Home Depot 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

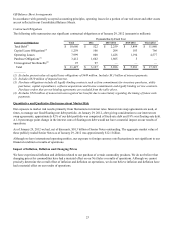

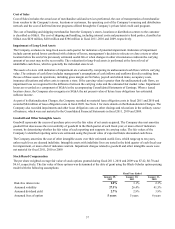

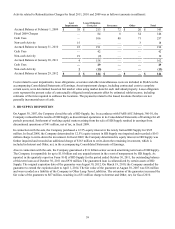

32

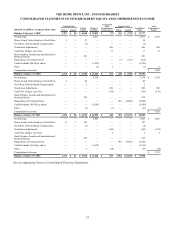

THE HOME DEPOT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND COMPREHENSIVE INCOME

amounts in millions, except per share data

Balance, February 1, 2009

Net Earnings

Shares Issued Under Employee Stock Plans

Tax Effect of Stock-Based Compensation

Translation Adjustments

Cash Flow Hedges, net of tax

Stock Options, Awards and Amortization of

Restricted Stock

Repurchases of Common Stock

Cash Dividends ($0.90 per share)

Other

Comprehensive Income

Balance, January 31, 2010

Net Earnings

Shares Issued Under Employee Stock Plans

Tax Effect of Stock-Based Compensation

Translation Adjustments

Cash Flow Hedges, net of tax

Stock Options, Awards and Amortization of

Restricted Stock

Repurchases of Common Stock

Cash Dividends ($0.945 per share)

Other

Comprehensive Income

Balance, January 30, 2011

Net Earnings

Shares Issued Under Employee Stock Plans

Tax Effect of Stock-Based Compensation

Translation Adjustments

Cash Flow Hedges, net of tax

Stock Options, Awards and Amortization of

Restricted Stock

Repurchases of Common Stock

Cash Dividends ($1.04 per share)

Other

Comprehensive Income

Balance, January 29, 2012

Common Stock

Shares

1,707

—

9

—

—

—

—

—

—

—

1,716

—

6

—

—

—

—

—

—

—

1,722

—

11

—

—

—

—

—

—

—

1,733

Amount

$85

—

1

—

—

—

—

—

—

—

$86

—

—

—

—

—

—

—

—

—

$86

—

1

—

—

—

—

—

—

—

$87

Paid-In

Capital

$ 6,048

—

57

(2)

—

—

201

—

—

—

$ 6,304

—

42

2

—

—

214

—

—

(6)

$ 6,556

—

196

(2)

—

—

215

—

—

1

$ 6,966

Retained

Earnings

$ 12,093

2,661

—

—

—

—

—

—

(1,525)

(3)

$ 13,226

3,338

—

—

—

—

—

—

(1,569)

—

$ 14,995

3,883

—

—

—

—

—

—

(1,632)

—

$ 17,246

Accumulated

Other

Comprehensive

Income (Loss)

$ (77)

—

—

—

426

11

—

—

—

2

$ 362

—

—

—

206

(116)

—

—

—

(7)

$ 445

—

—

—

(143)

5

—

—

—

(14)

$ 293

Treasury Stock

Shares

(11)

—

—

—

—

—

—

(7)

—

—

(18)

—

—

—

—

—

—

(81)

—

—

(99)

—

—

—

—

—

—

(97)

—

—

(196)

Amount

$ (372)

—

—

—

—

—

—

(213)

—

—

$ (585)

—

—

—

—

—

—

(2,608)

—

—

$(3,193)

—

—

—

—

—

—

(3,501)

—

—

$(6,694)

Stockholders’

Equity

$ 17,777

2,661

58

(2)

426

11

201

(213)

(1,525)

(1)

$ 19,393

3,338

42

2

206

(116)

214

(2,608)

(1,569)

(13)

$ 18,889

3,883

197

(2)

(143)

5

215

(3,501)

(1,632)

(13)

$ 17,898

Total

Comprehensive

Income

$ 2,661

426

11

2

$ 3,100

$ 3,338

206

(116)

(7)

$ 3,421

$ 3,883

(143)

5

(14)

$ 3,731

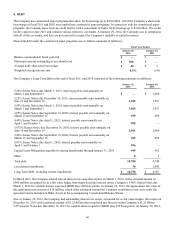

See accompanying Notes to Consolidated Financial Statements.