Home Depot 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company believes that the realization of the deferred tax assets is more likely than not, based upon the expectation

that it will generate the necessary taxable income in future periods and, except for certain net operating losses discussed

below, no valuation reserves have been provided.

At February 1, 2009, the Company had state and foreign net operating loss carryforwards available to reduce future

taxable income, expiring at various dates from 2010 to 2028. Management has concluded that it is more likely than not

that the tax benefits related to the net operating losses will be realized. However, certain foreign net operating losses are

in jurisdictions where the expiration period is too short to be assured of utilization. Therefore, a $12 million valuation

allowance has been provided to reduce the deferred tax asset related to net operating losses to an amount that is more

likely than not to be realized. Total valuation allowances at February 1, 2009 and February 3, 2008 were $12 million and

$7 million, respectively.

As a result of its sale of HD Supply, the Company incurred a tax loss, resulting in a net capital loss carryover of

approximately $187 million. The tax loss on sale resulted primarily from the Company’s tax basis in excess of its book

investment in HD Supply. The net capital loss carryover will expire if not used by 2012. However, the Company has

concluded that it is more likely than not that the tax benefits related to the capital loss carryover will be realized based on

its ability to generate adequate capital gain income during the carryover period. Therefore, no valuation allowance has

been provided.

The Company has not provided for U.S. deferred income taxes on approximately $1.3 billion of undistributed earnings of

international subsidiaries because of its intention to indefinitely reinvest these earnings outside the U.S. The determination

of the amount of the unrecognized deferred U.S. income tax liability related to the undistributed earnings is not

practicable; however, unrecognized foreign income tax credits would be available to reduce a portion of this liability.

On January 29, 2007, the Company adopted FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes —

an Interpretation of FASB Statement No. 109” (“FIN 48”). Among other things, FIN 48 requires application of a “more

likely than not” threshold to the recognition and derecognition of tax positions. It further requires that a change in

judgment related to prior years’ tax positions be recognized in the quarter of such change. The adoption of FIN 48

reduced the Company’s Retained Earnings by $111 million. As a result of the implementation, the gross amount of

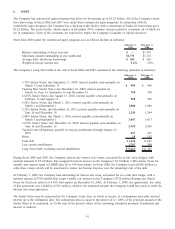

unrecognized tax benefits at January 29, 2007 for continuing operations totaled $667 million. A reconciliation of the

beginning and ending amount of gross unrecognized tax benefits for continuing operations is as follows (amounts in

millions):

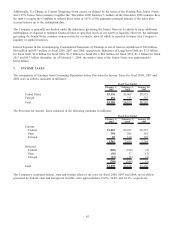

February 1,

2009 February 3,

2008

Unrecognized tax benefits balance at beginning of fiscal year $ 608 $ 667

Additions based on tax positions related to the current year 67 66

Additions for tax positions of prior years 231 25

Reductions for tax positions of prior years (142) (115)

Reductions due to settlements (65) (31)

Reductions due to lapse of statute of limitations (4) (4)

Unrecognized tax benefits balance at end of fiscal year $ 695 $ 608

The gross amount of unrecognized tax benefits as of February 1, 2009 includes $401 million of net unrecognized tax

benefits that, if recognized, would affect the annual effective income tax rate.

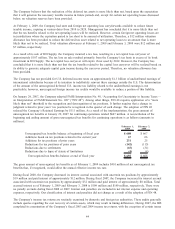

During fiscal 2008, the Company decreased its interest accrual associated with uncertain tax positions by approximately

$19 million and paid interest of approximately $12 million. During fiscal 2007, the Company increased its interest accrual

associated with uncertain tax positions by approximately $32 million and paid interest of approximately $8 million. Total

accrued interest as of February 1, 2009 and February 3, 2008 is $109 million and $140 million, respectively. There were

no penalty accruals during fiscal 2008 or 2007. Interest and penalties are included in net interest expense and operating

expenses, respectively. Our classification of interest and penalties did not change as a result of the adoption of FIN 48.

The Company’s income tax returns are routinely examined by domestic and foreign tax authorities. These audits generally

include queries regarding the cost recovery of certain assets, which may result in timing differences. During 2007, the IRS

completed its examination of the Company’s fiscal 2003 and 2004 income tax returns, with the exception of certain issues

44