Home Depot 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

Recent Accounting Pronouncements

In June 2011, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update No. 2011-05,

"Comprehensive Income (Topic 220): Presentation of Comprehensive Income" ("ASU No. 2011-05"). ASU No. 2011-05

eliminates the current option to report other comprehensive income and its components in the Consolidated Statements of

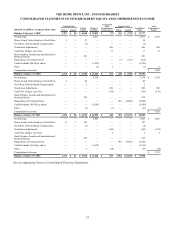

Stockholders' Equity and Comprehensive Income. Under ASU No. 2011-05, an entity can elect to present items of net

earnings and other comprehensive income in one continuous statement or in two separate, but consecutive, statements. This

guidance is effective for publicly traded companies for annual reporting periods beginning after December 15, 2011 and for

interim and annual reporting periods thereafter, and retrospective application is required. As we report other comprehensive

income within the Consolidated Statements of Stockholders' Equity and Comprehensive Income, the adoption of ASU

No. 2011-05 will impact the presentation of our Consolidated Financial Statements beginning in the first quarter of fiscal

2012.

In June 2009, the FASB issued "Amendments to FASB Interpretation No. 46(R)" ("FASB ASC Subtopic 810-10"), which

clarifies that the determination of whether a company is required to consolidate an entity is based on, among other things, an

entity’s purpose and design and a company’s ability to direct the activities of the entity that most significantly impact the

entity’s economic performance. FASB ASC Subtopic 810-10 requires ongoing reassessments of whether a company is the

primary beneficiary of a variable interest entity and eliminates the qualifying special purpose entity concept. FASB ASC

Subtopic 810-10 also requires additional disclosures about a company’s involvement in variable interest entities and any

significant changes in risk exposure due to that involvement. This guidance was effective for annual reporting periods

beginning after November 15, 2009, for interim periods within that first annual reporting period, and for interim and annual

reporting periods thereafter. This guidance did not have a material impact on our consolidated financial statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

The information required by this item is incorporated by reference to Item 7, "Management’s Discussion and Analysis of

Financial Condition and Results of Operations" of this report.