Home Depot 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

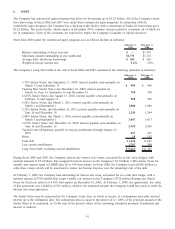

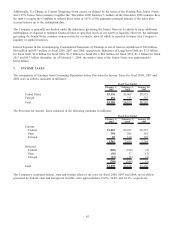

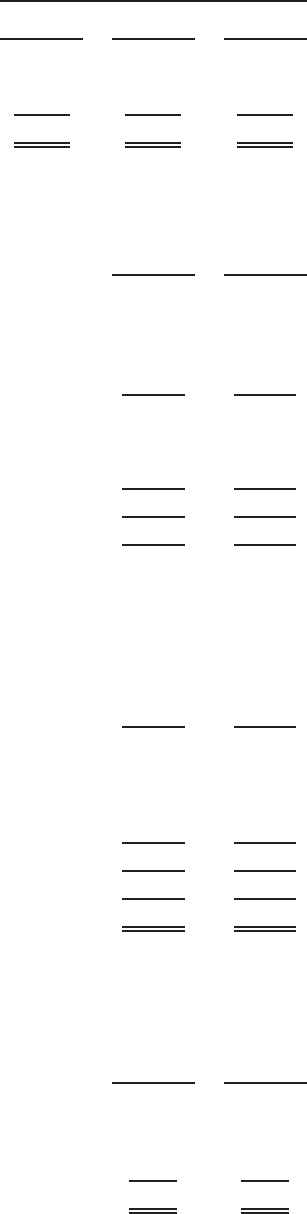

The reconciliation of the Provision for Income Taxes at the federal statutory rate of 35% to the actual tax expense for the

applicable fiscal years was as follows (amounts in millions):

February 1,

2009 February 3,

2008 January 28,

2007

Fiscal Year Ended

Income taxes at federal statutory rate $1,257 $2,317 $2,976

State income taxes, net of federal income tax benefit 92 196 234

Other, net (71) (103) 26

Total $1,278 $2,410 $3,236

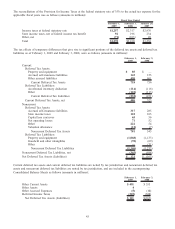

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax

liabilities as of February 1, 2009 and February 3, 2008, were as follows (amounts in millions):

February 1,

2009 February 3,

2008

Current:

Deferred Tax Assets:

Property and equipment $85 $—

Accrued self-insurance liabilities 143 155

Other accrued liabilities 490 601

Current Deferred Tax Assets 718 756

Deferred Tax Liabilities:

Accelerated inventory deduction (114) (118)

Other (118) (113)

Current Deferred Tax Liabilities (232) (231)

Current Deferred Tax Assets, net 486 525

Noncurrent:

Deferred Tax Assets:

Accrued self-insurance liabilities 317 285

State income taxes 118 105

Capital loss carryover 65 56

Net operating losses 71 52

Other 222 54

Valuation allowance (12) (7)

Noncurrent Deferred Tax Assets 781 545

Deferred Tax Liabilities:

Property and equipment (1,068) (1,133)

Goodwill and other intangibles (78) (69)

Other —(31)

Noncurrent Deferred Tax Liabilities (1,146) (1,233)

Noncurrent Deferred Tax Liabilities, net (365) (688)

Net Deferred Tax Assets (Liabilities) $ 121 $ (163)

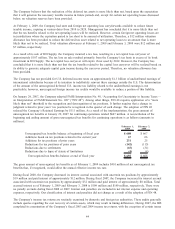

Current deferred tax assets and current deferred tax liabilities are netted by tax jurisdiction and noncurrent deferred tax

assets and noncurrent deferred tax liabilities are netted by tax jurisdiction, and are included in the accompanying

Consolidated Balance Sheets as follows (amounts in millions):

February 1,

2009 February 3,

2008

Other Current Assets $ 491 $ 535

Other Assets 4—

Other Accrued Expenses (5) (10)

Deferred Income Taxes (369) (688)

Net Deferred Tax Assets (Liabilities) $ 121 $(163)

43