Home Depot 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stock-Based Compensation

Effective January 30, 2006, the Company adopted the fair value recognition provisions of Statement of Financial

Accounting Standards (“SFAS”) No. 123(R), “Share-Based Payment” (“SFAS 123(R)”), using the modified prospective

transition method. Under the modified prospective transition method, the Company began expensing unvested options

granted prior to fiscal 2003 in addition to continuing to recognize stock-based compensation expense for all share-based

payments awarded since the adoption of SFAS 123 “Accounting for Stock-Based Compensation” in fiscal 2003. During

fiscal 2006, the Company recognized additional stock compensation expense of approximately $40 million as a result of

the adoption of SFAS 123(R). Results of prior periods have not been restated.

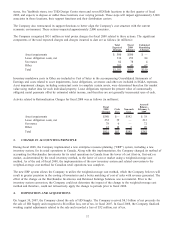

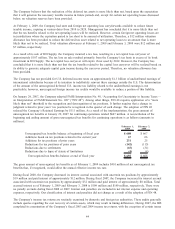

The per share weighted average fair value of stock options granted during fiscal 2008, 2007 and 2006 was $6.46, $9.45

and $11.88, respectively. The fair value of these options was determined at the date of grant using the Black- Scholes

option-pricing model with the following assumptions:

February 1,

2009 February 3,

2008 January 28,

2007

Fiscal Year Ended

Risk-free interest rate 2.9% 4.4% 4.7%

Assumed volatility 33.8% 25.5% 28.5%

Assumed dividend yield 3.5% 2.4% 1.5%

Assumed lives of option 6 years 6 years 5 years

Derivatives

The Company uses derivative financial instruments from time to time in the management of its interest rate exposure on

long-term debt and its exposure on foreign currency fluctuations. The Company accounts for its derivative financial

instruments in accordance with SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities.”

Comprehensive Income

Comprehensive Income includes Net Earnings adjusted for certain revenues, expenses, gains and losses that are excluded

from Net Earnings under accounting principles generally accepted in the U.S. Adjustments to Net Earnings and

Accumulated Other Comprehensive Income consist primarily of foreign currency translation adjustments.

Foreign Currency Translation

Assets and Liabilities denominated in a foreign currency are translated into U.S. dollars at the current rate of exchange on

the last day of the reporting period. Revenues and Expenses are generally translated using average exchange rates for the

period and equity transactions are translated using the actual rate on the day of the transaction.

Segment Information

The Company operates within a single reportable segment primarily within North America. Net Sales for the Company

outside of the U.S. were $7.4 billion for fiscal 2008 and 2007 and were $6.3 billion for fiscal 2006. Long-lived assets

outside of the U.S. totaled $2.8 billion and $3.1 billion as of February 1, 2009 and February 3, 2008, respectively.

2. RATIONALIZATION CHARGES

In fiscal 2008, the Company reduced its square footage growth plans to improve free cash flow, provide stronger returns

for the Company and invest in its existing stores to continue improving the customer experience. As a result of this store

rationalization plan, the Company determined that it would no longer pursue the opening of approximately 50 U.S. stores

that had been in its new store pipeline. The Company expects to dispose of or sublet these pipeline locations over varying

periods. The Company also closed 15 underperforming U.S. stores in the second quarter of fiscal 2008, and the Company

expects to dispose of or sublet those locations over varying periods.

Also in fiscal 2008, the Company announced that it would exit its EXPO, THD Design Center, Yardbirds and HD Bath

businesses in order to focus on its core The Home Depot stores. The Company expects to close 34 EXPO Design Center

36