Home Depot 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Additionally, if a Change in Control Triggering Event occurs, as defined by the terms of the Floating Rate Senior Notes

and 5.25% Senior Notes issuance (together the “December 2006 Issuance”), holders of the December 2006 Issuance have

the right to require the Company to redeem those notes at 101% of the aggregate principal amount of the notes plus

accrued interest up to the redemption date.

The Company is generally not limited under the indentures governing the Senior Notes in its ability to incur additional

indebtedness or required to maintain financial ratios or specified levels of net worth or liquidity. However, the indenture

governing the Senior Notes contains various restrictive covenants, none of which is expected to impact the Company’s

liquidity or capital resources.

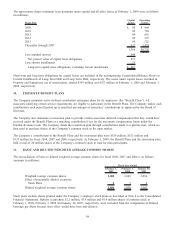

Interest Expense in the accompanying Consolidated Statements of Earnings is net of interest capitalized of $20 million,

$46 million and $47 million in fiscal 2008, 2007 and 2006, respectively. Maturities of Long-Term Debt are $1.8 billion

for fiscal 2009, $1.0 billion for fiscal 2010, $1.0 billion for fiscal 2011, $24 million for fiscal 2012, $1.3 billion for fiscal

2013 and $6.3 billion thereafter. As of February 1, 2009, the market value of the Senior Notes was approximately

$10.0 billion.

7. INCOME TAXES

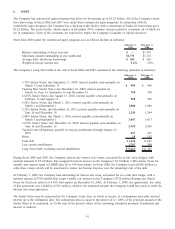

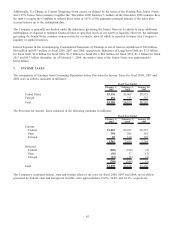

The components of Earnings from Continuing Operations before Provision for Income Taxes for fiscal 2008, 2007 and

2006 were as follows (amounts in millions):

February 1,

2009 February 3,

2008 January 28,

2007

Fiscal Year Ended

United States $3,136 $5,905 $7,915

Foreign 454 715 587

Total $3,590 $6,620 $8,502

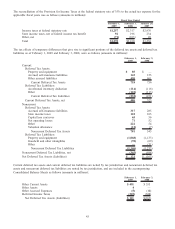

The Provision for Income Taxes consisted of the following (amounts in millions):

February 1,

2009 February 3,

2008 January 28,

2007

Fiscal Year Ended

Current:

Federal $1,283 $2,055 $2,557

State 198 285 361

Foreign 85 310 326

1,566 2,650 3,244

Deferred:

Federal (209) (242) (2)

State (56) 17 (1)

Foreign (23) (15) (5)

(288) (240) (8)

Total $1,278 $2,410 $3,236

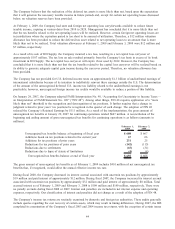

The Company’s combined federal, state and foreign effective tax rates for fiscal 2008, 2007 and 2006, net of offsets

generated by federal, state and foreign tax benefits, were approximately 35.6%, 36.4% and 38.1%, respectively.

42