Home Depot 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

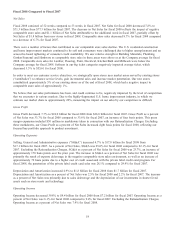

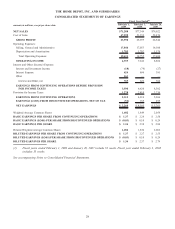

Provision for Income Taxes

Our combined effective income tax rate for continuing operations decreased to 36.4% for fiscal 2007 from 38.1% for

fiscal 2006. The decrease in our effective income tax rate for fiscal 2007 reflects the impact of a one-time retroactive tax

assessment received from the Canadian province of Quebec in the second quarter of fiscal 2006 and tax benefits

recognized upon settlement of several state audits and completion of the fiscal 2003 and 2004 federal tax audits in fiscal

2007.

Diluted Earnings per Share from Continuing Operations

Diluted Earnings per Share from Continuing Operations were $2.27 for fiscal 2007 and $2.55 for fiscal 2006. The

53

rd

week increased Diluted Earnings per Share from Continuing Operations by approximately $0.04 for fiscal 2007.

Diluted Earnings per Share from Continuing Operations were favorably impacted in both fiscal 2007 and 2006 by the

repurchase of shares of our common stock.

Discontinued Operations

Discontinued operations consist of the results of operations for HD Supply through August 30, 2007 and a loss on the sale

of HD Supply. Net Sales from discontinued operations were $7.4 billion for fiscal 2007 compared to $11.8 billion for

fiscal 2006. Earnings from Discontinued Operations, net of tax, were $185 million for fiscal 2007, compared to

$495 million for fiscal 2006. Earnings from Discontinued Operations for fiscal 2007 include a $4 million loss, net of tax,

recognized on the sale of the business.

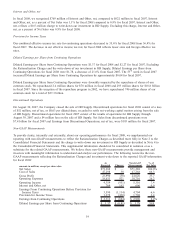

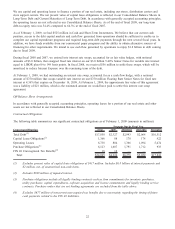

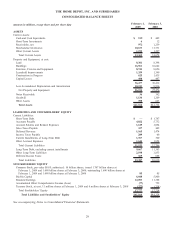

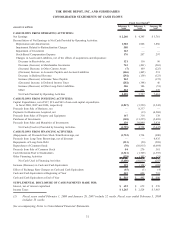

Liquidity and Capital Resources

Cash flow generated from operations provides a significant source of liquidity. For fiscal 2008, Net Cash Provided by

Operating Activities was $5.5 billion compared to $5.7 billion for fiscal 2007. This change was primarily a result of

decreased Net Earnings partially offset by improved inventory management.

Net Cash Used in Investing Activities for fiscal 2008 was $1.7 billion compared to $4.8 billion provided by investing

activities for fiscal 2007. The change in Net Cash Used in/Provided by Investing Activities was primarily the result of

$8.3 billion of net proceeds from the sale of HD Supply in the third quarter of fiscal 2007 partially offset by $1.7 billion

less in capital expenditures in fiscal 2008 compared to fiscal 2007.

In fiscal 2008, we spent $1.8 billion on Capital Expenditures, allocated as follows: 45% for new stores, 15% for

merchandising and operations, 12% for maintenance, 11% for core technology and 17% for other initiatives. In fiscal

2008, we added 62 new stores, including six relocations.

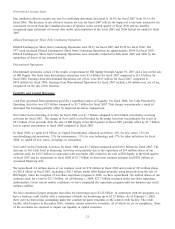

Net Cash Used in Financing Activities for fiscal 2008 was $3.7 billion compared with $10.6 billion for fiscal 2007. The

decrease in Net Cash Used in Financing Activities was primarily due to the repurchase of 289 million shares of our

common stock for $10.7 billion in connection with our tender offer related to the sale of HD Supply in the third quarter

of fiscal 2007 and by repayments in fiscal 2008 of $1.7 billion of short-term commercial paper and $282 million of

structured financing debt.

We repurchased 2.4 million shares of our common stock for $70 million in fiscal 2008 and a total of 293 million shares

for $10.8 billion in fiscal 2007, including a $10.7 billion tender offer funded primarily using proceeds from the sale of

HD Supply. Since the inception of our share repurchase program in 2002, we have repurchased 746 million shares of our

common stock for a total of $27.3 billion. As of February 1, 2009, $12.7 billion remained under our share repurchase

authorization. Given current market conditions, we have suspended the repurchase program until our business and credit

markets stabilize.

We have commercial paper programs that allow for borrowings up to $3.25 billion. In connection with the programs, we

have a back-up credit facility with a consortium of banks for borrowings up to $3.25 billion. As of February 1, 2009,

there were no borrowings outstanding under the commercial paper programs or the related credit facility. The credit

facility, which expires in December 2010, contains various restrictive covenants, all of which we are in compliance. None

of the covenants are expected to impact our liquidity or capital resources.

21