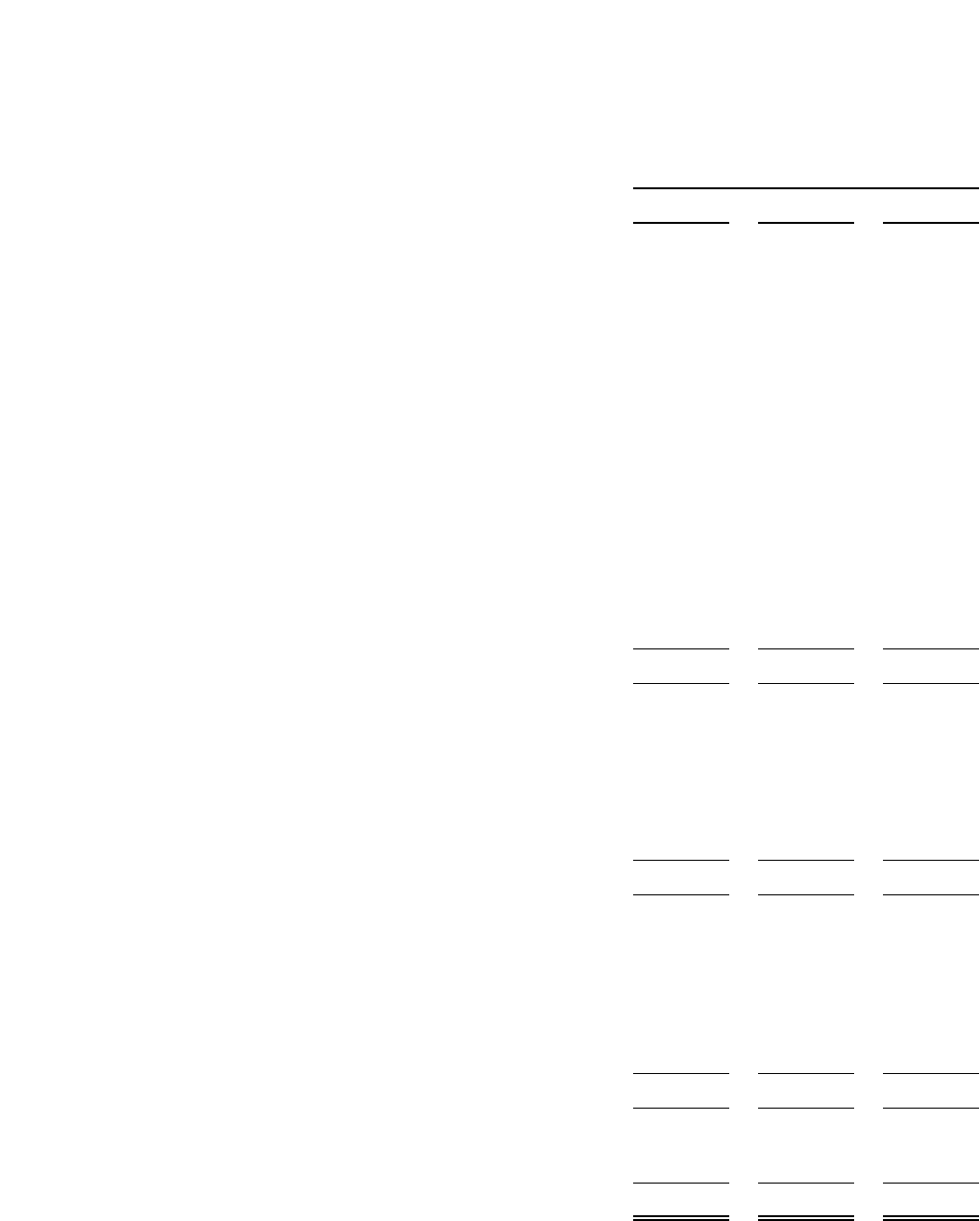

33

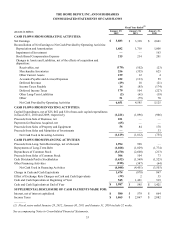

THE HOME DEPOT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

amounts in millions

CASH FLOWS FROM OPERATING ACTIVITIES:

Net Earnings

Reconciliation of Net Earnings to Net Cash Provided by Operating Activities:

Depreciation and Amortization

Impairment of Investment

Stock-Based Compensation Expense

Changes in Assets and Liabilities, net of the effects of acquisition and

disposition:

Receivables, net

Merchandise Inventories

Other Current Assets

Accounts Payable and Accrued Expenses

Deferred Revenue

Income Taxes Payable

Deferred Income Taxes

Other Long-Term Liabilities

Other

Net Cash Provided by Operating Activities

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital Expenditures, net of $25, $62 and $10 of non-cash capital expenditures

in fiscal 2011, 2010 and 2009, respectively

Proceeds from Sale of Business, net

Payments for Business Acquired, net

Proceeds from Sales of Property and Equipment

Proceeds from Sales and Maturities of Investments

Net Cash Used in Investing Activities

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from Long-Term Borrowings, net of discount

Repayments of Long-Term Debt

Repurchases of Common Stock

Proceeds from Sales of Common Stock

Cash Dividends Paid to Stockholders

Other Financing Activities

Net Cash Used in Financing Activities

Change in Cash and Cash Equivalents

Effect of Exchange Rate Changes on Cash and Cash Equivalents

Cash and Cash Equivalents at Beginning of Year

Cash and Cash Equivalents at End of Year

SUPPLEMENTAL DISCLOSURE OF CASH PAYMENTS MADE FOR:

Interest, net of interest capitalized

Income Taxes

Fiscal Year Ended(1)

January 29,

2012

$ 3,883

1,682

—

215

(170)

256

159

422

(29)

14

170

(2)

51

6,651

(1,221)

101

(65)

56

—

(1,129)

1,994

(1,028)

(3,470)

306

(1,632)

(218)

(4,048)

1,474

(32)

545

$ 1,987

$ 580

$ 1,865

January 30,

2011

$ 3,338

1,718

—

214

(102)

(355)

12

(133)

10

(85)

104

(61)

(75)

4,585

(1,096)

—

—

84

—

(1,012)

998

(1,029)

(2,608)

104

(1,569)

(347)

(4,451)

(878)

2

1,421

$ 545

$ 579

$ 2,067

January 31,

2010

$ 2,661

1,806

163

201

(23)

625

4

59

(21)

(174)

(227)

(19)

70

5,125

(966)

—

—

178

33

(755)

—

(1,774)

(213)

73

(1,525)

(64)

(3,503)

867

35

519

$ 1,421

$ 664

$ 2,082

—————

(1) Fiscal years ended January 29, 2012, January 30, 2011 and January 31, 2010 include 52 weeks.

See accompanying Notes to Consolidated Financial Statements.