Home Depot 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Vendor Allowances

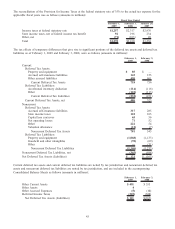

Vendor allowances primarily consist of volume rebates that are earned as a result of attaining certain purchase levels and

advertising co-op allowances for the promotion of vendors’ products that are typically based on guaranteed minimum

amounts with additional amounts being earned for attaining certain purchase levels. These vendor allowances are accrued

as earned, with those allowances received as a result of attaining certain purchase levels accrued over the incentive period

based on estimates of purchases.

Volume rebates and certain advertising co-op allowances earned are initially recorded as a reduction in Merchandise

Inventories and a subsequent reduction in Cost of Sales when the related product is sold. Certain advertising co-op

allowances that are reimbursements of specific, incremental and identifiable costs incurred to promote vendors’ products

are recorded as an offset against advertising expense. In fiscal 2008, 2007 and 2006, gross advertising expense was

$1.0 billion, $1.2 billion and $1.2 billion, respectively, which was recorded in SG&A. Specific, incremental and

identifiable advertising co-op allowances were $107 million, $120 million and $83 million for fiscal 2008, 2007 and 2006,

respectively, and were recorded as an offset to advertising expense in SG&A.

Cost of Sales

Cost of Sales includes the actual cost of merchandise sold and services performed, the cost of transportation of

merchandise from vendors to the Company’s stores, locations or customers, the operating cost of the Company’s sourcing

and distribution network and the cost of deferred interest programs offered through the Company’s private label credit

card program.

The cost of handling and shipping merchandise from the Company’s stores, locations or distribution centers to the

customer is classified as SG&A. The cost of shipping and handling, including internal costs and payments to third parties,

classified as SG&A was $501 million, $571 million and $545 million in fiscal 2008, 2007 and 2006, respectively.

Goodwill and Other Intangible Assets

Goodwill represents the excess of purchase price over the fair value of net assets acquired. The Company does not

amortize goodwill, but does assess the recoverability of goodwill in the third quarter of each fiscal year by determining

whether the fair value of each reporting unit supports its carrying value. The fair values of the Company’s identified

reporting units were estimated using the present value of expected future discounted cash flows.

The Company amortizes the cost of other intangible assets over their estimated useful lives, which range from 1 to

20 years, unless such lives are deemed indefinite. Intangible assets with indefinite lives are tested in the third quarter of

each fiscal year for impairment. The Company recorded no impairment charges for goodwill or other intangible assets for

fiscal 2008, 2007 or 2006.

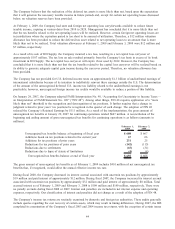

Impairment of Long-Lived Assets

The Company evaluates the carrying value of long-lived assets when management makes the decision to relocate or close

a store or other location, or when circumstances indicate the carrying amount of an asset may not be recoverable. A

store’s assets are evaluated for impairment by comparing its undiscounted cash flows with its carrying value. If the

carrying value is greater than the undiscounted cash flows, a provision is made to write down the related assets to fair

value if the carrying value is greater than the fair value. Impairment losses are recorded as a component of SG&A in the

accompanying Consolidated Statements of Earnings. When a location closes, the Company also recognizes in SG&A the

net present value of future lease obligations, less estimated sublease income.

In fiscal 2008, the Company recorded $580 million of asset impairments and $252 million of lease obligation costs as part

of its Rationalization Charges. See Note 2 for more details on the Rationalization Charges. The Company also recorded

impairments on the other closings and relocations in the ordinary course of business, which were not material to the

Consolidated Financial Statements in fiscal 2008, 2007 and 2006.

35