Home Depot 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

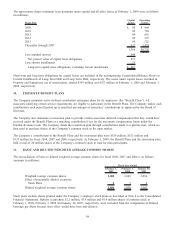

6. DEBT

The Company has commercial paper programs that allow for borrowings up to $3.25 billion. All of the Company’s short-

term borrowings in fiscal 2008 and 2007 were under these commercial paper programs. In connection with the

commercial paper programs, the Company has a back-up credit facility with a consortium of banks for borrowings up to

$3.25 billion. The credit facility, which expires in December 2010, contains various restrictive covenants, all of which we

are in compliance. None of the covenants are expected to impact the Company’s liquidity or capital resources.

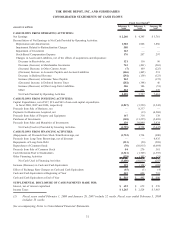

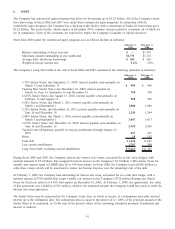

Short-Term Debt under the commercial paper programs was as follows (dollars in millions):

February 1,

2009 February 3,

2008

Balance outstanding at fiscal year-end $— $1,747

Maximum amount outstanding at any month-end $1,771 $1,747

Average daily short-term borrowings $ 403 $ 526

Weighted average interest rate 3.4% 5.0%

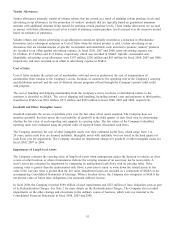

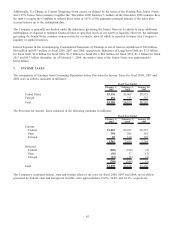

The Company’s Long-Term Debt at the end of fiscal 2008 and 2007 consisted of the following (amounts in millions):

February 1,

2009 February 3,

2008

3.75% Senior Notes; due September 15, 2009; interest payable semi-annually on

March 15 and September 15 $ 999 $ 998

Floating Rate Senior Notes; due December 16, 2009; interest payable on

March 16, June 16, September 16 and December 16 750 750

4.625% Senior Notes; due August 15, 2010; interest payable semi-annually on

February 15 and August 15 998 998

5.20% Senior Notes; due March 1, 2011; interest payable semi-annually on

March 1 and September 1 1,000 1,000

5.25% Senior Notes; due December 16, 2013; interest payable semi-annually on

June 16 and December 16 1,245 1,244

5.40% Senior Notes; due March 1, 2016; interest payable semi-annually on

March 1 and September 1 3,047 3,017

5.875% Senior Notes; due December 16, 2036; interest payable semi-annually on

June 16 and December 16 2,959 2,959

Capital Lease Obligations; payable in varying installments through January 31,

2055 417 415

Other 19 302

Total debt 11,434 11,683

Less current installments 1,767 300

Long-Term Debt, excluding current installments $ 9,667 $11,383

During fiscal 2008 and 2007, the Company entered into interest rate swaps, accounted for as fair value hedges, with

notional amounts of $3.0 billion, that swapped fixed rate interest on the Company’s $3.0 billion 5.40% Senior Notes for

variable rate interest equal to LIBOR plus 60 to 149 basis points. In fiscal 2008, the Company received $56 million to

settle these swaps, which will be amortized to reduce net Interest Expense over the remaining term of the debt.

At February 1, 2009, the Company had outstanding an interest rate swap, accounted for as a cash flow hedge, with a

notional amount of $750 million that swaps variable rate interest on the Company’s $750 million floating rate Senior

Notes for fixed rate interest at 4.36% that expires on December 16, 2009. At February 1, 2009, the approximate fair value

of this agreement was a liability of $21 million, which is the estimated amount the Company would have paid to settle the

interest rate swap agreement.

The Senior Notes may be redeemed by the Company at any time, in whole or in part, at a redemption price plus accrued

interest up to the redemption date. The redemption price is equal to the greater of (1) 100% of the principal amount of the

Senior Notes to be redeemed, or (2) the sum of the present values of the remaining scheduled payments of principal and

interest to maturity.

41