Home Depot 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.initiative helps reduce the amount of time our store managers spend on these issues, removes unnecessary clutter from the

aisles and implements a basic and consistent approach to store appearance.

Product Availability – We continued our supply chain transformation to improve product availability. We have five RDCs

operating that now serve approximately 500 of our stores. We plan to open additional RDCs in fiscal 2009 and expect that

they will serve approximately 1,000 of our stores by the end of fiscal 2009. We remain committed to our overall roll-out

strategy for RDCs, supporting our goal of increasing our central distribution penetration.

Own the Pro – We have made significant improvements in the services we provide our pro customers, particularly through

our pro bid room. The pro bid room, which is available in all of our stores, allows us to leverage the buying power of The

Home Depot for the benefit of our pro customers. Our direct ship program allows us to have large orders delivered from

our vendors to the customer’s job site directly, reducing handling, lead-time and cost while building loyalty with the pro

customer.

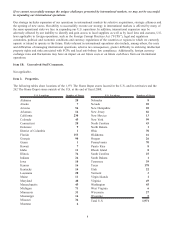

We opened 62 new stores in fiscal 2008, including 6 relocations, closed 15 stores as part of our store rationalization

actions and closed one store in Mexico due to a fire, bringing our total store count at the end of fiscal 2008 to 2,274. As

of the end of fiscal 2008, 262, or approximately 12%, of our stores were located in Canada, Mexico and China compared

to 243 as of fiscal 2007.

We generated $5.5 billion of cash flow from operations in fiscal 2008. We used this cash flow to repay $2.0 billion of

short-term debt and other debt obligations, fund $1.8 billion in capital expenditures and pay $1.5 billion of dividends.

At the end of fiscal 2008, our long-term debt-to-equity ratio was 54.4% compared to 64.3% at the end of fiscal 2007. Our

return on invested capital for continuing operations (computed on the average of beginning and ending long-term debt and

equity for the trailing twelve months) was 9.5% at the end of fiscal 2008 compared to 13.9% for fiscal 2007. This

decrease reflects the decline in our operating profit, which includes the impact of the Rationalization Charges. Excluding

Rationalization Charges, our return on invested capital for continuing operations was 11.4%.

16