Home Depot 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

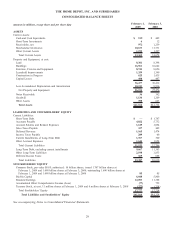

We use capital and operating leases to finance a portion of our real estate, including our stores, distribution centers and

store support centers. The net present value of capital lease obligations is reflected in our Consolidated Balance Sheets in

Long-Term Debt and Current Maturities of Long-Term Debt. In accordance with generally accepted accounting principles,

the operating leases are not reflected in our Consolidated Balance Sheets. As of the end of fiscal 2008, our long-term

debt-to-equity ratio was 54.4% compared to 64.3% at the end of fiscal 2007.

As of February 1, 2009, we had $525 million in Cash and Short-Term Investments. We believe that our current cash

position, access to the debt capital markets and cash flow generated from operations should be sufficient to enable us to

complete our capital expenditure programs and required long-term debt payments through the next several fiscal years. In

addition, we have funds available from our commercial paper programs and the ability to obtain alternative sources of

financing for other requirements. We intend to use cash flow generated by operations to repay $1.8 billion in debt coming

due in fiscal 2009.

During fiscal 2008 and 2007, we entered into interest rate swaps, accounted for as fair value hedges, with notional

amounts of $3.0 billion, that swapped fixed rate interest on our $3.0 billion 5.40% Senior Notes for variable rate interest

equal to LIBOR plus 60 to 149 basis points. In fiscal 2008, we received $56 million to settle these swaps, which will be

amortized to reduce Interest Expense over the remaining term of the debt.

At February 1, 2009, we had outstanding an interest rate swap, accounted for as a cash flow hedge, with a notional

amount of $750 million that swaps variable rate interest on our $750 million Floating Rate Senior Notes for fixed rate

interest at 4.36% that expires on December 16, 2009. At February 1, 2009, the approximate fair value of this agreement

was a liability of $21 million, which is the estimated amount we would have paid to settle this interest rate swap

agreement.

Off-Balance Sheet Arrangements

In accordance with generally accepted accounting principles, operating leases for a portion of our real estate and other

assets are not reflected in our Consolidated Balance Sheets.

Contractual Obligations

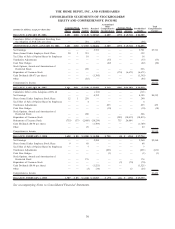

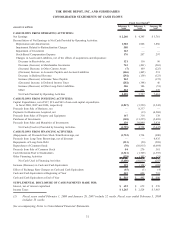

The following table summarizes our significant contractual obligations as of February 1, 2009 (amounts in millions):

Contractual Obligations Total 2009 2010-2011 2012-2013 Thereafter

Payments Due by Fiscal Year

Total Debt

(1)

$17,850 $2,327 $2,943 $2,068 $10,512

Capital Lease Obligations

(2)

1,366 88 178 178 922

Operating Leases 8,738 804 1,366 1,094 5,474

Purchase Obligations

(3)

6,123 1,687 1,791 1,712 933

FIN 48 Unrecognized Tax Benefits

(4)

18 18 — — —

Total $34,095 $4,924 $6,278 $5,052 $17,841

(1) Excludes present value of capital lease obligations of $417 million. Includes $6.8 billion of interest payments and

$2 million, net, of unamortized non-cash items.

(2) Includes $949 million of imputed interest.

(3) Purchase obligations include all legally binding contracts such as firm commitments for inventory purchases,

utility purchases, capital expenditures, software acquisition and license commitments and legally binding service

contracts. Purchase orders that are not binding agreements are excluded from the table above.

(4) Excludes $677 million of noncurrent unrecognized tax benefits due to uncertainty regarding the timing of future

cash payments related to the FIN 48 liabilities.

22