Home Depot 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

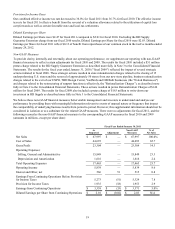

Provision for Income Taxes

Our combined effective income tax rate decreased to 36.0% for fiscal 2011 from 36.7% for fiscal 2010. The effective income

tax rate for fiscal 2011 reflects a benefit from the reversal of a valuation allowance related to the utilization of capital loss

carryforwards as well as certain favorable state and local tax settlements.

Diluted Earnings per Share

Diluted Earnings per Share were $2.47 for fiscal 2011 compared to $2.01 for fiscal 2010. Excluding the HD Supply

Guarantee Extension charge from our fiscal 2010 results, Diluted Earnings per Share for fiscal 2010 were $2.03. Diluted

Earnings per Share for fiscal 2011 reflect $0.13 of benefit from repurchases of our common stock in the twelve months ended

January 29, 2012.

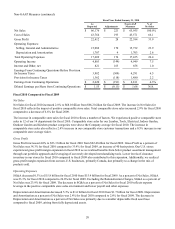

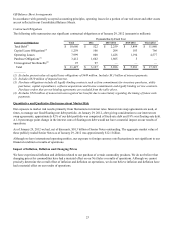

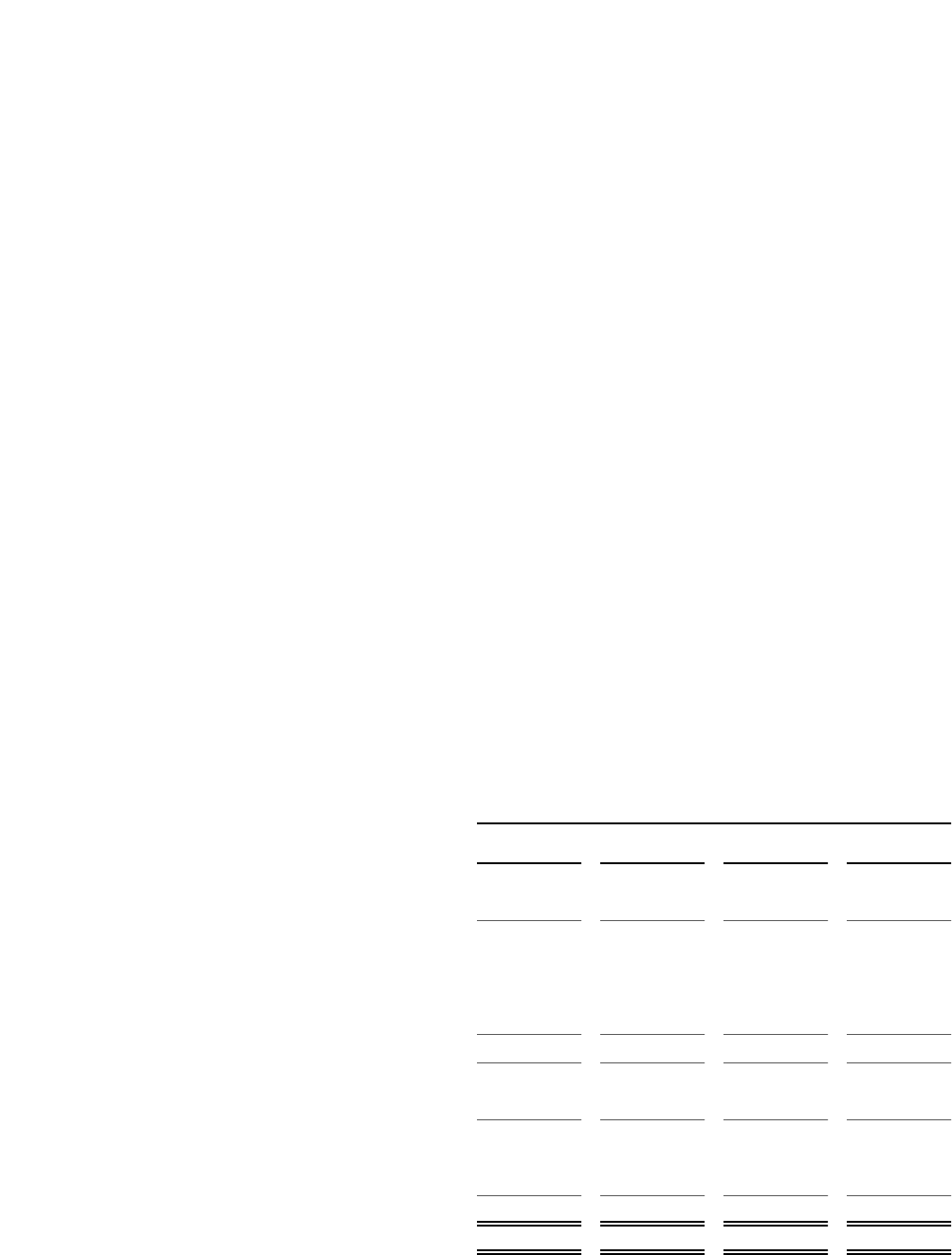

Non-GAAP Measures

To provide clarity, internally and externally, about our operating performance, we supplement our reporting with non-GAAP

financial measures to reflect certain adjustments for fiscal 2010 and 2009. The results for fiscal 2010 included a $51 million

pretax charge related to the HD Supply Guarantee Extension as described more fully in Note 3 to the Consolidated Financial

Statements. The results for the fiscal year ended January 31, 2010 ("fiscal 2009") reflected the impact of several strategic

actions initiated in fiscal 2008. These strategic actions resulted in store rationalization charges related to the closing of 15

underperforming U.S. stores and the removal of approximately 50 stores from our new store pipeline, business rationalization

charges related to the exit of our EXPO, THD Design Center, Yardbirds and HD Bath businesses (the "Exited Businesses")

and charges related to the restructuring of support functions (collectively, the "Rationalization Charges"), as described more

fully in Note 2 to the Consolidated Financial Statements. These actions resulted in pretax Rationalization Charges of $146

million for fiscal 2009. The results for fiscal 2009 also included a pretax charge of $163 million to write-down our

investment in HD Supply as described more fully in Note 3 to the Consolidated Financial Statements.

We believe these non-GAAP financial measures better enable management and investors to understand and analyze our

performance by providing them with meaningful information relevant to events of unusual nature or frequency that impact

the comparability of underlying business results from period to period. However, this supplemental information should not be

considered in isolation or as a substitute for the related GAAP measures. There were no adjustments for fiscal 2011, and the

following reconciles the non-GAAP financial measures to the corresponding GAAP measures for fiscal 2010 and 2009

(amounts in millions, except per share data):

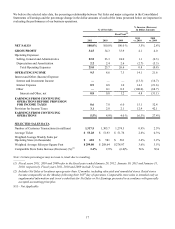

Net Sales

Cost of Sales

Gross Profit

Operating Expenses:

Selling, General and Administrative

Depreciation and Amortization

Total Operating Expenses

Operating Income

Interest and Other, net

Earnings From Continuing Operations Before Provision

for Income Taxes

Provision for Income Taxes

Earnings from Continuing Operations

Diluted Earnings per Share from Continuing Operations

Fiscal Year Ended January 30, 2011

As

Reported

$ 67,997

44,693

23,304

15,849

1,616

17,465

5,839

566

5,273

1,935

$ 3,338

$ 2.01

Adjustment

$—

—

—

—

—

—

—

51

(51)

(18)

$(33)

$(0.02)

Non-GAAP

Measures

$ 67,997

44,693

23,304

15,849

1,616

17,465

5,839

515

5,324

1,953

$ 3,371

$ 2.03

% of

Net Sales

100.0%

65.7

34.3

23.3

2.4

25.7

8.6

0.8

7.8

2.9

5.0%

N/A