Home Depot 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

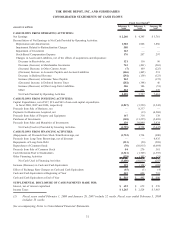

In connection with the sale, the Company purchased a 12.5% equity interest in the newly formed HD Supply for

$325 million. In fiscal 2008, the Company determined its 12.5% equity interest in HD Supply was impaired and recorded

a $163 million charge to write-down the investment, which is included in Interest and Other, net, in the accompanying

Consolidated Statements of Earnings.

Also in connection with the sale, the Company guaranteed a $1.0 billion senior secured loan (“guaranteed loan”) of HD

Supply. The fair value of the guarantee, which was determined to be approximately $16 million, is recorded as a liability

of the Company and included in Other Long-Term Liabilities. The guaranteed loan has a term of five years and the

Company is responsible for up to $1.0 billion and any unpaid interest in the event of non-payment by HD Supply. The

guaranteed loan is collateralized by certain assets of HD Supply.

In accordance with Statement of Financial Accounting Standards No. 144, “Accounting for the Impairment or Disposal of

Long-Lived Assets” (“SFAS 144”), the Company reclassified the results of HD Supply as discontinued operations in its

Consolidated Statements of Earnings for all periods presented.

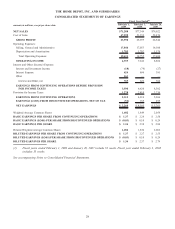

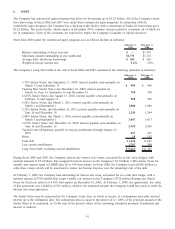

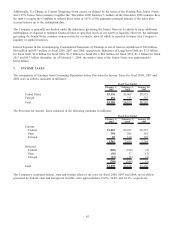

The following table presents Net Sales and Earnings of HD Supply through August 30, 2007 and the losses on disposition

which have been classified as discontinued operations in the Consolidated Statements of Earnings for fiscal 2008, 2007

and 2006 (amounts in millions):

February 1,

2009 February 3,

2008 January 28,

2007

Fiscal Year Ended

Net Sales $— $7,391 $11,815

Earnings Before Provision for Income Taxes $— $ 291 $ 806

Provision for Income Taxes —(102) (311)

Loss on Discontinued Operations, net (52) (4) —

Earnings (Loss) from Discontinued Operations, net of tax $(52) $ 185 $ 495

The Company made no acquisitions during fiscal 2008. The aggregate purchase price for acquisitions in fiscal 2007 and

2006 was $25 million and $4.5 billion, respectively, including $3.5 billion for Hughes Supply in fiscal 2006. The

Company recorded Goodwill related to the HD Supply businesses of $20 million and $2.8 billion for fiscal 2007 and

2006, respectively, and recorded no Goodwill related to its retail businesses for fiscal 2007 and $229 million for fiscal

2006.

5. STAFF ACCOUNTING BULLETIN NO. 108

In fiscal 2006, the Company adopted Staff Accounting Bulletin No. 108, “Considering the Effects of Prior Year

Misstatements when Quantifying Misstatements in Current Year Financial Statements” (“SAB 108”). SAB 108 addresses

the process of quantifying prior year financial statement misstatements and their impact on current year financial

statements. The provisions of SAB 108 allowed companies to report the cumulative effect of correcting immaterial prior

year misstatements, based on the Company’s historical method for evaluating misstatements, by adjusting the opening

balance of retained earnings in the financial statements of the year of adoption rather than amending previously filed

reports. In accordance with SAB 108, the Company adjusted beginning Retained Earnings for fiscal 2006 in the

accompanying Consolidated Financial Statements for the items described below. The Company does not consider these

adjustments to have a material impact on the Company’s consolidated financial statements in any of the prior years

affected.

Historical Stock Option Practices

During fiscal 2006, the Company requested that its Board of Directors review its historical stock option granting practices.

A subcommittee of the Audit Committee undertook the review with the assistance of independent outside counsel, and it

has completed its review. The principal findings of the 2006 review were as follows:

• All options granted in the period from 2002 through the present had an exercise price based on the market

price of the Company’s stock on the date the grant was approved by the Board of Directors or an officer

acting pursuant to delegated authority. During this period, the stock administration department corrected

38