Home Depot 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Revenues

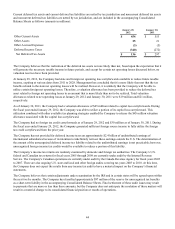

The Company recognizes revenue, net of estimated returns and sales tax, at the time the customer takes possession of

merchandise or receives services. The liability for sales returns is estimated based on historical return levels. When the

Company receives payment from customers before the customer has taken possession of the merchandise or the service has

been performed, the amount received is recorded as Deferred Revenue in the accompanying Consolidated Balance Sheets

until the sale or service is complete. The Company also records Deferred Revenue for the sale of gift cards and recognizes

this revenue upon the redemption of gift cards in Net Sales. Gift card breakage income is recognized based upon historical

redemption patterns and represents the balance of gift cards for which the Company believes the likelihood of redemption by

the customer is remote. During fiscal 2011, 2010 and 2009, the Company recognized $42 million, $46 million and $40

million, respectively, of gift card breakage income. This income is included in the accompanying Consolidated Statements of

Earnings as a reduction in SG&A.

Services Revenue

Net Sales include services revenue generated through a variety of installation, home maintenance and professional service

programs. In these programs, the customer selects and purchases material for a project and the Company provides or arranges

professional installation. These programs are offered through the Company’s stores and in-home sales programs. Under

certain programs, when the Company provides or arranges the installation of a project and the subcontractor provides

material as part of the installation, both the material and labor are included in services revenue. The Company recognizes this

revenue when the service for the customer is complete.

All payments received prior to the completion of services are recorded in Deferred Revenue in the accompanying

Consolidated Balance Sheets. Services revenue was $2.9 billion, $2.7 billion and $2.6 billion for fiscal 2011, 2010 and 2009,

respectively.

Self-Insurance

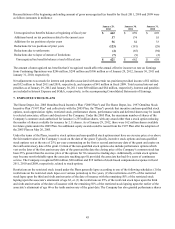

The Company is self-insured for certain losses related to general liability, workers’ compensation, medical, product liability

and automobile claims. The expected ultimate cost for claims incurred as of the balance sheet date is not discounted and is

recognized as a liability. The expected ultimate cost of claims is estimated based upon analysis of historical data and actuarial

estimates.

Prepaid Advertising

Television and radio advertising production costs, along with media placement costs, are expensed when the advertisement

first appears. Amounts included in Other Current Assets in the accompanying Consolidated Balance Sheets relating to

prepayments of production costs for print and broadcast advertising as well as sponsorship promotions were not material at

the end of fiscal 2011 and 2010.

Vendor Allowances

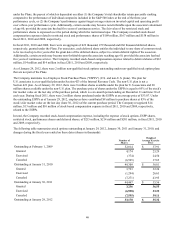

Vendor allowances primarily consist of volume rebates that are earned as a result of attaining certain purchase levels and

advertising co-op allowances for the promotion of vendors’ products that are typically based on guaranteed minimum

amounts with additional amounts being earned for attaining certain purchase levels. These vendor allowances are accrued as

earned, with those allowances received as a result of attaining certain purchase levels accrued over the incentive period based

on estimates of purchases.

Volume rebates and certain advertising co-op allowances earned are initially recorded as a reduction in Merchandise

Inventories and a subsequent reduction in Cost of Sales when the related product is sold. Certain advertising co-op

allowances that are reimbursements of specific, incremental and identifiable costs incurred to promote vendors’ products are

recorded as an offset against advertising expense. In fiscal 2011, 2010 and 2009, gross advertising expense was $846 million,

$864 million and $897 million, respectively, and is included in SG&A. Specific, incremental and identifiable advertising co-

op allowances were $94 million, $90 million and $105 million for fiscal 2011, 2010 and 2009, respectively, and are recorded

as an offset to advertising expense in SG&A.