Home Depot 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

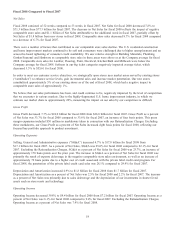

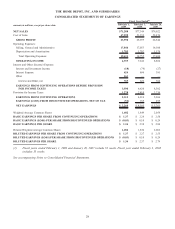

Interest and Other, net

In fiscal 2008, we recognized $769 million of Interest and Other, net, compared to $622 million in fiscal 2007. Interest

and Other, net, as a percent of Net Sales was 1.1% for fiscal 2008 compared to 0.8% for fiscal 2007. Interest and Other,

net, reflects a $163 million charge to write-down our investment in HD Supply. Excluding this charge, Interest and Other,

net, as a percent of Net Sales was 0.9% for fiscal 2008.

Provision for Income Taxes

Our combined effective income tax rate for continuing operations decreased to 35.6% for fiscal 2008 from 36.4% for

fiscal 2007. The decrease in our effective income tax rate for fiscal 2008 reflects lower state and foreign effective tax

rates.

Diluted Earnings per Share from Continuing Operations

Diluted Earnings per Share from Continuing Operations were $1.37 for fiscal 2008 and $2.27 for fiscal 2007. Excluding

the Rationalization Charges and the write-down of our investment in HD Supply, Diluted Earnings per Share from

Continuing Operations for fiscal 2008 were $1.78, a decrease of 21.6% from fiscal 2007. The 53

rd

week in fiscal 2007

increased Diluted Earnings per Share from Continuing Operations by approximately $0.04 for fiscal 2007.

Diluted Earnings per Share from Continuing Operations were favorably impacted by the repurchase of shares of our

common stock. We repurchased 2.4 million shares for $70 million in fiscal 2008 and 293 million shares for $10.8 billion

in fiscal 2007. Since the inception of the repurchase program in 2002, we have repurchased 746 million shares of our

common stock for a total of $27.3 billion.

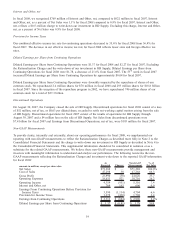

Discontinued Operations

On August 30, 2007, the Company closed the sale of HD Supply. Discontinued operations for fiscal 2008 consist of a loss

of $52 million, net of tax, or $0.03 per diluted share, recorded to settle net working capital matters arising from the sale

of HD Supply. Discontinued operations for fiscal 2007 consist of the results of operations for HD Supply through

August 30, 2007 and a $4 million loss on the sale of HD Supply. Net Sales from discontinued operations were

$7.4 billion for fiscal 2007 and Earnings from Discontinued Operations, net of tax, were $185 million for fiscal 2007.

Non-GAAP Measurements

To provide clarity, internally and externally, about our operating performance for fiscal 2008, we supplemented our

reporting with non-GAAP measurements to reflect the Rationalization Charges as described more fully in Note 2 to the

Consolidated Financial Statements and the charge to write-down our investment in HD Supply as described in Note 4 to

the Consolidated Financial Statements. This supplemental information should not be considered in isolation or as a

substitute for the related GAAP measurements. We believe these non-GAAP measurements provide management and

investors with meaningful information to understand and analyze our performance. The following reconciles the non-

GAAP measurements reflecting the Rationalization Charges and investment write-down to the reported GAAP information

for fiscal 2008:

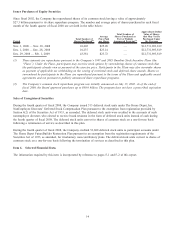

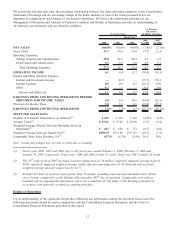

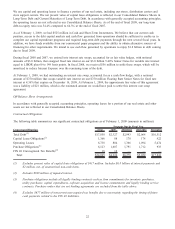

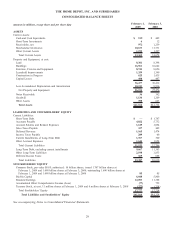

amounts in millions, except per share data

As

Reported Charges Non-GAAP

Measurement %of

Net Sales

Net Sales $71,288 $ — $71,288 100.0%

Cost of Sales 47,298 30 47,268 66.3

Gross Profit 23,990 (30) 24,020 33.7

Operating Expenses 19,631 921 18,710 26.2

Operating Income 4,359 (951) 5,310 7.4

Interest and Other, net 769 163 606 0.9

Earnings From Continuing Operations Before Provision for

Income Taxes 3,590 (1,114) 4,704 6.6

Provision for Income Taxes 1,278 (430) 1,708 2.4

Earnings from Continuing Operations $ 2,312 $ (684) $ 2,996 4.2%

Diluted Earnings per Share from Continuing Operations $ 1.37 $ (0.41) $ 1.78 N/A

19