Home Depot 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

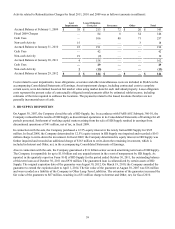

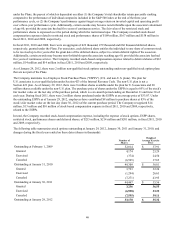

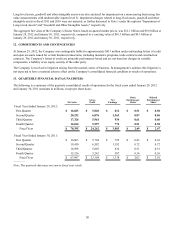

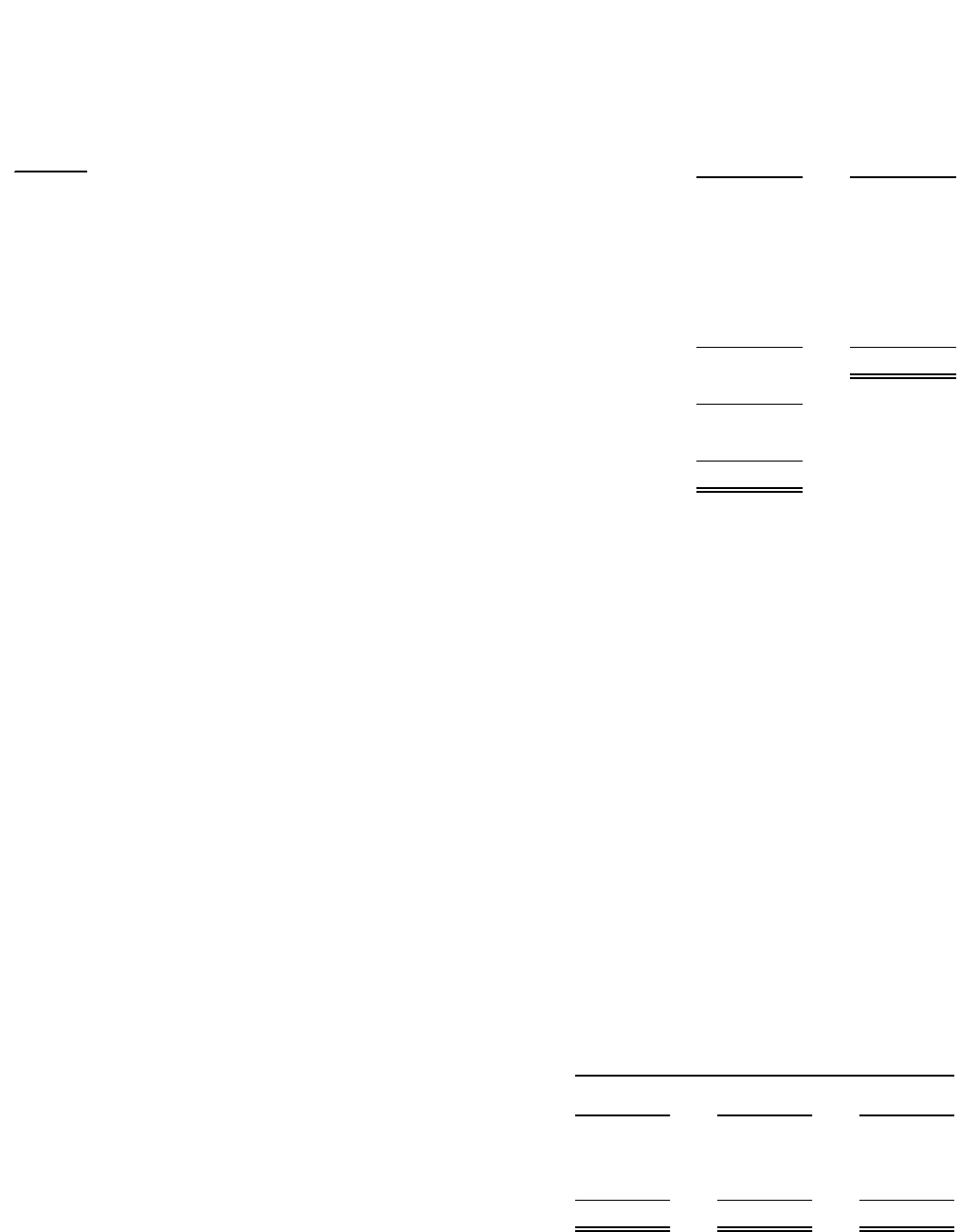

The approximate future minimum lease payments under capital and all other leases at January 29, 2012 were as follows

(amounts in millions):

Fiscal Year

2012

2013

2014

2015

2016

Thereafter through 2097

Less imputed interest

Net present value of capital lease obligations

Less current installments

Long-term capital lease obligations, excluding current installments

Capital

Leases

$ 106

104

100

93

90

766

1,259

810

449

29

$ 420

Operating

Leases

$ 800

746

682

637

557

4,577

$ 7,999

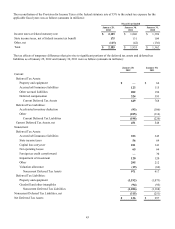

Short-term and long-term obligations for capital leases are included in the accompanying Consolidated Balance Sheets in

Current Installments of Long-Term Debt and Long-Term Debt, respectively. The assets under capital leases recorded in

Property and Equipment, net of amortization, totaled $328 million and $336 million at January 29, 2012 and January 30,

2011, respectively.

9. EMPLOYEE BENEFIT PLANS

The Company maintains active defined contribution retirement plans for its employees (the "Benefit Plans"). All associates

satisfying certain service requirements are eligible to participate in the Benefit Plans. The Company makes cash contributions

each payroll period up to specified percentages of associates’ contributions as approved by the Board of Directors.

The Company also maintains a restoration plan to provide certain associates deferred compensation that they would have

received under the Benefit Plans as a matching contribution if not for the maximum compensation limits under the Internal

Revenue Code. The Company funds the restoration plan through contributions made to a grantor trust, which are then used to

purchase shares of the Company’s common stock in the open market.

The Company’s contributions to the Benefit Plans and the restoration plan were $171 million, $171 million and $161 million

for fiscal 2011, 2010 and 2009, respectively. At January 29, 2012, the Benefit Plans and the restoration plan held a total of 14

million shares of the Company’s common stock in trust for plan participants.

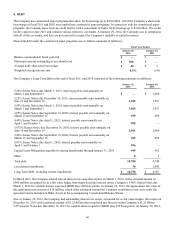

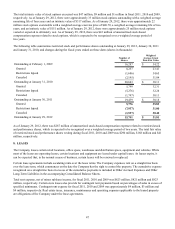

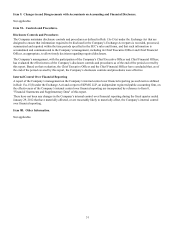

10. BASIC AND DILUTED WEIGHTED AVERAGE COMMON SHARES

The reconciliation of basic to diluted weighted average common shares for fiscal 2011, 2010 and 2009 was as follows

(amounts in millions):

Weighted average common shares

Effect of potentially dilutive securities:

Stock Plans

Diluted weighted average common shares

Fiscal Year Ended

January 29,

2012

1,562

8

1,570

January 30,

2011

1,648

10

1,658

January 31,

2010

1,683

9

1,692

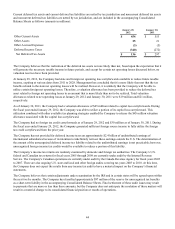

Stock plans consist of shares granted under the Company’s employee stock plans as described in Note 7 to the Consolidated

Financial Statements. Options to purchase 23 million, 39 million and 48 million shares of common stock at January 29,

2012, January 30, 2011 and January 31, 2010, respectively, were excluded from the computation of Diluted Earnings per

Share because their effect would have been anti-dilutive.