Home Depot 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

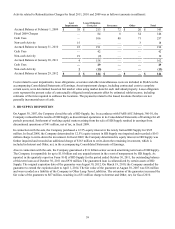

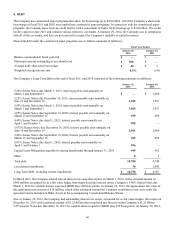

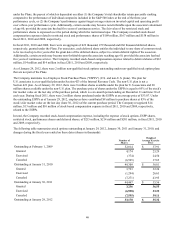

The reconciliation of the Provision for Income Taxes at the federal statutory rate of 35% to the actual tax expense for the

applicable fiscal years was as follows (amounts in millions):

Income taxes at federal statutory rate

State income taxes, net of federal income tax benefit

Other, net

Total

Fiscal Year Ended

January 29,

2012

$ 2,125

175

(115)

$ 2,185

January 30,

2011

$ 1,846

131

(42)

$ 1,935

January 31,

2010

$ 1,394

104

(136)

$ 1,362

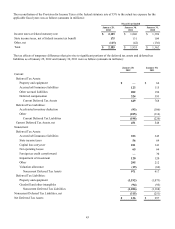

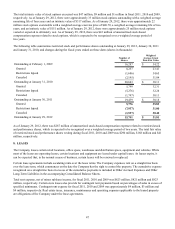

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax

liabilities as of January 29, 2012 and January 30, 2011 were as follows (amounts in millions):

Current:

Deferred Tax Assets:

Property and equipment

Accrued self-insurance liabilities

Other accrued liabilities

Deferred compensation

Current Deferred Tax Assets

Deferred Tax Liabilities:

Accelerated inventory deduction

Other

Current Deferred Tax Liabilities

Current Deferred Tax Assets, net

Noncurrent:

Deferred Tax Assets:

Accrued self-insurance liabilities

State income taxes

Capital loss carryover

Net operating losses

Foreign tax credit carryforward

Impairment of investment

Other

Valuation allowance

Noncurrent Deferred Tax Assets

Deferred Tax Liabilities:

Property and equipment

Goodwill and other intangibles

Noncurrent Deferred Tax Liabilities

Noncurrent Deferred Tax Liabilities, net

Net Deferred Tax Assets

January 29,

2012

$—

123

202

324

649

(93)

(105)

(198)

451

353

56

101

65

—

120

295

(19)

971

(1,192)

(94)

(1,286)

(315)

$ 136

January 30,

2011

$64

115

196

393

768

(106)

(114)

(220)

548

345

69

141

66

30

120

212

(66)

917

(1,073)

(95)

(1,168)

(251)

$ 297